Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Estimate the market value of each component of the capital structure Wal-Mart Cost of Capital Wal-Mart, with $55 billion in sales in 1992, 3

1) Estimate the market value of each component of the capital structure

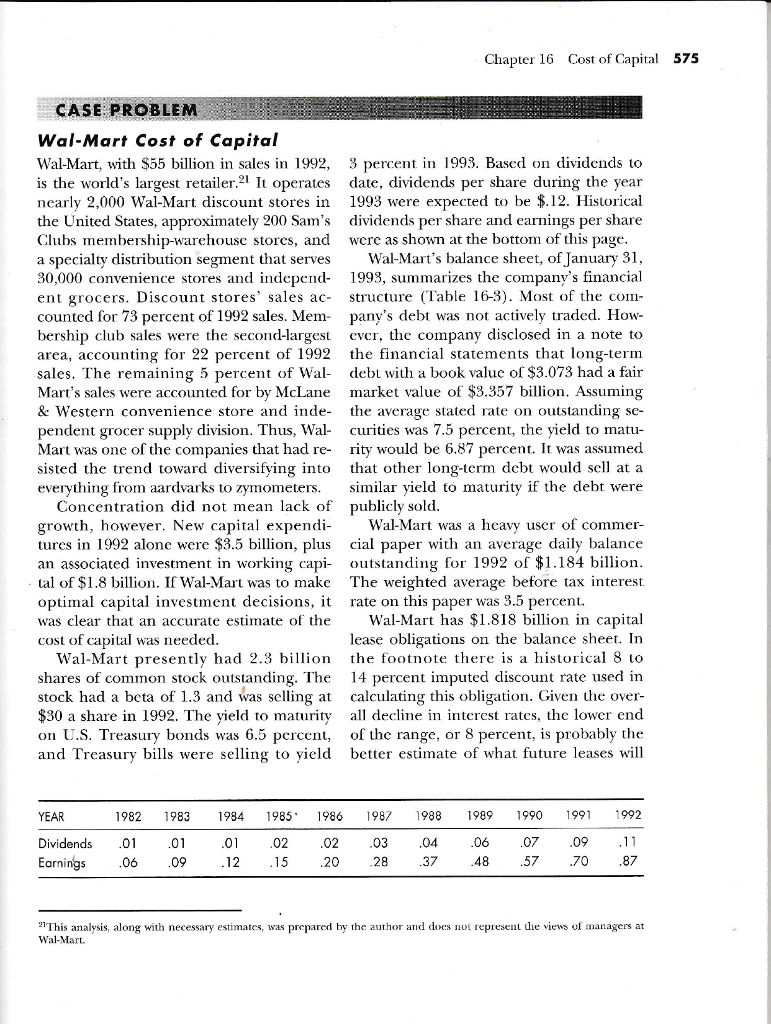

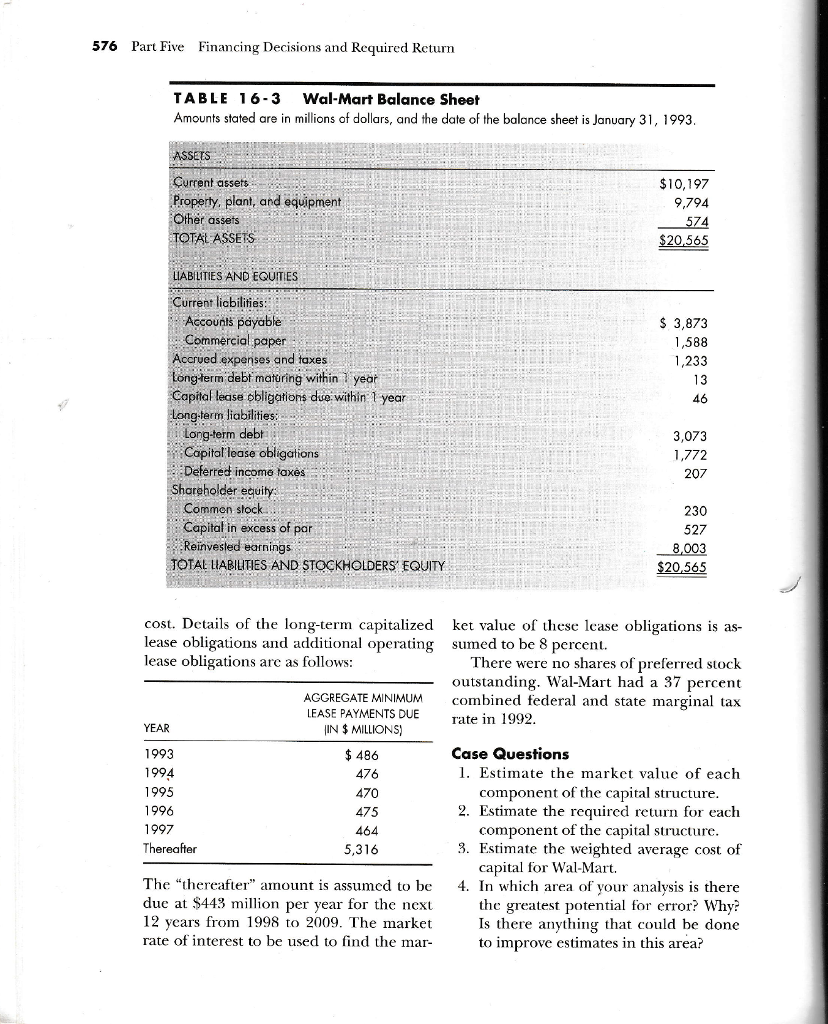

Wal-Mart Cost of Capital Wal-Mart, with $55 billion in sales in 1992, 3 percent in 1993. Based on dividends to is the world's largest retailer. 11 It operates date, dividends per share during the year nearly 2,000 Wal-Mart discount stores in 1993 were expected to be $.12. Historical the United States, approximately 200 Sam's dividends per share and earnings per share Clubs membership-warehouse stores, and were as shown at the bottom of this page. a specialty distribution segment that serves Wal-Mart's balance sheet, of January 31, 30,000 convenience stores and independ- 1993, summarizes the company's financial ent grocers. Discount stores' sales ac- structure (Table 16-3). Most of the comcounted for 73 percent of 1992 sales. Mem- pany's debt was not actively traded. Howbership club sales were the second-largest ever, the company disclosed in a note to area, accounting for 22 percent of 1992 the financial statements that long-term sales. The remaining 5 percent of Wal- debt with a book value of $3.073 had a fair Mart's sales were accounted for by McLane market value of $3.357 billion. Assuming \& Western convenience store and inde- the average stated rate on outstanding sependent grocer supply division. Thus, Wal- curities was 7.5 percent, the yield to matuMart was one of the companies that had re- rity would be 6.87 percent. It was assumed sisted the trend toward diversifying into that other long-term debt would sell at a everything from aardvarks to zymometers. similar yield to maturity if the debt were Concentration did not mean lack of publicly sold. growth, however. New capital expendi- Wal-Mart was a heavy user of commertures in 1992 alone were $3.5 billion, plus cial paper with an average daily balance an associated investment