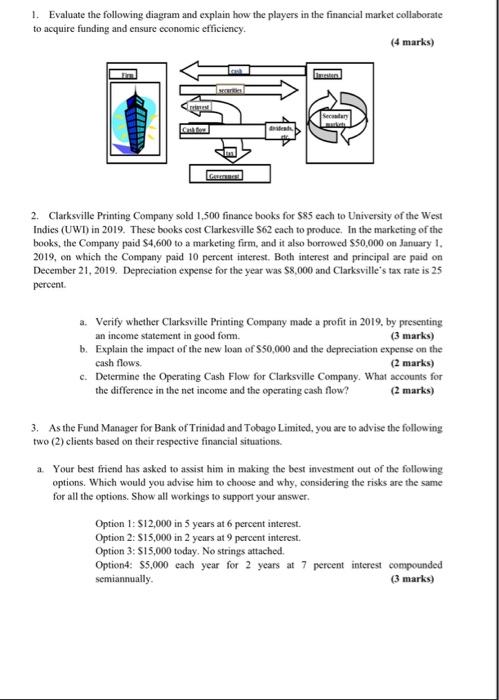

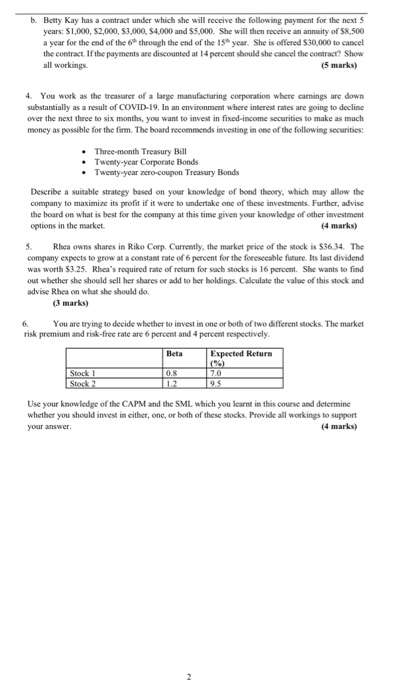

1. Evaluate the following diagram and explain how the players in the financial market collaborate to acquire funding and ensure economic efficiency. (4 marks) 2. Clarksville Printing Company sold 1,500 finance books for $85 each to University of the West Indies (UWT) in 2019. These books cost Clarkesville 562 each to produce. In the marketing of the books, the Company paid $4,600 to a marketing firm, and it also borrowed S50,000 on January 1, 2019, on which the Company paid 10 percent interest. Both interest and principal are paid on December 21, 2019. Depreciation expense for the year was $8,000 and Clarksville's tax rate is 25 percent a. Verify whether Clarksville Printing Company made a profit in 2019, by presenting an income statement in good form. (3 marks) b. Explain the impact of the new loan of S50,000 and the depreciation expense on the cash flows. (2 marks) c. Determine the Operating Cash Flow for Clarksville Company. What accounts for the difference in the net income and the operating cash flow? (2 marks) 3. As the Fund Manager for Bank of Trinidad and Tobago Limited, you are to advise the following two (2) clients based on their respective financial situations. a. Your best friend has asked to assist him in making the best investment out of the following options, which would you advise him to choose and why, considering the risks are the same for all the options. Show all workings to support your answer. Option 1: $12,000 in 5 years at 6 percent interest. Option 2: $15,000 in 2 years at 9 percent interest. Option 3: $15,000 today. No strings attached. Option4: $5,000 cach year for 2 years at 7 percent interest compounded semiannually (3 marks) b. Betty Kay has a contract under which she will receive the following payment for the next years: $1,000 $2,000 $3,000 $4,000 and $5,000. She will then receive an annuity of $8.500 a year for the end of the 6through the end of the 15 year. She is offered $30,000 to cancel the contract. If the payments are discounted at 14 percent should she cancel the contract Show all workings 5 marks) 4. You work as the treasurer of a large manufacturing corporation where carings are down substantially as a result of COVID-19. In an environment where interest rates are going to decline over the next three to six months, you want to invest in fixed-income securities to make as much money as possible for the firm. The board recommends investing in one of the following securities Three-month Treasury Ball Twenty-year Corporate Bonds Twenty year coupon Treasury Bonds Describe a suitable strategy based on your knowledge of bond theory, which may allow the company to maximize its profit if it were to undertake one of these investments. Further, advise the board on what is best for the company at this time given your knowledge of other investment options in the market (4 marks) 5. Rhea owns shares in Riko Corp. Currently, the market price of the stock is $36.34. The company expects to grow at a constant role of 6 percent for the foreseeable future. Its last dividend was worth $3.25. Rhea's required rate of return for such stocks is 16 percent. She wants to find out whether she should sell her shares or add to her holdings. Calculate the value of this stock and advise Rhea on what she should do (3 marks) 6 You are trying to decide whether to invest in one or both of two different stocks. The market risk premium and risk-free rate are 6 percent and 4 percent respectively. Beta Expected Return 10%) 0.8 7.0 11295 Stock ! Stack 2 Use your knowledge of the CAPM and the SML which you learnt in this course and determine whether you should invest in either, one, or both of these stocks. Provide all workings to support your answer (4 marks) INSTRUCTIONS: I. Read the case below carefully and answer ALL the questions which follow 2. Your answers may be entered using a Microsoft Excel spreadsheet OR may be entered in a table format using