Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Elizabeth made a RM200,000, 15-year housing loan with the interest rate 5.4% compounded monthly. After 5 years, the loan's interest rate dropped to 4.8%

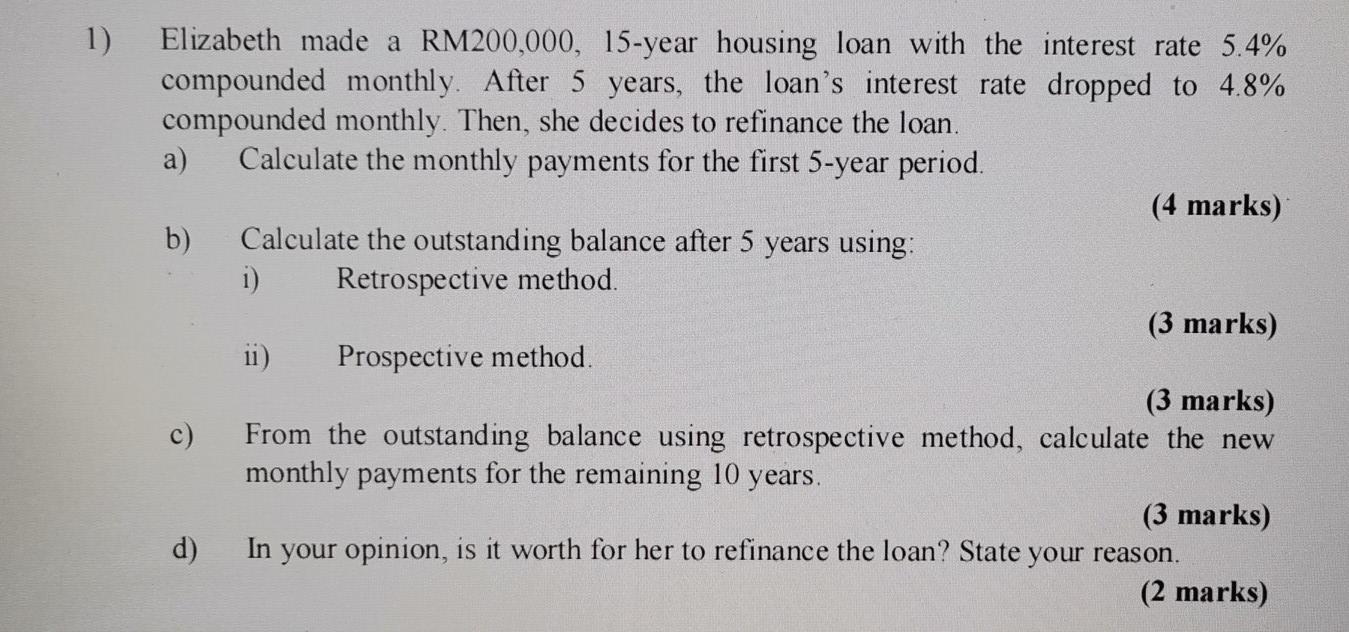

1) Elizabeth made a RM200,000, 15-year housing loan with the interest rate 5.4% compounded monthly. After 5 years, the loan's interest rate dropped to 4.8% compounded monthly. Then, she decides to refinance the loan. a) Calculate the monthly payments for the first 5-year period. (4 marks) b) Calculate the outstanding balance after 5 years using: i) Retrospective method. (3 marks) 11) Prospective method. (3 marks) c) From the outstanding balance using retrospective method, calculate the new monthly payments for the remaining 10 years. (3 marks) d) In your opinion, is it worth for her to refinance the loan? State your reason. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started