Question

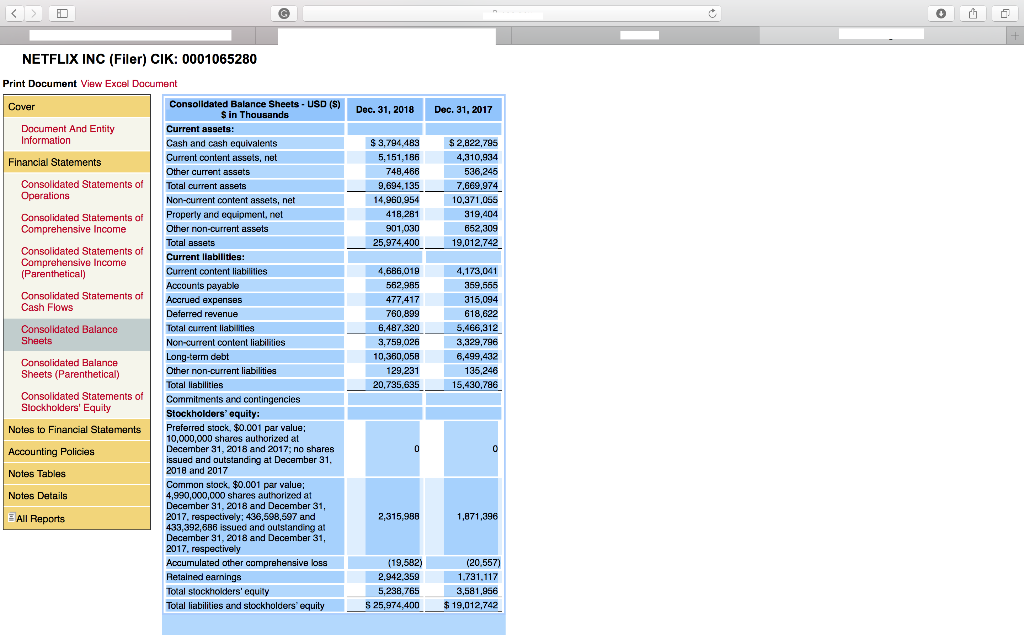

1. Evaluate the GAAP assets listed in the SEC.gov 10K for your primary company. If you are using a privately held company or non-profit, you

1. Evaluate the GAAP assets listed in the SEC.gov 10K for your primary company. If you are using a privately held company or non-profit, you are more than welcome to use a publicly traded company of your choice to conduct your research. Just make sure to explain why you selected the company.

2. The 10K Notes to Financials will likely discuss your primary company's GAAP assets that will allow you to focus on AT LEAST TWO line items. However, you must guess the potential hidden value by using your research. There are many online tools that can assist you in finding guesstimate asset values on a balance sheet.

3. Of all the assets contained in your company's balance sheet, select two and explain the current base GAAP value. At this point, apply the lessons learned from your readings to provide and support the guesstimate hidden value for each asset. If you use the WAG (Wild A** Guess) approach, you will need to provide enough reasons to justify the valuations. That guess will not come from the 10K balances or notes, just your critical thinking, business knowledge, and research.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started