in working capi- outstanding for 1992 of $1.184 billion. tal of $1.8 billion. If Wal-Mart was to make The weighted average before tax interest. optimal capital investment decisions, it rate on this paper was 3.5 percent. was clear that an accurate estimate of the Wal-Mart has $1.818 billion in capital cost of capital was needed. lease obligations on the balance sheet. In Wal-Mart presently had 2.3 billion the footnote there is a historical 8 to shares of common stock outstanding. The 14 percent imputed discount rate used in stock had a beta of 1.3 and was selling at calculating this obligation. Given the over$30 a share in 1992. The yield to maturity all decline in interest rates, the lower end on U.S. Treasury bonds was 6.5 percent, of the range, or 8 percent, is probably the and Treasury bills were selling to yield better estimate of what future leases will 21 This analysis, along with necessary estimates, was prepared by the anthor and does not represent dhe views of managers at Wal-Mart. 576 Part Five Financing Decisions and Required Return TABLE 163 Wal-Mart Balance Sheet Amounts stated are in millions of dollars, and the date of the balance sheet is January 31,1993. cost. Details of the long-term capitalized ket value of these lease obligations is aslease obligations and additional operating sumed to be 8 percent. lease obligations are as follows: There were no shares of preferred stock outstanding. Wal-Mart had a 37 percent combined federal and state marginal tax rate in 1992. Case Questions 1. Estimate the market value of each component of the capital structure. 2. Estimate the required return for each component of the capital structure. 3. Estimate the weighted average cost of capital for Wal-Mart. The "thereafter" amount is assumed to be 4. In which area of your analysis is there due at $443 million per year for the next the greatest potential for error? Why? 12 years from 1998 to 2009 . The market Is there anything that could be done rate of interest to be used to find the mar- to improve estimates in this areaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started