Microsoft Word HEALTHY OPTIONS INC. Healthy Options is a Pharmaceutical Company which is considering investing in a new production line of portable electrocardiogram (ECG) machines for its clients who suffer from cardiovascular diseases The company has to invest in equipment which costs $2.500,000 and falls within a MARCS depreciation of 5 years, and is expected to have a scrap value of $200,000 at the end of the project Other than the equipment, the company needs to increase its cash and cash equivalents by S100,000 increase the level of inventory by $30,000, increase accounts receivable by $250,000 and increase counts payable by $50,000 at the beginning of the project. Healthy Options expects the project to have a life of five years. The company would have to pay for transportation and installation of the oquipment which has an invoice price of $450,000 The company has already invested $75,000 in Research and Development and therefore expects a positive impact on the demand for the new product line. Expected annual sales for the ECG machines in years one to three are $1.200,000, and $850,000 in the following two years. The variable costs of production are projected to be S267,000 per year in years one to three and $375,000 in years four and five. Fixed overhead is $180,000 per year over the life of the project The introduction of the new line of portable ECG machines will cause a net decrease of $50,000 in profit contribution after taxes, due to a decrease in sales of the other lines of tester machines produced by the company. By investing in the new product line Healthy Options would have to use a packaging machine which the company already has and which will be sold at the end of the project for $350,000 after-tax in the equipment market. The company's financial analyst has advised Healthy Options to use the weighted average cost of capital as the appropriate discount rate to evaluate the project. Information about the company's sources of financing is provided below: The company will contract a new loan in the sum of $2,000,000 that is secured by machinery and the loan has an interest rate of 6 percent. Healthy Options has also issued 4,000 new bond issues with an 8 percent coupon, paid semiannually, and which matures in 10 years. The bonds were sold at par, and incurred floatation cost of 2 percent per issue. The company's preferred stock pays an annual dividend of 45 percent and is currently selling for $60, and there are 100,000 shares outstanding. There are 300.000 million shares of common stock outstanding, and they are currently selling for $21 cach. The beta on these shares is 0.95 Other relevant information about the company follows: The 20-year Treasury Bond rate is currently 45 percent and you have estimated market-risk premium to be 6.75 percent using the returns on stocks and Treasury Bonds from 2010 to 2019. Healthy Options has a marginal tax rate of 25 percent. As a recent graduate of the UWIOC, The General Manager of the company has hired you to work alongside the Financial Controller of the company to help determine whether the company should invest in the new product line. He has provided you with the following questions to guide you in your assessment of the project and to present your findings to the Company REQUIRED: 7. Determine the weighted average cost of capital (WACC) for Healthy Options marks) 8. Calculate the initial investment cash-flows. 9. Calculate the after-tax operating cash-flows (10 marks) 10. Determine the tax on salvage value of the equipment, then show the terminal year cash flows 11. Identify three (3) relevant cash flows which were mentioned in the case and how they should be treated in the capital budgeting decision mark 12. Taking into consideration all the information given, determine the Net Present Value of the project and advise the company on whether to invest in the new line of product marks) r ed to the nearest whole in the calculations of the other questions where Use your answe HANG