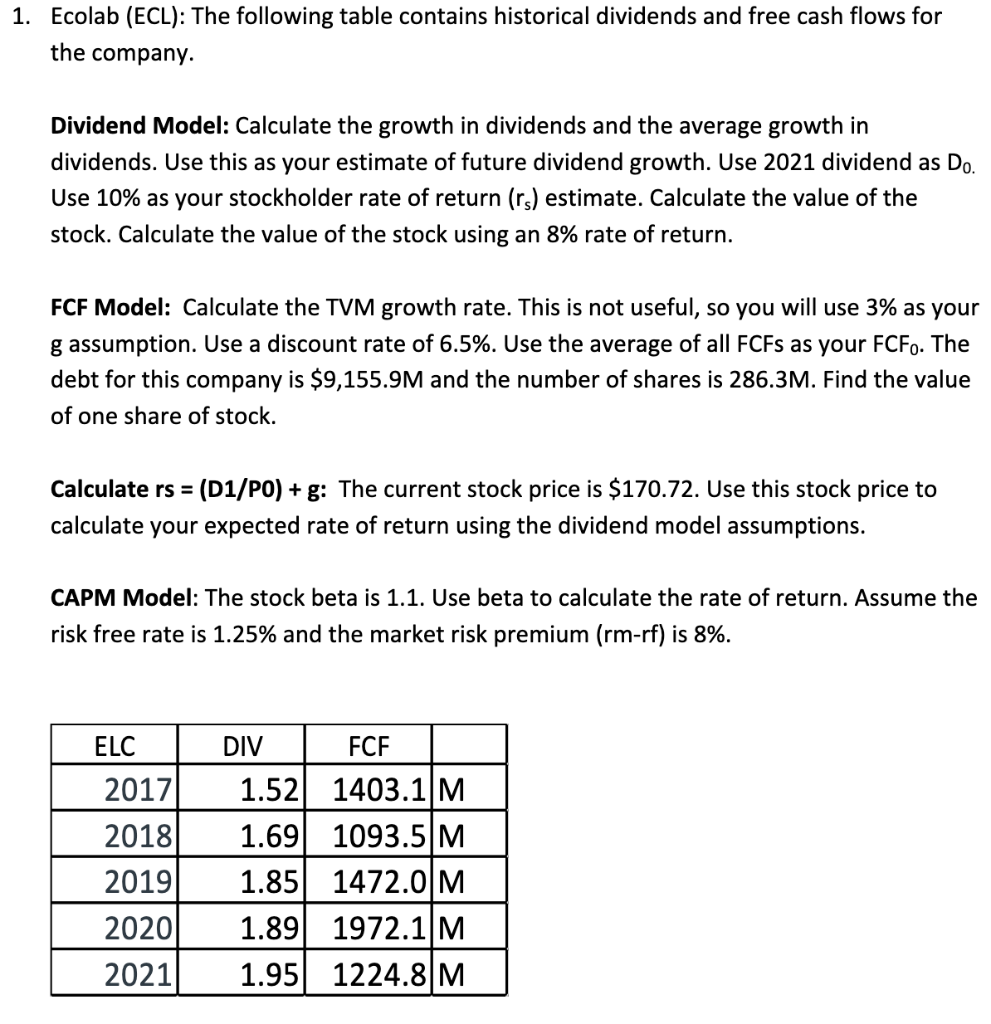

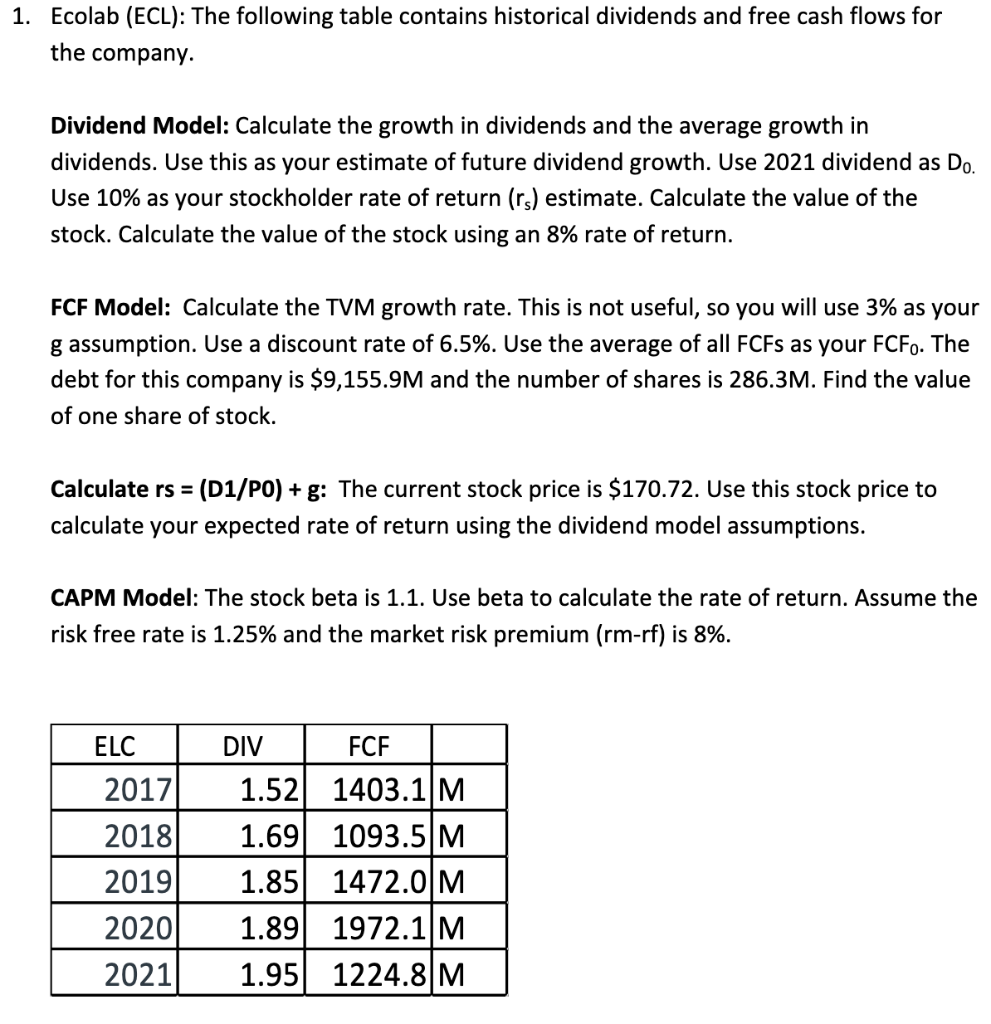

1. Ecolab (ECL): The following table contains historical dividends and free cash flows for the company. Dividend Model: Calculate the growth in dividends and the average growth in dividends. Use this as your estimate of future dividend growth. Use 2021 dividend as Do. Use 10% as your stockholder rate of return (rs) estimate. Calculate the value of the stock. Calculate the value of the stock using an 8% rate of return. FCF Model: Calculate the TVM growth rate. This is not useful, so you will use 3% as your g assumption. Use a discount rate of 6.5%. Use the average of all FCFs as your FCF.. The debt for this company is $9,155.9M and the number of shares is 286.3M. Find the value of one share of stock. Calculate rs = (D1/PO) + g: The current stock price is $170.72. Use this stock price to calculate your expected rate of return using the dividend model assumptions. CAPM Model: The stock beta is 1.1. Use beta to calculate the rate of return. Assume the risk free rate is 1.25% and the market risk premium (rm-rf) is 8%. ELC 2017 2018 2019 2020 2021 DIV FCF 1.52| 1403.1|M 1.69 1093.5 M 1.85 1472.0 M 1.89 1972.1|M 1.95| 1224.8 M 1. Ecolab (ECL): The following table contains historical dividends and free cash flows for the company. Dividend Model: Calculate the growth in dividends and the average growth in dividends. Use this as your estimate of future dividend growth. Use 2021 dividend as Do. Use 10% as your stockholder rate of return (rs) estimate. Calculate the value of the stock. Calculate the value of the stock using an 8% rate of return. FCF Model: Calculate the TVM growth rate. This is not useful, so you will use 3% as your g assumption. Use a discount rate of 6.5%. Use the average of all FCFs as your FCF.. The debt for this company is $9,155.9M and the number of shares is 286.3M. Find the value of one share of stock. Calculate rs = (D1/PO) + g: The current stock price is $170.72. Use this stock price to calculate your expected rate of return using the dividend model assumptions. CAPM Model: The stock beta is 1.1. Use beta to calculate the rate of return. Assume the risk free rate is 1.25% and the market risk premium (rm-rf) is 8%. ELC 2017 2018 2019 2020 2021 DIV FCF 1.52| 1403.1|M 1.69 1093.5 M 1.85 1472.0 M 1.89 1972.1|M 1.95| 1224.8 M