Question

1. Estimate the Pre-Tax Cost of Debt What is the pre-tax cost of debt for your company? Show how you get the number. Use

1. Estimate the Pre-Tax Cost of Debt

What is the pre-tax cost of debt for your company? Show how you get the number.

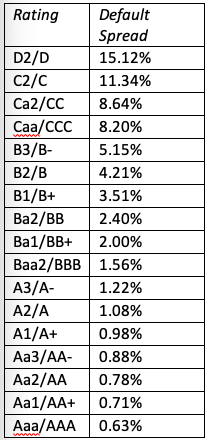

Use the default spread (default premium) table in this case study and identify the spread for the debt rating given for your company in the case study. Add this spread to your risk-free rate to estimate the pre-tax cost of debt.

Pre-Tax Cost of Debt=Risk free rate + default spread

2. Estimate the Tax Rate and After-Tax Cost of Debt

a. What is the firm's tax rate? Explain how you get the number.

You may find the effective tax rate for your company from the SEC Form 10-K filings:

https://www.sec.gov/edgar/searchedgar/companysearch.html

· In the search box, type the ticker of your company, and click when you see your company in the list.

· In "Filing type" box, search for 10-k

· Locate the most recent 10-k filing and click on "documents"

· Then click on the document which has "10-k" in description column.

If the effective tax rate is not stated in the 10-k filing, you can compute the tax rate as the ratio of (provision for income taxes) over (income before income taxes).

b. What is after-tax cost of debt? Show how you get the number. {pre-tax cost of debt*(1-tax rate)}

3. Estimate the Market Value of Common Equity and Debt

a. Identify the current number of outstanding shares. (You may get this from Yahoo Finance)

b. What is the current stock price? (You may get this from Yahoo Finance)

c. Estimate the market value of common equity. (stock price * number of outstanding shares)

d. What is the market value of total debt outstanding? Explain how you get the number.

You can assume that the book value of debt listed on the balance sheet is a close proxy for the market value of debt. (Use "long term debt" + "short term portion of long term debt" + "commercial paper" (if any) from most recent balance sheet in 10-k filing)

4. Estimate the WACC

Using the information identified in the above questions, estimate the firm's WACC. Show your work.

5. Estimate the WACC under a target debt ratio

Suppose the company increases its debt-to-value ratio (D/D+E) by 10 percentage points (e.g. from 40% to 50%), its debt rating decreases by one category (one category that will lead to a higher default spread in the default spread table, e.g. from AA to AA-) and its tax rate does not change. What will be the new cost of debt, cost of equity and the WACC? Show your work.

Note that you need to first calculate ra (cost of assets) using the levels of re, rd and D/E before the change. Then use the formula again with the new levels of rd and D/E, to get the new re.

Default Spread Table:

Rating Default Spread D2/D 15.12% C2/C 11.34% Ca2/CC 8.64% Caa/CCC 8.20% B3/B- 5.15% B2/B 4.21% B1/B+ 3.51% Ba2/BB 2.40% Ba1/BB+ 2.00% Baa2/BBB 1.56% A3/A- 1.22% A2/A 1.08% A1/A+ 0.98% Aa3/AA- 0.88% Aa2/AA 0.78% Aa1/AA+ 0.71% Aaa/AAA 0.63% ww

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this multipart finance question 1 PreTax Cost of Debt Given company rati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started