Alison owns all of the common shares of Knight Manufacturing Limited (KML) which operates an active business in Belleville, Ontario. Over the past few months

Alison owns all of the common shares of Knight Manufacturing Limited (KML) which operates an active business in Belleville, Ontario. Over the past few months she has been thinking about doing an estate freeze on her shares of KML in anticipation of her retirement in a few years. She has received a proposed plan from an adviser and she would like your thoughts on whether it will accomplish what she wants in a tax-efficient manner. The following is information provided in the proposed plan:

(1) Alison is 55 years old and a widow. She is a Canadian citizen and resident.

(2) She acquired the shares of KML 20 years ago from an arm's-length person for $400,000. The KML shares have a paid-up capital of $100,000.

(3) She has three children. Sandra (32) works in a big bank in Toronto. Tom (30) is a CPA working for one of the large accounting firms in Vancouver. Helen (28) is an engineer with an MBA and she works in KML with Alison.

(4) KML has a current fair market value of $2.7 million and it is expected that this value will continue to grow rapidly, particularly with Helen's energy and skill leading the way.

(5) Alison is concerned about the issue of control of KML after a freeze. Since Helen is showing significant skills and is rapidly taking over the leadership of the company, Alison wants her to have operating control in the long term. However, she wants to maintain control of KML while she has a significant investment in the company.

(6) Alison is delighted with Helen's role in KML, since she would like to retire in three to five years and travel. She has been too busy with the business over the last 10 years to travel as much as she would like.

(7) Alison would like to freeze the value of KML and have her adult children benefit from the current value that she has built up over the years.

(8) Since Helen is responsible for building the increase in value of the business she would like Helen to benefit from the future growth in value.

(9) She does not want to do anything that would lead to conflict among her children over the business in future years. She has heard too many stories where the children fight over control of the business after the parent is gone, especially where they are not all active in the business.

(10)Alison does not have significant assets outside of KML so she will be relying on her interest in KML for her retirement.

(11)Alison has not used any of her capital gains exemption to date.

(12)All of KML's assets are used in a Canadian active business and have been since incorporation.

(13)Alison does not have a cumulative net investment loss and has never claimed an ABIL.

(14)Alison does not want her children involved in her financial affairs while she is alive.

Proposed Sequence of Transactions

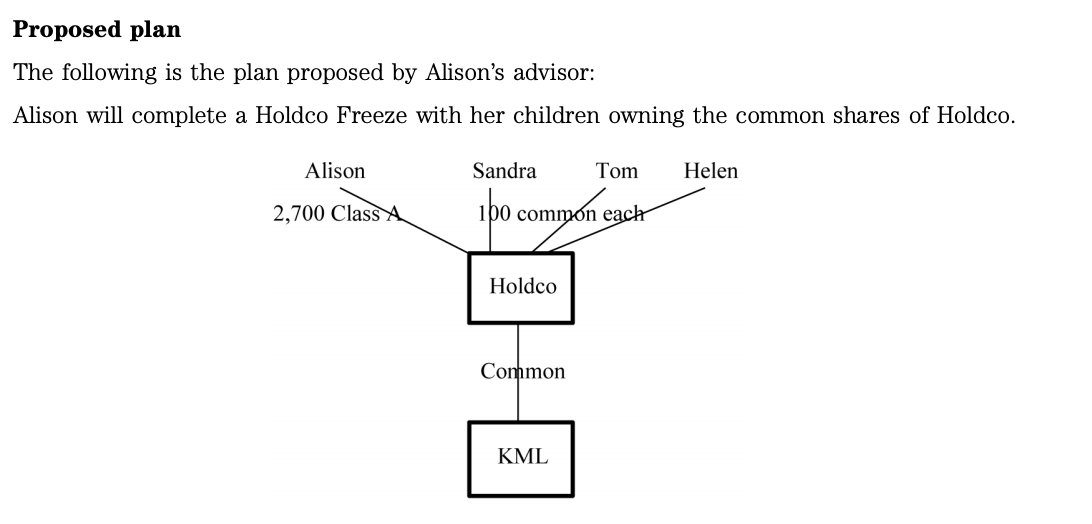

(1) The three children will incorporate Holdco Inc. (Holdco) by paying $1 per share for the common shares. Each child would purchase 100 shares from Holdco using money they have earned themselves.

