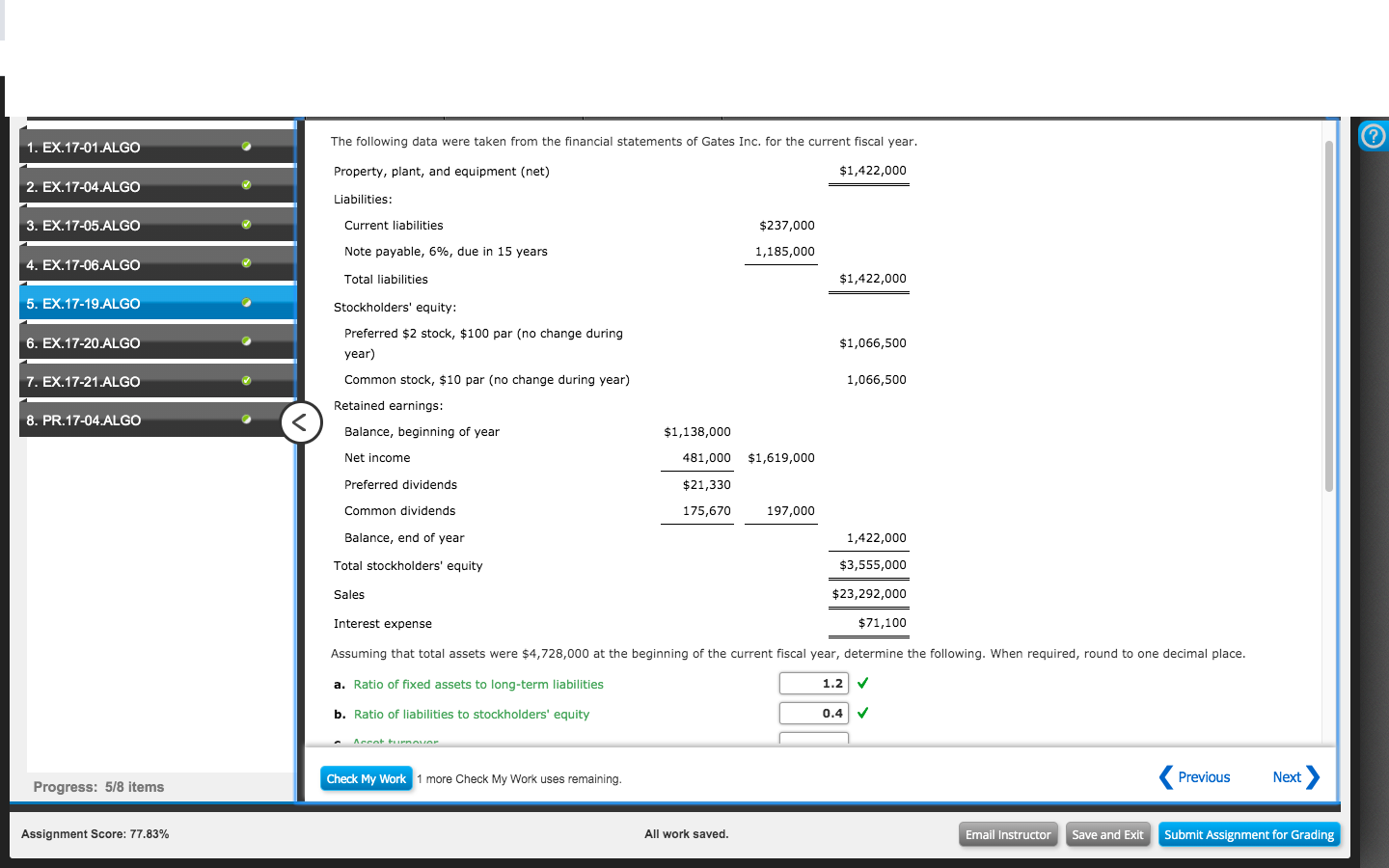

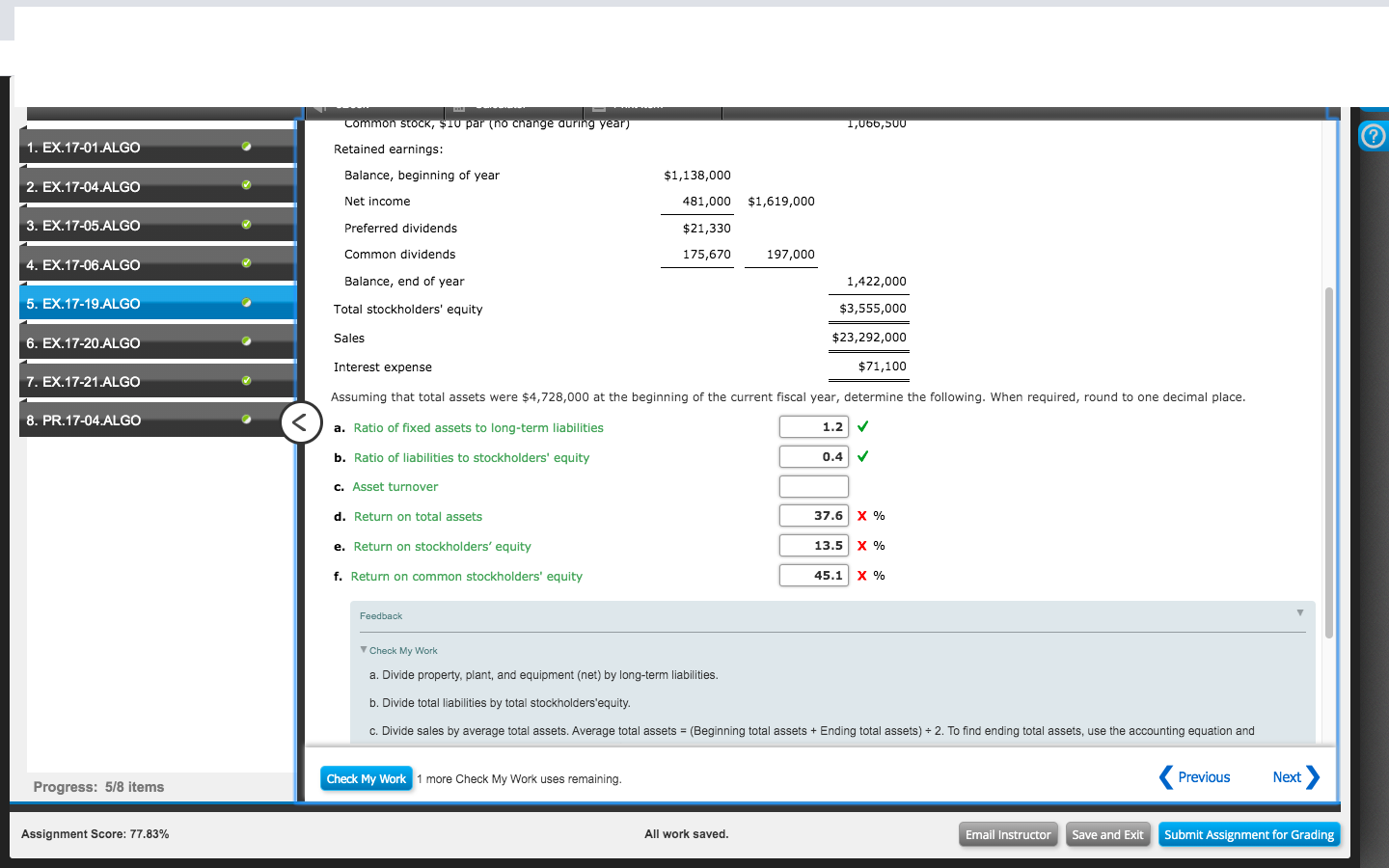

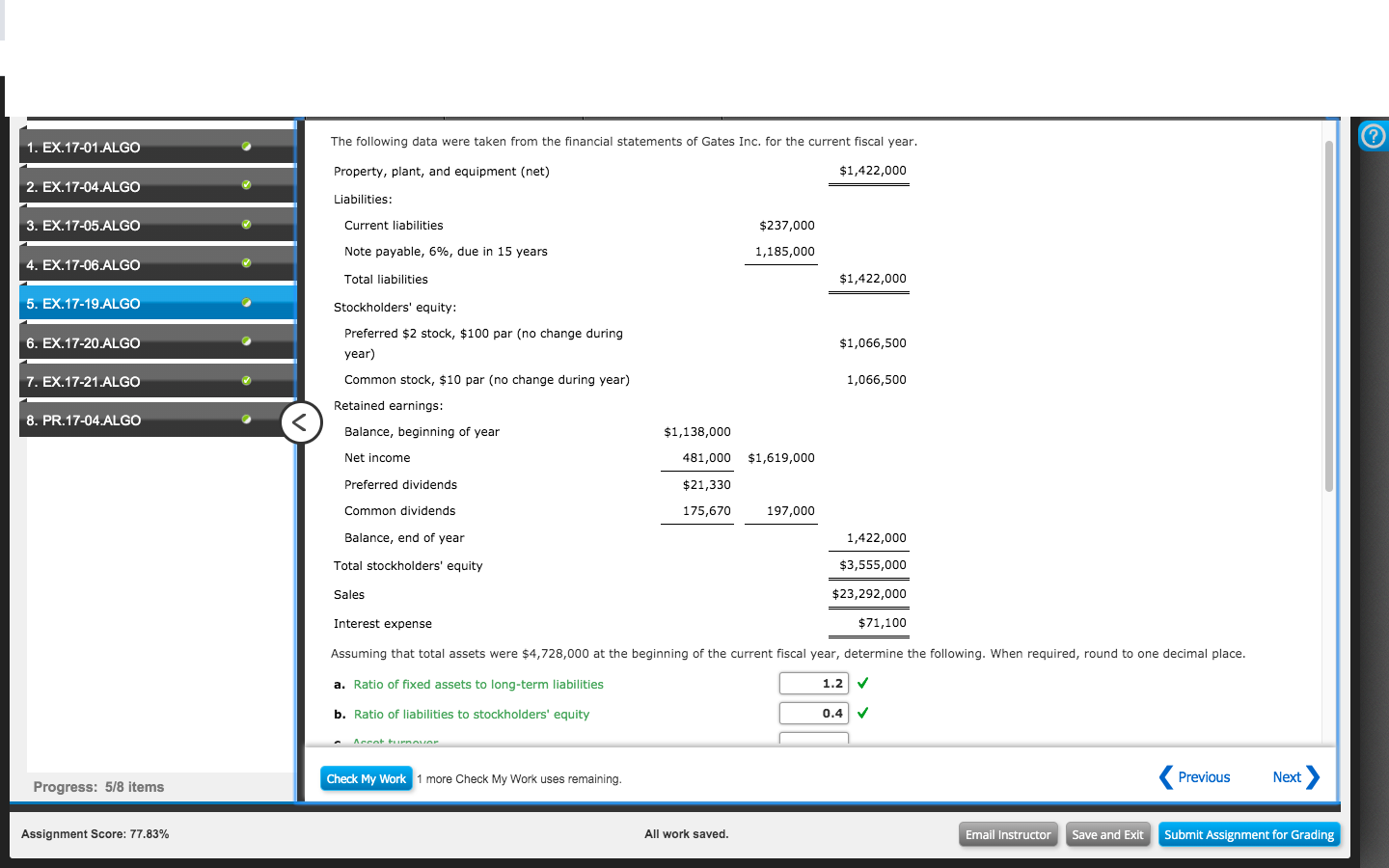

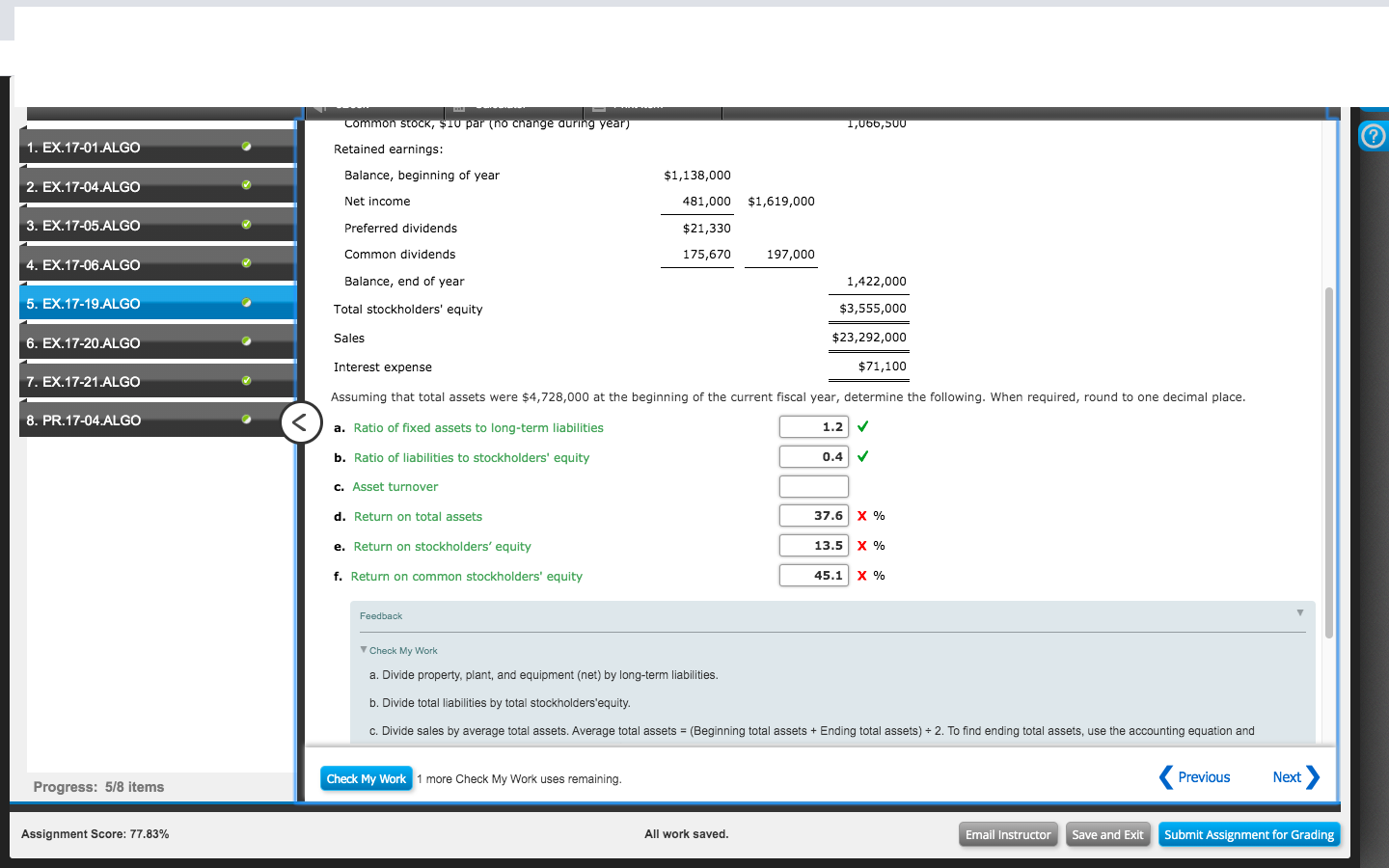

1. EX.17-01.ALGO The following data were taken from the financial statements of Gates Inc. for the current fiscal year. Property, plant, and equipment (net) $1,422,000 2. EX.17-04.ALGO 3. EX.17-05.ALGO Liabilities: Current liabilities Note payable, 6%, due in 15 years $ 237,000 1,185,000 4. EX.17-06.ALGO Total liabilities $1,422,000 5. EX.17-19.ALGO Stockholders' equity: Preferred $2 stock, $100 par (no change during 6. EX.17-20.ALGO $1,066,500 year) 7. EX.17-21.ALGO Common stock, $10 par (no change during year) 1,066,500 Retained earnings: 8. PR. 17-04.ALGO Balance, beginning of year $1,138,000 Net income $1,619,000 Preferred dividends 481,000 $21,330 175,670 Common dividends 197,000 Balance, end of year 1,422,000 Total stockholders' equity $3,555,000 Sales $23,292,000 Interest expense $71,100 Assuming that total assets were $4,728,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities 1.2 b. Ratio of liabilities to stockholders' equity 0.4 - Accottur RALA Check My Work 1 more Check My Work uses remaining. Previous Next > Progress: 5/8 items Assignment Score: 77.83% All work saved. Email Instructor Save and Exit Submit Assignment for Grading common stock, $TU par no change during year) 1,066,500 1. EX.17-01.ALGO Retained earnings: Balance, beginning of year 2. EX.17-04.ALGO $1,138,000 481,000 Net income $1,619,000 3. EX.17-05.ALGO Preferred dividends $21,330 Common dividends 175,670 197,000 4. EX.17-06.ALGO Balance, end of year 1,422,000 5. EX.17-19.ALGO Total stockholders' equity $3,555,000 6. EX.17-20.ALGO Sales $23,292,000 Interest expense $71,100 7. EX.17-21.ALGO Assuming that total assets were $4,728,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal place. 8. PR. 17-04.ALGO a. Ratio of fixed assets to long-term liabilities 1.2 b. Ratio of liabilities to stockholders' equity 0.4 c. Asset turnover d. Return on total assets e. Return on stockholders' equity 37.6 X % 13.5 X % 45.1 x % f. Return on common stockholders' equity Feedback Check My Work a. Divide property, plant, and equipment (net) by long-term liabilities. b. Divide total liabilities by total stockholders'equity. c. Divide sales by average total assets. Average total assets = (Beginning total assets + Ending total assets) + 2. To find ending total assets, use the accounting equation and Check My Work 1 more Check My Work uses remaining. Progress: 5/8 items Assignment Score: 77.83% All work saved. Email Instructor Save and Exit Submit Assignment for Grading 1. EX.17-01.ALGO The following data were taken from the financial statements of Gates Inc. for the current fiscal year. Property, plant, and equipment (net) $1,422,000 2. EX.17-04.ALGO 3. EX.17-05.ALGO Liabilities: Current liabilities Note payable, 6%, due in 15 years $ 237,000 1,185,000 4. EX.17-06.ALGO Total liabilities $1,422,000 5. EX.17-19.ALGO Stockholders' equity: Preferred $2 stock, $100 par (no change during 