Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Equity above 3M would be obtained from the sale of new common stock. (12% flotation cost) 2. Preferred stock over $800,000, the flotation cost

1. Equity above 3M would be obtained from the sale of new common stock. (12% flotation cost)

2. Preferred stock over $800,000, the flotation cost is $2 per share.

a. Calculate the component cost of each type of capital.

b. Calculate the $ levels at which the cost of capital would change.

c. And calculate the WACC at each level.

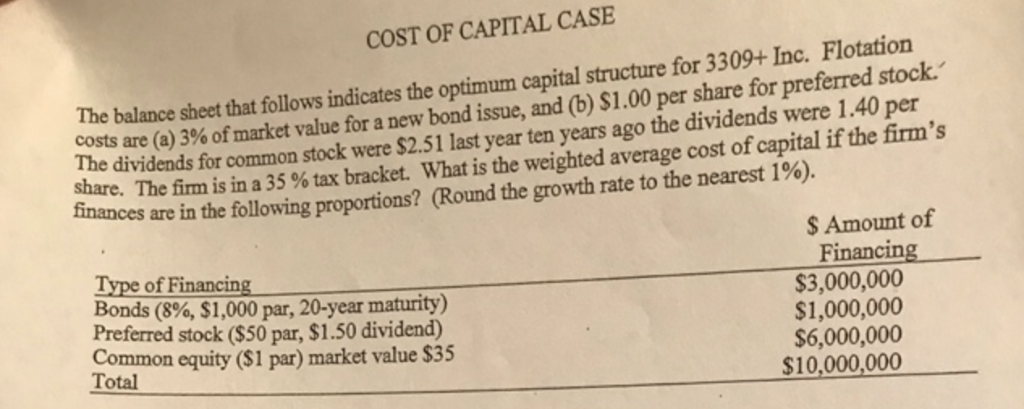

COST OF CAPITAL CASE The balance sheet that follows indicates the optimum capital structure for 3309+Inc. Flotation costs are (a) 3% of market value for a new bond issue, and (b) $1.00 per share for preferred stock. the dividends for common stock were $2.51 last year ten years ago the dividends were 1.40 per share. The firm is ina 35 % tax bracket what is the weighted average cost of capital if the firm's finances are g proportions? (Round the growth rate to the nearest 1%). ces are in the followin $ Amount of Financing_ Type of Financing Bonds (896, $1,000 par, 20-year maturity) Preferred stock ($50 par, $1.50 dividend) Common equity ($1 par) market value 535 $3,000,000 $1,000,000 $6,000,000 $10,000,000 TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started