Question

1. Explain how would you forecast the NOPAT for the next 5 years? Be as detailed as possible , but you use only the necessary

1. Explain how would you forecast the NOPAT for the next 5 years? Be as detailed as possible , but you use only the necessary data and explanations

2. Using the information from above explain what else do you need in order to determine the Unlevered Free Cash Flows?

3. Being an Excel Guru and having only the historical data points (without access to any independent analysts or guidance estimates) what kind of forecasting techniques in Excel would you apply in order to forecast the Sales and Operating Income for the next couple of years.

Build a Revenue Forecast chart as well as an Operating Income and Nopat Forecast Charts

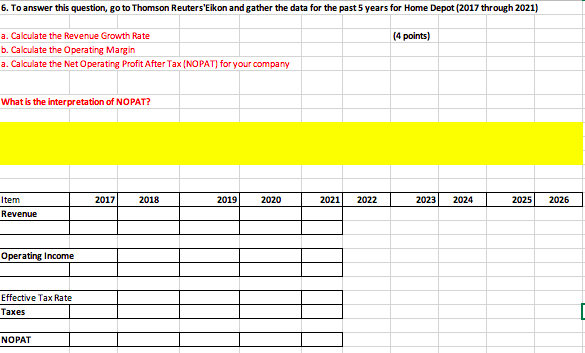

6. To answer this question, go to Thomson Reuters'Eikon and gather the data for the past 5 years for Home Depot (2017 through 2021) a. Calculate the Revenue Growth Rate (4 points) b. Calculate the Operating Margin a. Calculate the Net Operating Profit After Tax (NOPAT) for your company What is the interpretation of NOPAT? 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 Item Revenue Operating Income Effective Tax Rate Taxes NOPAT 6. To answer this question, go to Thomson Reuters'Eikon and gather the data for the past 5 years for Home Depot (2017 through 2021) a. Calculate the Revenue Growth Rate (4 points) b. Calculate the Operating Margin a. Calculate the Net Operating Profit After Tax (NOPAT) for your company What is the interpretation of NOPAT? 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 Item Revenue Operating Income Effective Tax Rate Taxes NOPATStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started