1. Elizabeth Myers invested in a project that required an initial amount of $1,560, and returned one cash inflow of $12,000 at the end of

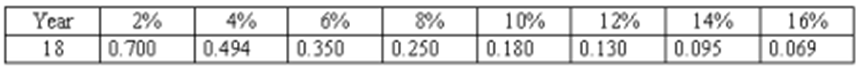

1. Elizabeth Myers invested in a project that required an initial amount of $1,560, and returned one cash inflow of $12,000 at the end of the 18 th year. A partial table of the present value of an annuity of $1 in arrears is as follows:

What is the internal rate of return for this investment?

a. 14%

b. 10%

c. 12%

d. 8%

e. 16%

2.

Financing activities involve:

a. purchasing long-tern assets.

b. payment of operating expenses.

c. selling long-term assets.

d. issuance of Song-term debt.

3.

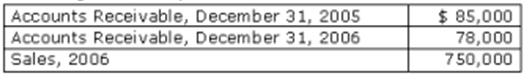

The following items were reported on the balance sheets and income statement for Collin Inc.:

How would the change in accounts receivable be reported in the operating activities section of the statement of cash flows?

a. as a deduction from net income.

b. as an addition to net income.

c. as an addition to sales.

d. as a deduction from sales.

4.

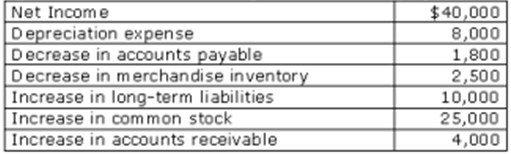

The data given below are from the accounting records of Kain Company:

Based on this information, the net cash flows from operating activities on the statement of cash flows using the indirect method would be:

a. $50,000

b. $42,100

c. $51,300

d. $44,700

Year 2% 18 0.700 4% 0.494 6% 0.350 8% 0.250 10% 0.180 12% 14% 0.130 0.095 16% 0.069 Accounts Receivable, December 31, 2005 Accounts Receivable, December 31, 2006 Sales, 2006 $ 85,000 78,000 750,000 Net Income Depreciation expense Decrease in accounts payable Decrease in merchandise inventory Increase in long-term liabilities Increase in common stock Increase in accounts receivable $40,000 8,000 1,800 2,500 10,000 25,000 4,000

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Internal rate of return IRR is the Rate at which NPV is ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started