Answered step by step

Verified Expert Solution

Question

1 Approved Answer

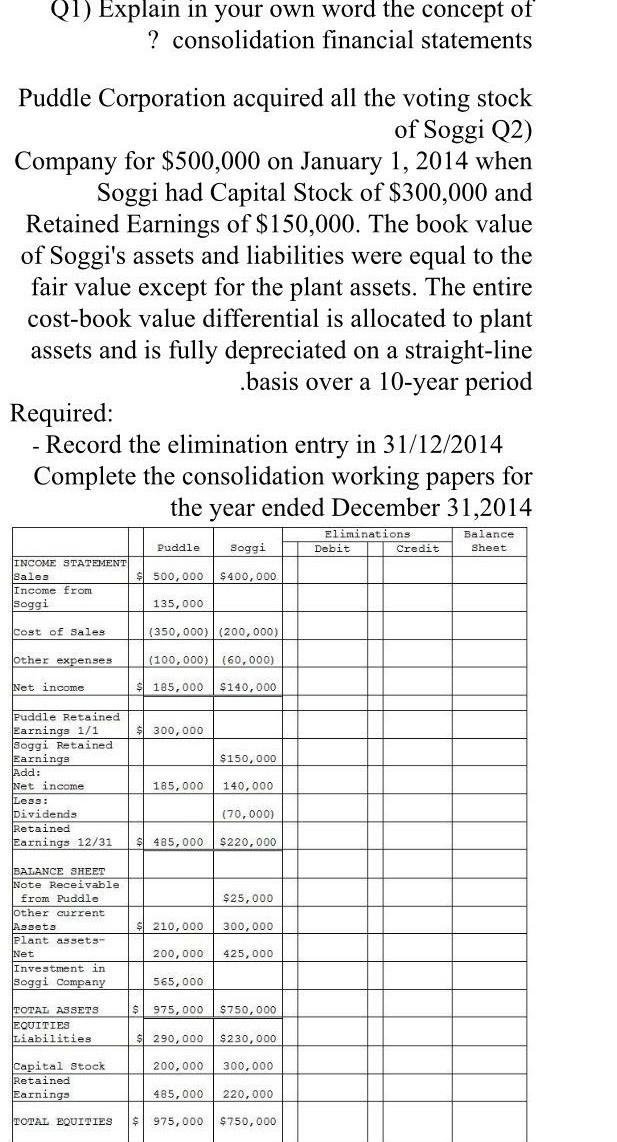

(1) Explain in your own word the concept of ? consolidation financial statements Puddle Corporation acquired all the voting stock of Soggi (2) Company for

(1) Explain in your own word the concept of ? consolidation financial statements Puddle Corporation acquired all the voting stock of Soggi (2) Company for $500,000 on January 1, 2014 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000. The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets. The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line .basis over a 10-year period Required: - Record the elimination entry in 31/12/2014 Complete the consolidation working papers for the year ended December 31,2014 Eliminations Dobit Credit Balance Sheet Puddle Soggi INCOME STATEMENT salos Income from 500,000 $400,000 Soggi 135,000 cost of Sales (350,000) (200,000) other expenses (100, 000) (60,000) Net income $ 185,000 $140,000 $ 300,000 $150,000 Puddle Retained Earnings 1/1 Soggi Retained Earnings Add: Net income Less Dividends Retained Earnings 12/31 185,000 140,000 (70,000) $ 485,000 $220,000 $ 25,000 BALANCE SHEET Note Receivable from Puddle other current Assets Plant assets- Net Investment in soggi Company 210,000 300,000 200,000 425,000 565,000 $ 975,000 $750,000 TOTAL ASSETS EQUITIES Liabilities $ 290,000 $230,000 200,000 300,000 Capital Stock Retained Earnings 485,000 220,000 TOTAL EQUITIES 975,000 $750,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started