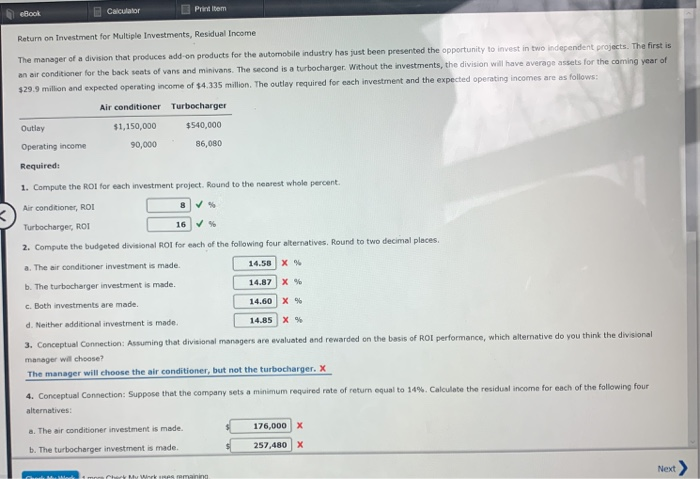

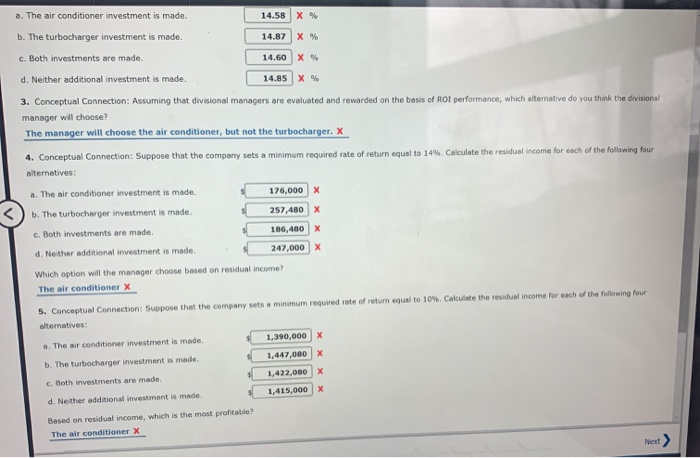

1 eBook Calculator Print item Return on investment for Multiple Investments, Residual Income The manager of a division that produces add-on products for the automobile industry has just been presented the opportunity to invest in two independent projects. The first is an air conditioner for the back seats of vans and minivans. The second is a turbocharger. Without the investments, the division will have average assets for the coming year of $29.9 million and expected operating income of $4.335 million. The outlay required for each investment and the expected operating incomes are as follows: Air conditioner Outly $1,150,000 90,000 Turbocharger $540,000 86,080 Operating income Required: 1. Compute the ROI for each investment project. Round to the nearest whole percent. Air conditioner, ROI Turbocharger, ROI 16 2. Compute the budgeted divisional ROI for each of the following four alternatives, Round to two decimal places a. The air conditioner investment is made 14.58 X b. The turbocharger investment is made. 14.87 X % c. Both investments are made 14.60 X d. Neither additional investment is made. 14.85 X % 3. Conceptual Connection: Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which alternative do you think the divisional manager will choose The manager will choose the air conditioner, but not the turbocharger. X 4. Conceptual Connection: Suppose that the company sets a minimum required rate of return equal to 14 Calculate the residual income for each of the following four alternatives: a. The air conditioner investment is made 126.000 x b. The turbocharger investment is made. Next a. The air conditioner investment is made. 14.58 X % b. The turbocharger investment is made. 14.87 X % c. Both investments are made. 14.60 X % d. Neither additional investment is made. 14.85 X % 3. Conceptual Connection: Assuming that divisional managers are evaluated and rewarded on the basis of Rof performance, which alternative do you think the divisional manager will choose? The manager will choose the air conditioner, but not the turbocharger. X 4. Conceptual Connection: Suppose that the company sets a minimum required rate of return equal to 14% Calculate the residual income for each of the following four alternatives: a. The air conditioner investment is made 176.000X 257,480 X b. The turbocharger investment is made 186,400 C. Both investments are made. 247.000 d. Nether additional investment is made Which option will the manager choose based on residual income? The air conditioner X 5. Conceptual Connection: Suppose that the company sets a minimum required rate of return equal to 10% Calculate the residual income for each of the following four alternatives: The air conditioner investment is made. b. The turbocharger investment is made 1,390,000 X 1,447,080 x 1,422,050 x 1,415,000 x c. Both investments are made. $ d. Nether additional investment is made Based on residual income, which is the most profitabile? The air conditioner X Next >