Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Error in June 30 journal transaction. complete both financial transaction statements 2. correct the red highlighted boxes On July 1, 2020, Sunland Ltd. borrowed

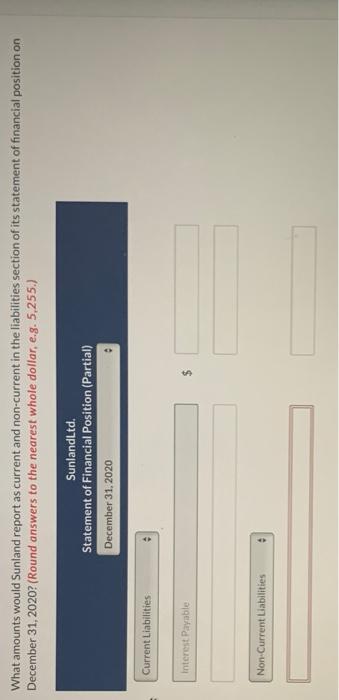

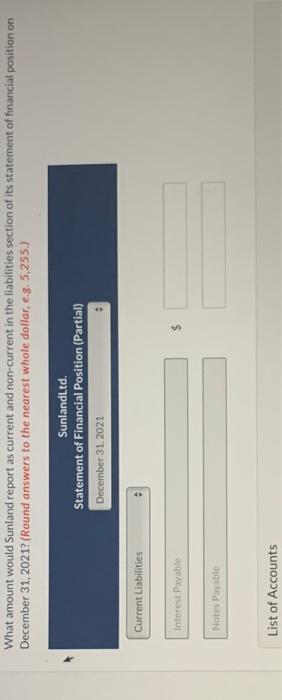

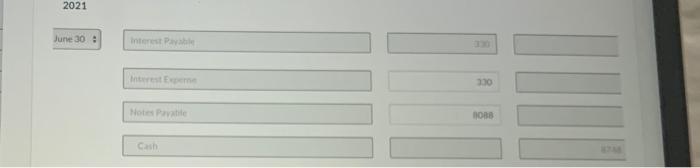

1. Error in June 30 journal transaction.

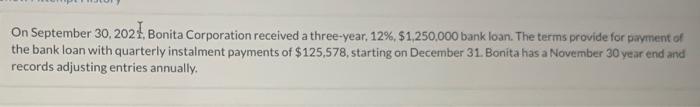

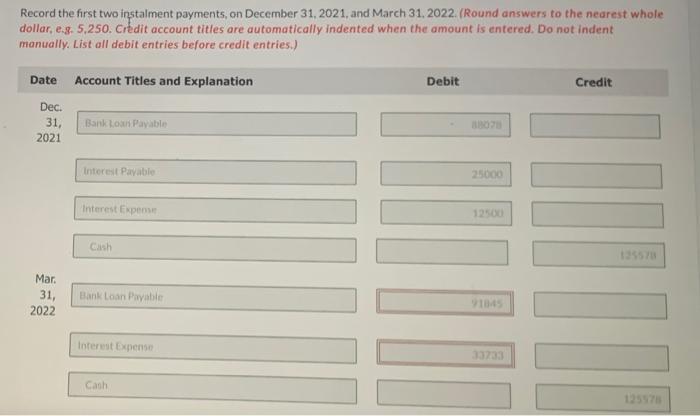

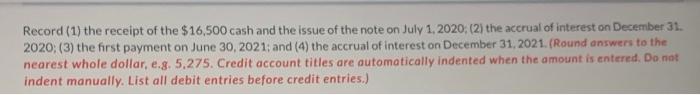

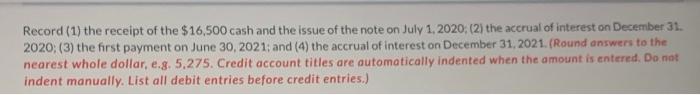

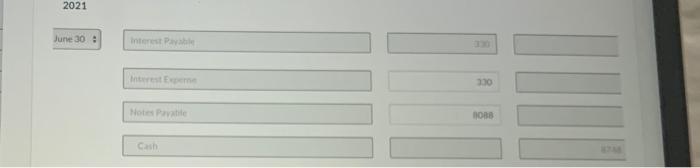

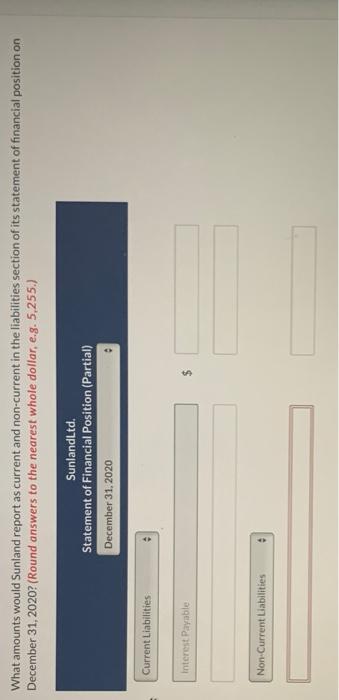

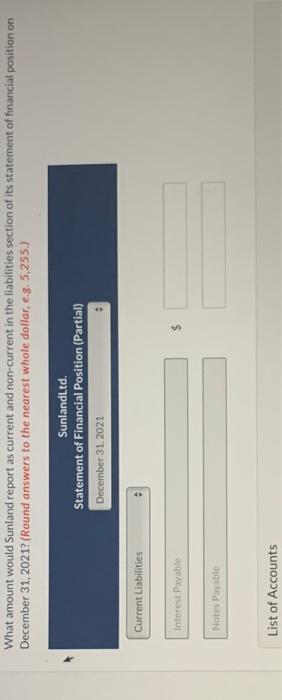

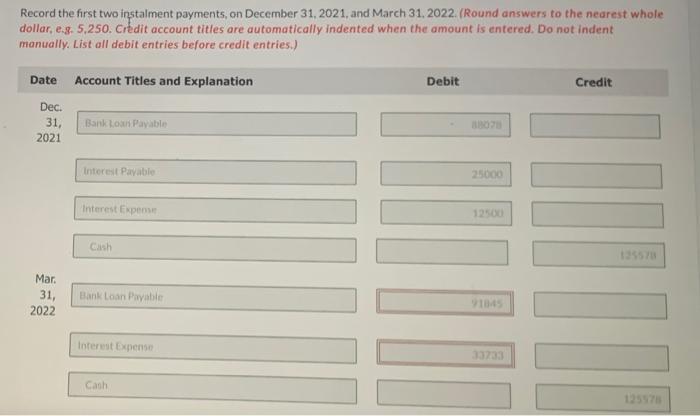

On July 1, 2020, Sunland Ltd. borrowed $16,500 by signing a two-year, 4% note payable. The note is payable in two annual instalments of $8.748 on June 30. The company records adjusting journal entries annually at year end on December 31 Record (1) the receipt of the $16,500 cash and the issue of the note on July 1, 2020; (2) the accrual of interest on December 31. 2020; (3) the first payment on June 30, 2021; and (4) the accrual of interest on December 31, 2021. (Round answers to the nearest whole dollar, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) 2021 June 30 230 Notes Paratite BOBB Cash What amounts would Sunland report as current and non-current in the liabilities section of its statement of financial position on December 31, 2020? (Round answers to the nearest whole dollar, e.g. 5.255.) SunlandLtd. Statement of Financial Position (Partial) December 31, 2020 Current Liabilities Interest Payable Non-Current Liabilities What amount would Sunland report as current and non-current in the liabilities section of its statement of financial position on December 31, 2021? (Round answers to the nearest whole dollar, e.g. 5,255.) SunlandLtd. Statement of Financial Position (Partial) December 31, 2021 Current Liabilities Interest Payable $ Notes Payable List of Accounts On September 30, 2021, Bonita Corporation received a three-year 12%, $1,250.000 bank loan. The terms provide for payment of the bank loan with quarterly instalment payments of $125,578, starting on December 31. Bonta has a November 30 year end and records adjusting entries annually. Record the first two instalment payments, on December 31, 2021, and March 31, 2022. (Round answers to the nearest whole dollar, e.g. 5,250. Crdit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021 Bank Loan Payable Interest Payable 25000 Interest Expense 12500 Canh ULLAMAA Mar. 31, 2022 Bank Loan Payable Interest Expense 33733 Cach complete both financial transaction statements

2.

correct the red highlighted boxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started