(2) Holdco will have two classes of shares authorized:

(a) Common shares that are fully participating and voting.

(b) Class A preference shares that are voting as well as redeemable and retractable for $1,000 each. They have a non-cumulative dividend of 6% annually.

(3) The common shares of KML owned by Alison should qualify as QSBC shares since the three tests are met:

(a) KML is a small business corporation.

(b) She has held the shares for more than two years.

(c) The asset mix has not changed in the past five years .

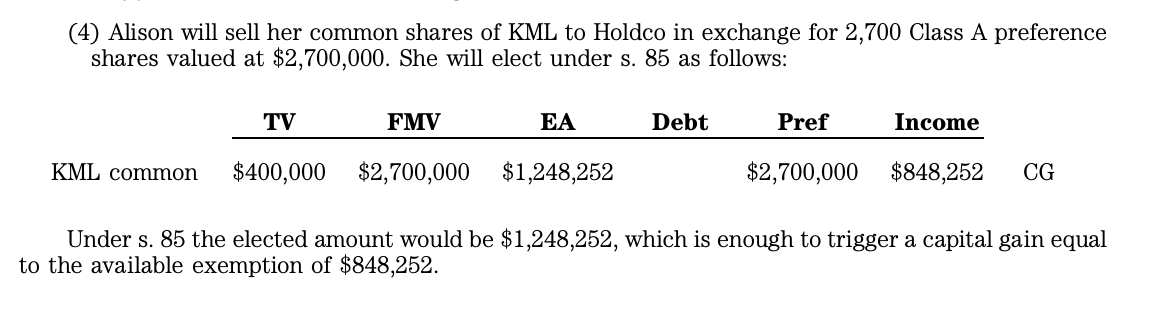

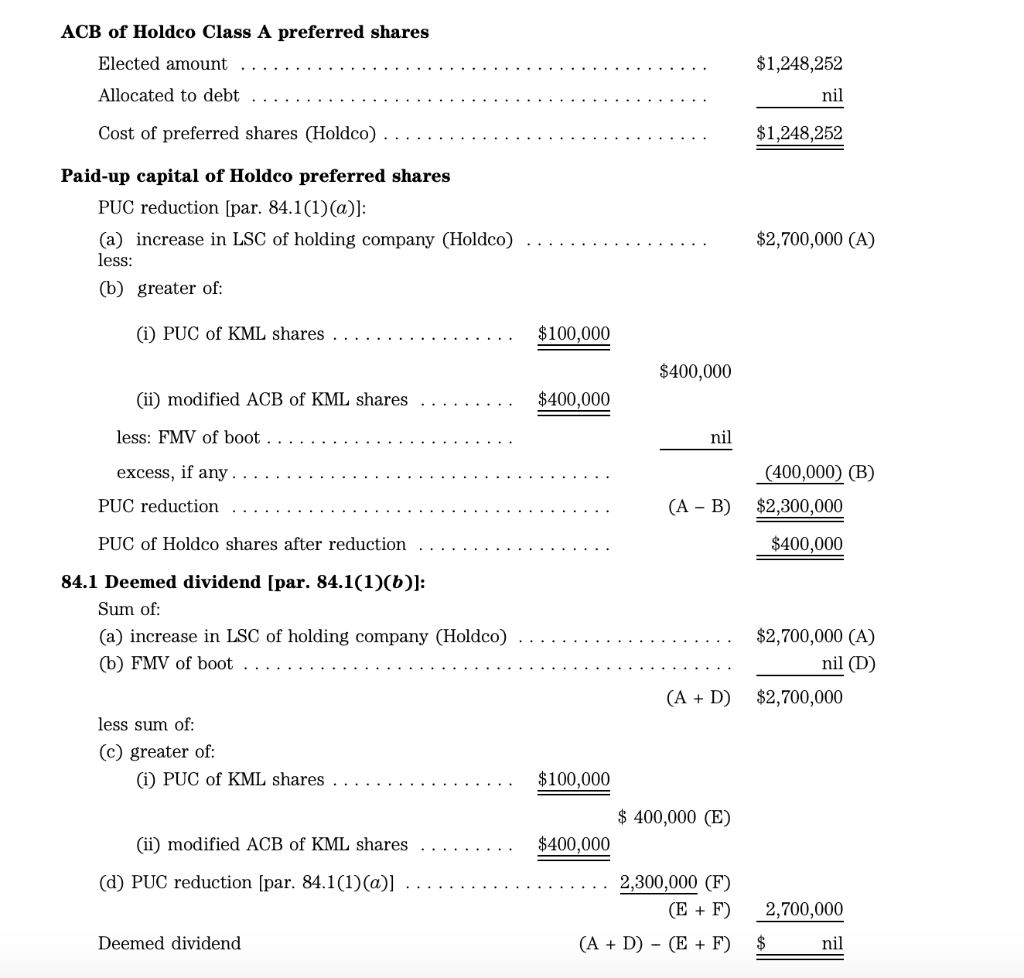

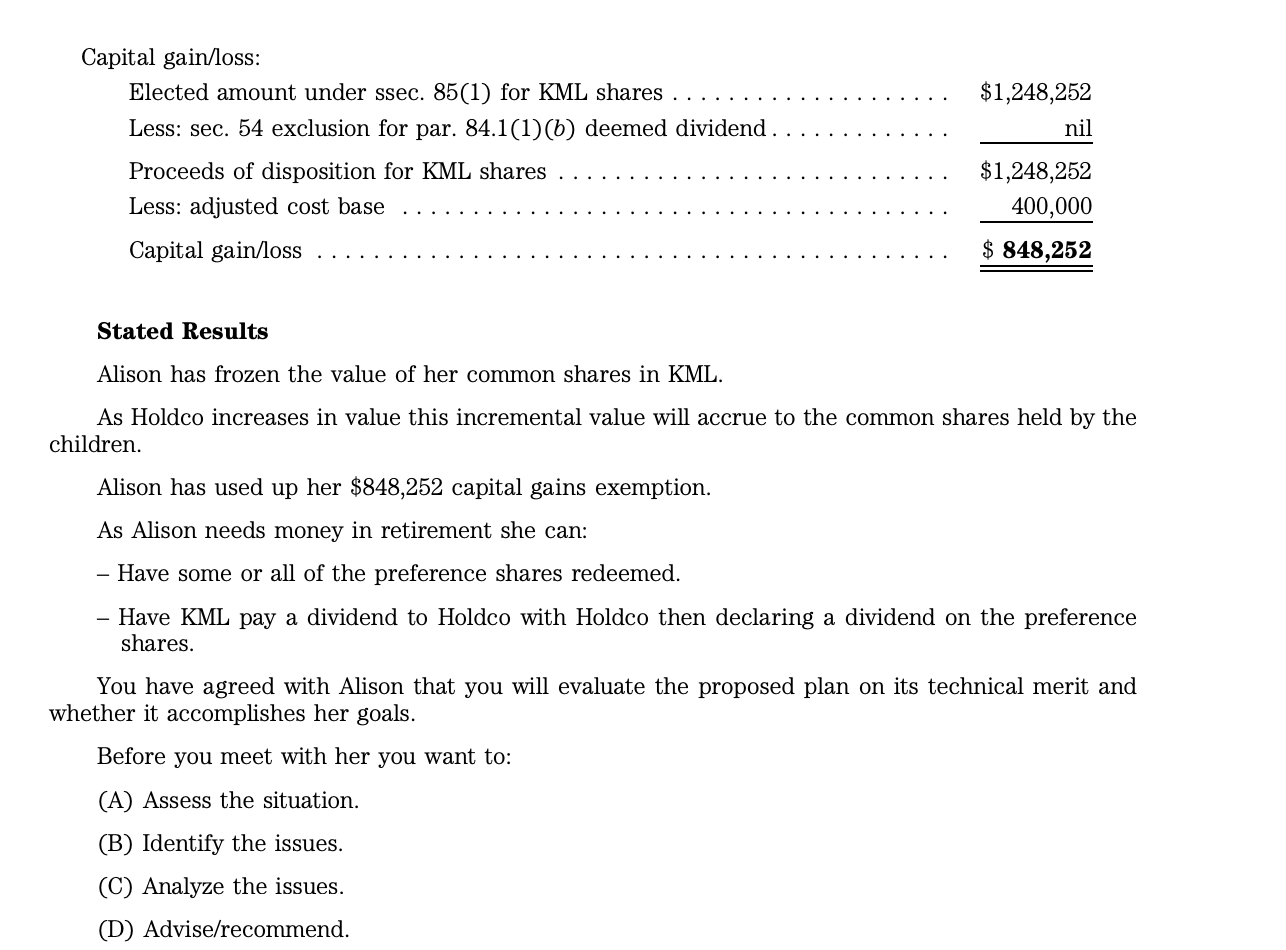

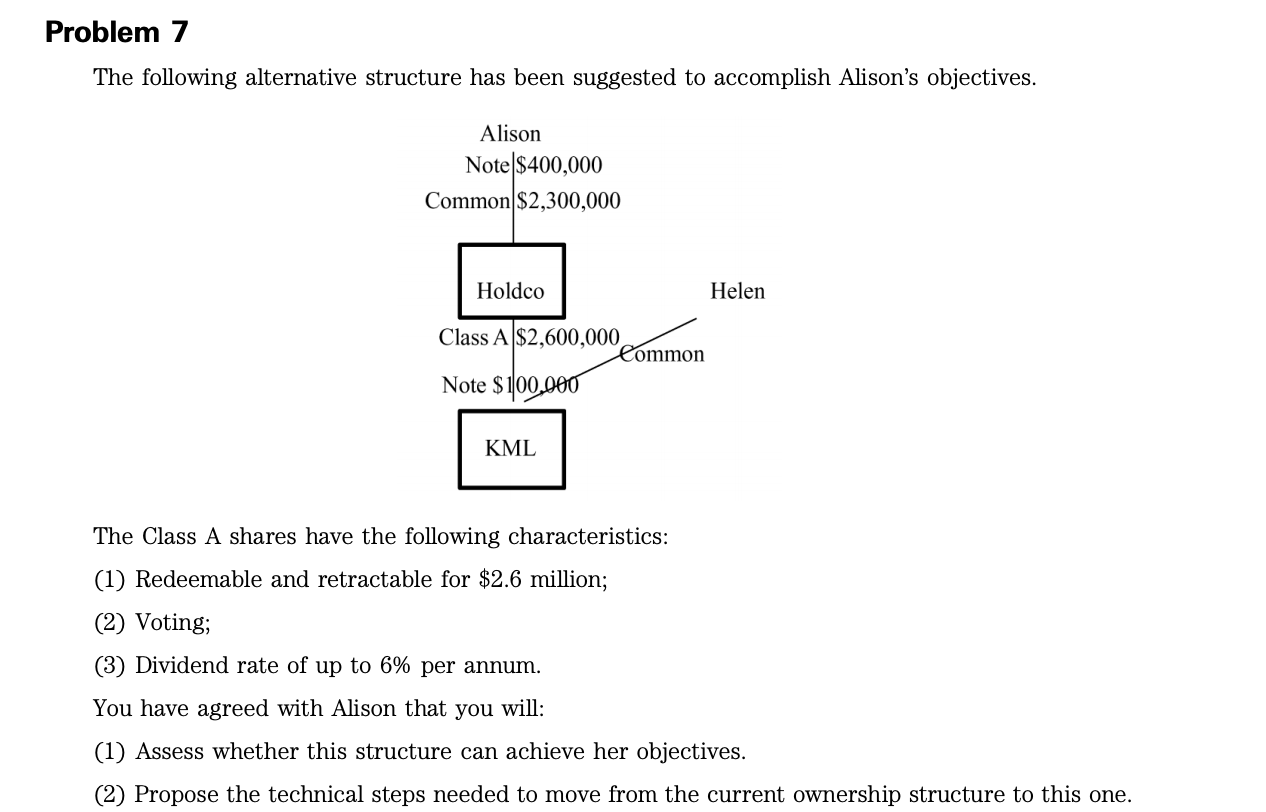

Proposed plan The following is the plan proposed by Alison's advisor: Alison will complete a Holdco Freeze with her children owning the common shares of Holdco. Alison 2,700 Class A Sandra Tom 100 common each Holdco Common KML Helen (4) Alison will sell her common shares of KML to