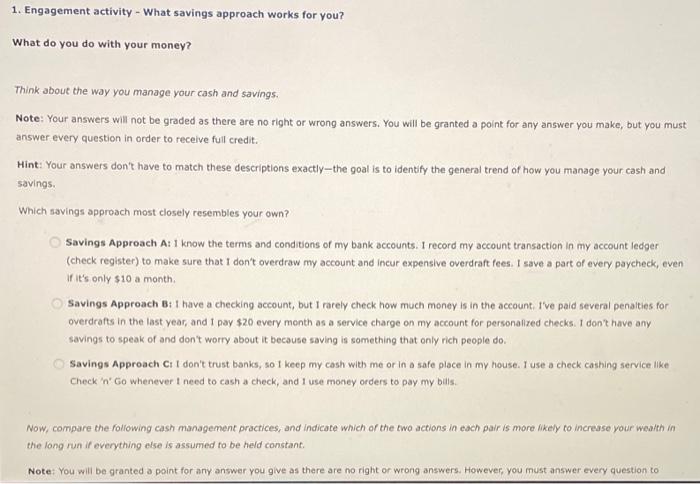

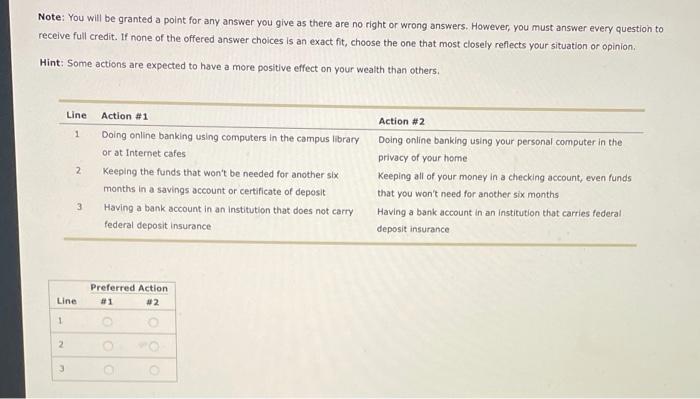

1. Engagement activity - What savings approach works for you? What do you do with your money? Think about the way you manage your cash and savings. Note: Your answers will not be graded as there are no right or wrong answers. You will be granted a point for any answer you make, but you must answer every question in order to receive full credit. Hint: Your answers don't have to match these descriptions exactlythe goal is to identify the general trend of how you manage your cash and savings. Which savings approach most closely resembles your own? Savings Approach A: 1 know the terms and conditions of my bank accounts. I record my account transaction in my account ledger (check register) to make sure that I don't overdraw my account and incur expensive overdraft fees. I save a part of every paycheck, even it's only $10 a month Savings Approach B: I have a checking account, but I rarely check how much money is in the account. I've paid several penalties for overdrafts in the last year, and I pay $20 every month as a service charge on my account for personalized checks. I don't have any savings to speak of and don't worry about it because saving is something that only rich people do. Savings Approach C I don't trust banks, so I keep my cash with me or in a safe place in my house. I use a check cathing service like Check 'n' Go whenever I need to cash a check, and I use money orders to pay my bills. Now.compare the following cash management practices, and indicate which of the two actions in each pair is more likely to increase your wealth in the long run if everything else is assumed to be held constant Note: You will be granted a point for any answer you give as there are no right or wrong answers. However, you must answer every question to Note: You will be granted a point for any answer you give as there are no right or wrong answers. However, you must answer every question to receive full credit. If none of the offered answer choices is an exact fit, choose the one that most closely reflects your situation or opinion Hint: Some actions are expected to have a more positive effect on your wealth than others. Line 1 2 Action #1 Doing online banking using computers in the campus library or at Internet cafes Keeping the funds that won't be needed for another six months in a savings account or certificate of deposit Having a bank account in an institution that does not carry federal deposit Insurance Action #2 Doing online banking using your personal computer in the privacy of your home Keeping all of your money in a checking account, even funds that you won't need for another six months Having a bank account in an institution that carries federal deposit insurance 3 Preferred Action #2 Line 1 2 3