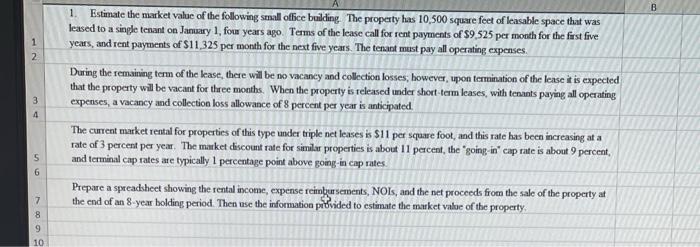

1. Estimate the market value of the following small offee beilding. The property has 10,500 square feet of leasable space that was leased to a single tenant on January 1, four years ago. Tems of the lease call for rent payments of $9,525 per month for the first five years, and rent payments of $11,325 per month for the next five years. The tenant must pay all operating expenses. During the remaining term of the lease, there will be no vacancy and collection losses; bowever, upon termination of the lease it is expected that the property will be vacant for three months. When the property is released under short-tam leases, with tenints paying all operating expenses, a vacancy and collection loss allowance of 8 percent per year is anticipated. The current market rental for properties of this type under triple net leases is $11 per square foot, and this rate has been increasing at a rate of 3 percent per year. The market discount rate for similar properties is about 11 pecent, the "going-in" cap rate is about 9 percent, and taminal cap rates are typically 1 percentage point above going -in cap rates. Prepare a spreadsheet showing the rental income, expense reinbursements, NOIs, and the net procceds from the sale of the property at the end of an 8-year bolding period. Then use the information potvided to estimate the murket value of the property. 1. Estimate the market value of the following small offee beilding. The property has 10,500 square feet of leasable space that was leased to a single tenant on January 1, four years ago. Tems of the lease call for rent payments of $9,525 per month for the first five years, and rent payments of $11,325 per month for the next five years. The tenant must pay all operating expenses. During the remaining term of the lease, there will be no vacancy and collection losses; bowever, upon termination of the lease it is expected that the property will be vacant for three months. When the property is released under short-tam leases, with tenints paying all operating expenses, a vacancy and collection loss allowance of 8 percent per year is anticipated. The current market rental for properties of this type under triple net leases is $11 per square foot, and this rate has been increasing at a rate of 3 percent per year. The market discount rate for similar properties is about 11 pecent, the "going-in" cap rate is about 9 percent, and taminal cap rates are typically 1 percentage point above going -in cap rates. Prepare a spreadsheet showing the rental income, expense reinbursements, NOIs, and the net procceds from the sale of the property at the end of an 8-year bolding period. Then use the information potvided to estimate the murket value of the property