Holdco in exchange for 2,700 Class A preference shares valued at $2,700,000. She will elect under s. 85 as follows: FMV KML common $400,000 $2,700,000 TV EA $1,248,252 Debt Income $2,700,000 $848,252 CG Pref Under s. 85 the elected amount would be $1,248,252, which is enough to trigger a capital gain equal to the available exemption of $848,252. ACB of Holdco Class A preferred shares Elected amount Allocated to debt Cost of preferred shares (Holdco) Paid-up capital of Holdco preferred shares PUC reduction [par. 84.1(1)(a)]: (a) increase in LSC of holding company (Holdco) less: (b) greater of: (i) PUC of KML shares (ii) modified ACB of KML shares less: FMV of boot. excess, if any PUC reduction PUC of Holdco shares after reduction 84.1 Deemed dividend [par. 84.1(1)(b)]: Sum of: (a) increase in LSC of holding company (Holdco) (b) FMV of boot.. less sum of: (c) greater of: (i) PUC of KML shares (ii) modified ACB of KML shares (d) PUC reduction [par. 84.1(1)(a)] Deemed dividend $100,000 $400,000 $100,000 $400,000 $400,000 nil (A - B) (A + D) $ 400,000 (E) 2,300,000 (F) (E + F) (A + D) (E+ F) $1,248,252 nil $1,248,252 $2,700,000 (A) (400,000) (B) $2,300,000 $400,000 $2,700,000 (A) nil (D) $2,700,000 2,700,000 $ nil Capital gain/loss: Elected amount under ssec. 85(1) for KML shares . . Less: sec. 54 exclusion for par. 84.1(1)(b) deemed dividend. Proceeds of disposition for KML shares Less: adjusted cost base Capital gain/loss $1,248,252 - nil $1,248,252 400,000 $ 848,252 Stated Results Alison has frozen the value of her common shares in KML. As Holdco increases in value this incremental value will accrue to the common shares held by the children. Alison has used up her $848,252 capital gains exemption. As Alison needs money in retirement she can: Have some or all of the preference shares redeemed. Have KML pay a dividend to Holdco with Holdco then declaring a dividend on the preference shares. You have agreed with Alison that you will evaluate the proposed plan on its technical merit and whether it accomplishes her goals. Before you meet with her you want to: (A) Assess the situation. (B) Identify the issues. (C) Analyze the issues. (D) Advise/recommend. Problem 7 The following alternative structure has been suggested to accomplish Alison's objectives. Alison Note $400,000 Common $2,300,000 Holdco Class A $2,600,000 Note $100,000 KML Common Helen The Class A shares have the following characteristics: (1) Redeemable and retractable for $2.6 million; (2) Voting; (3) Dividend rate of up to 6% per annum. You have agreed with Alison that you will: (1) Assess whether this structure can achieve her objectives. (2) Propose the technical steps needed to move from the current ownership structure to this one.

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The proposed plan appears to accomplish Alisons goals of freezing the value of her KML shares and pr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started