Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Estimated Total use of Cost Driver Total Assests Total Hrs Total Liabilities Total Manufacturing overhead Total owners Equity Total Plantwide Labor Total Revenue Sotir

1.

Estimated Total use of Cost Driver

Total Assests

Total Hrs

Total Liabilities

Total Manufacturing overhead

Total owners Equity

Total Plantwide Labor

Total Revenue

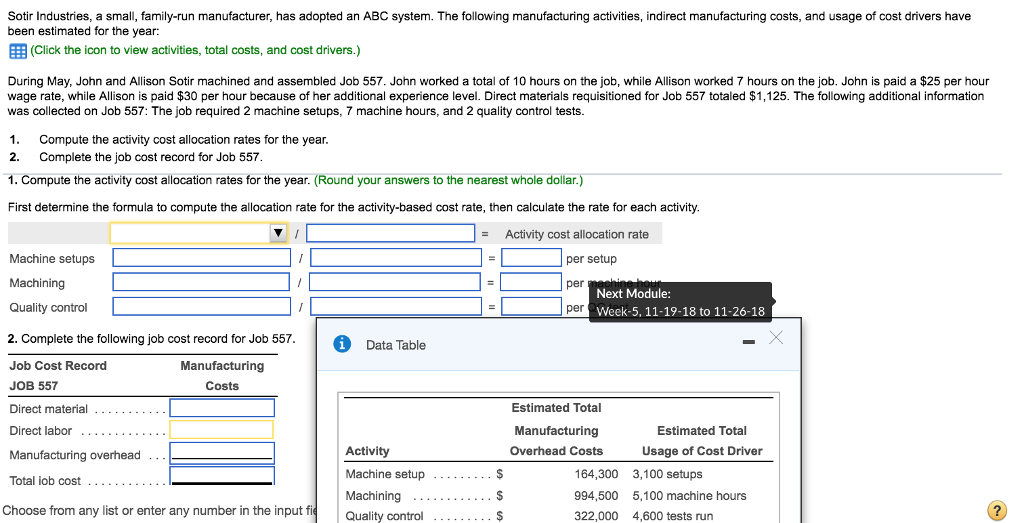

Sotir Industries, a small, family-run manufacturer, has adopted an ABC system. The following manufacturing activities, indirect manufacturing costs, and usage of cost drivers have been estimated for the year: EEB (Click the icon to view activities, total costs, and cost drivers.) During May, John and Allison Sotir machined and assembled Job 557. John worked a total of 10 hours on the job, while Allison worked 7 hours on the job. John is paid a $25 per hour wage rate, while Allison is paid $30 per hour because of her additional experience level. Direct materials requisitioned for Job 557 totaled $1,125. The following additional information was collected on Job 557: The job required 2 machine setups, 7 machine hours, and 2 quality control tests 1. Compute the activity cost allocation rates for the year. 2. Complete the job cost record for Job 557 1. Compute the activity cost allocation rates for the year. (Round your answers to the nearest whole dollar.) First determine the formula to compute the allocation rate for the activity-based cost rate, then calculate the rate for each activity Activity cost allocation rate Machine setups Machining Quality control 2. Complete the following job cost record for Job 557. Job Cost Record JOB 557 Direct material . .. . Direct labor Manufacturing overhead Total iob cost per setup per Next Module: Week-5, 11-19-18 to 11-26-18 Data Table Manufacturing Costs Estimated Total Manufacturing Overhead Costs Estimated Total Activity Machine setup Machining Quality control 164,300 994,500 322,000 Usage of Cost Driver 3,100 setups 5,100 machine hours 4,600 tests run Choose from any list or enter any number in the input fiStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started