Answered step by step

Verified Expert Solution

Question

1 Approved Answer

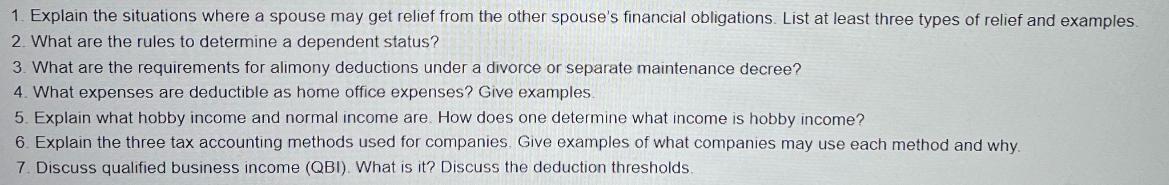

1. Explain the situations where a spouse may get relief from the other spouse's financial obligations. List at least three types of relief and

1. Explain the situations where a spouse may get relief from the other spouse's financial obligations. List at least three types of relief and examples. 2. What are the rules to determine a dependent status? 3. What are the requirements for alimony deductions under a divorce or separate maintenance decree? 4. What expenses are deductible as home office expenses? Give examples. 5. Explain what hobby income and normal income are How does one determine what income is hobby income? 6. Explain the three tax accounting methods used for companies. Give examples of what companies may use each method and why. 7. Discuss qualified business income (QBI). What is it? Discuss the deduction thresholds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Situations where a spouse may get relief from the other spouses financial obligations include a Innocent Spouse Relief This relief is available when one spouse can prove that they were unaware of an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663db344bc2b2_963460.pdf

180 KBs PDF File

663db344bc2b2_963460.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started