Answered step by step

Verified Expert Solution

Question

1 Approved Answer

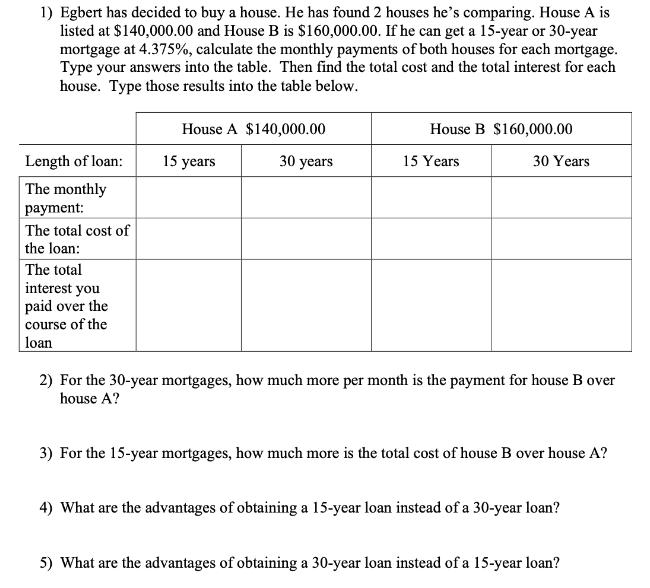

1) Egbert has decided to buy a house. He has found 2 houses he's comparing. House A is listed at $140,000.00 and House B

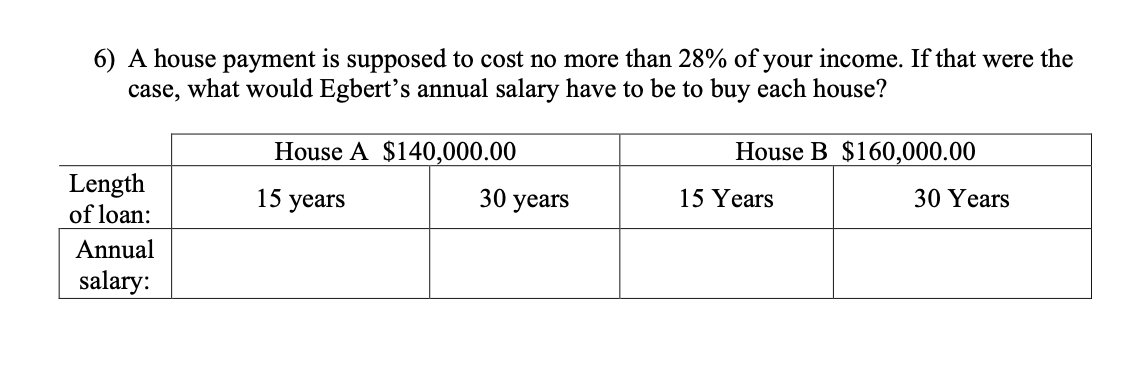

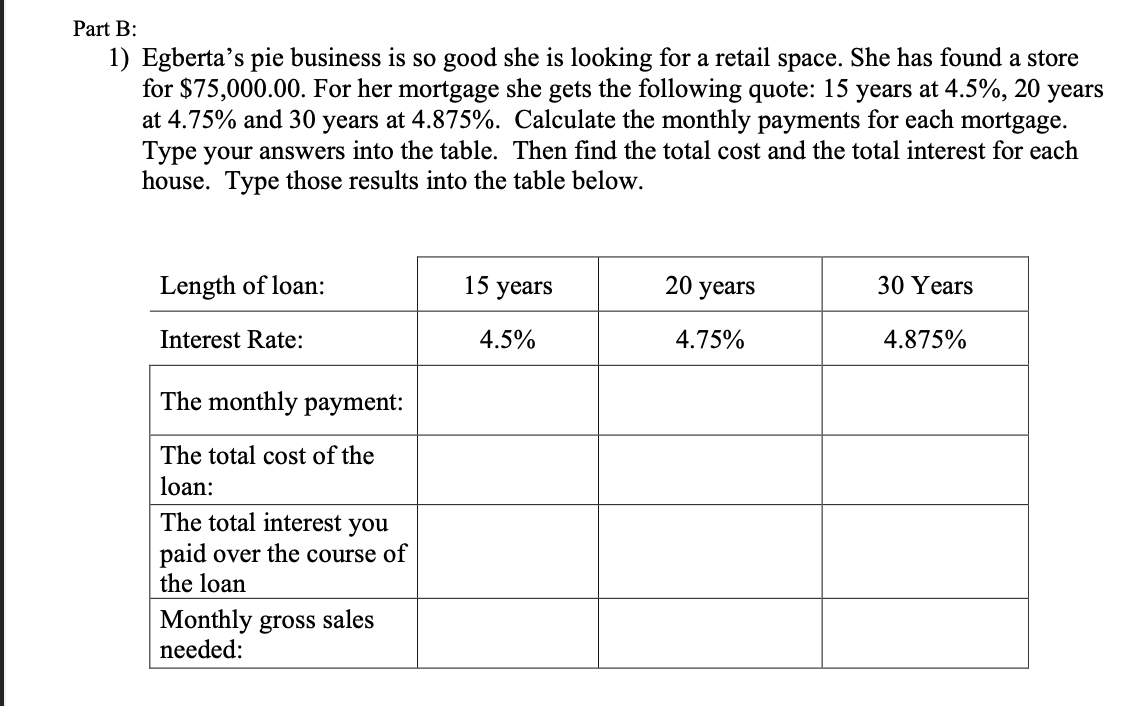

1) Egbert has decided to buy a house. He has found 2 houses he's comparing. House A is listed at $140,000.00 and House B is $160,000.00. If he can get a 15-year or 30-year mortgage at 4.375%, calculate the monthly payments of both houses for each mortgage. Type your answers into the table. Then find the total cost and the total interest for each house. Type those results into the table below. House A $140,000.00 House B $160,000.00 Length of loan: 15 years 30 years 15 Years 30 Years The monthly payment: The total cost of the loan: The total interest you paid over the course of the loan 2) For the 30-year mortgages, how much more per month is the payment for house B over house A? 3) For the 15-year mortgages, how much more is the total cost of house B over house A? 4) What are the advantages of obtaining a 15-year loan instead of a 30-year loan? 5) What are the advantages of obtaining a 30-year loan instead of a 15-year loan? 6) A house payment is supposed to cost no more than 28% of your income. If that were the case, what would Egbert's annual salary have to be to buy each house? House A $140,000.00 House B $160,000.00 Length of loan: 15 years 30 years 15 Years 30 Years Annual salary: Part B: 1) Egberta's pie business is so good she is looking for a retail space. She has found a store for $75,000.00. For her mortgage she gets the following quote: 15 years at 4.5%, 20 years at 4.75% and 30 years at 4.875%. Calculate the monthly payments for each mortgage. Type your answers into the table. Then find the total cost and the total interest for each house. Type those results into the table below. Length of loan: 15 years 20 years 30 Years Interest Rate: 4.5% 4.75% 4.875% The monthly payment: The total cost of the loan: The total interest you paid over the course of the loan Monthly gross sales needed: 2) For a retail business, the mortgage payment should not exceed 17% of gross sales for the month. For each mortgage calculate the gross sales needed to afford the loan for each of the loans and add it to the last line of the table above. 3) If her current month sales are $3350.00 which mortgage can she afford?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started