Answered step by step

Verified Expert Solution

Question

1 Approved Answer

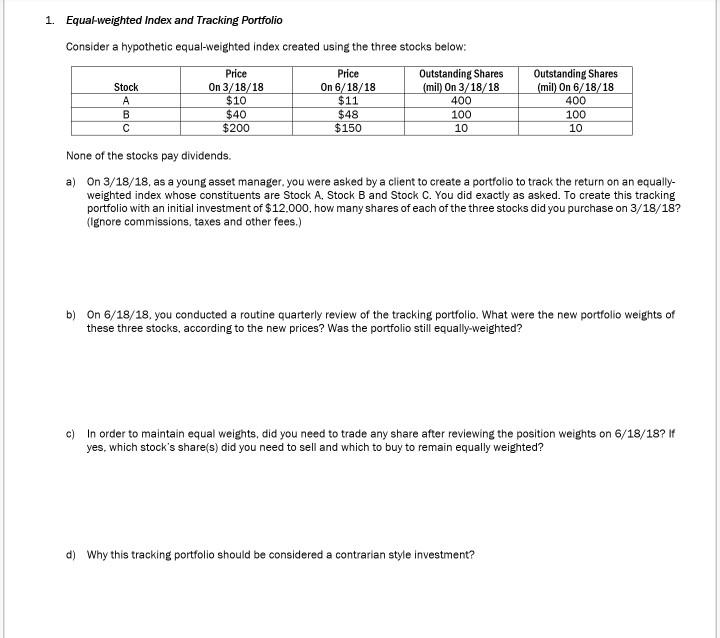

1. Equal-weighted Index and Tracking Portfolio Consider a hypothetic equal-weighted index created using the three stocks below: Stock A Price On 3/18/18 $10 Price

1. Equal-weighted Index and Tracking Portfolio Consider a hypothetic equal-weighted index created using the three stocks below: Stock A Price On 3/18/18 $10 Price On 6/18/18 $11 Outstanding Shares (mil) On 3/18/18 400 B C $40 $200 $48 $150 100 10 Outstanding Shares (mil) On 6/18/18 400 100 10 None of the stocks pay dividends. a) On 3/18/18, as a young asset manager, you were asked by a client to create a portfolio to track the return on an equally- weighted index whose constituents are Stock A, Stock B and Stock C. You did exactly as asked. To create this tracking portfolio with an initial investment of $12.000, how many shares of each of the three stocks did you purchase on 3/18/18? (Ignore commissions, taxes and other fees.) b) On 6/18/18, you conducted a routine quarterly review of the tracking portfolio. What were the new portfolio weights of these three stocks, according to the new prices? Was the portfolio still equally-weighted? c) In order to maintain equal weights, did you need to trade any share after reviewing the position weights on 6/18/18? If yes, which stock's share(s) did you need to sell and which to buy to remain equally weighted? d) Why this tracking portfolio should be considered a contrarian style investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started