6. EX.17-20.ALGO $1,066,500 year) 7. EX.17-21.ALGO Common stock, $10 par (no change during year) 1,066,500 Retained earnings: 8. PR. 17-04.ALGO Balance, beginning of year $1,138,000 Net income $1,619,000 Preferred dividends 481,000 $21,330 175,670 Common dividends 197,000 Balance, end of year 1,422,000 Total stockholders' equity $3,555,000 Sales $23,292,000 Interest expense $71,100 Assuming that total assets were $4,728,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities 1.2 b. Ratio of liabilities to stockholders' equity 0.4 - Accottur RALA Check My Work 1 more Check My Work uses remaining. Previous Next > Progress: 5/8 items Assignment Score: 77.83% All work saved. Email Instructor Save and Exit Submit Assignment for Grading common stock, $TU par no change during year) 1,066,500 1. EX.17-01.ALGO Retained earnings: Balance, beginning of year 2. EX.17-04.ALGO $1,138,000 481,000 Net income $1,619,000 3. EX.17-05.ALGO Preferred dividends $21,330 Common dividends 175,670 197,000 4. EX.17-06.ALGO Balance, end of year 1,422,000 5. EX.17-19.ALGO Total stockholders' equity $3,555,000 6. EX.17-20.ALGO Sales $23,292,000 Interest expense $71,100 7. EX.17-21.ALGO Assuming that total assets were $4,728,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal place. 8. PR. 17-04.ALGO a. Ratio of fixed assets to long-term liabilities 1.2 b. Ratio of liabilities to stockholders' equity 0.4 c. Asset turnover d. Return on total assets e. Return on stockholders' equity 37.6 X % 13.5 X % 45.1 x % f. Return on common stockholders' equity Feedback Check My Work a. Divide property, plant, and equipment (net) by long-term liabilities. b. Divide total liabilities by total stockholders'equity. c. Divide sales by average total assets. Average total assets = (Beginning total assets + Ending total assets) + 2. To find ending total assets, use the accounting equation and Check My Work 1 more Check My Work uses remaining. Progress: 5/8 items Assignment Score: 77.83% All work saved. Email Instructor Save and Exit Submit Assignment for Grading