Answered step by step

Verified Expert Solution

Question

1 Approved Answer

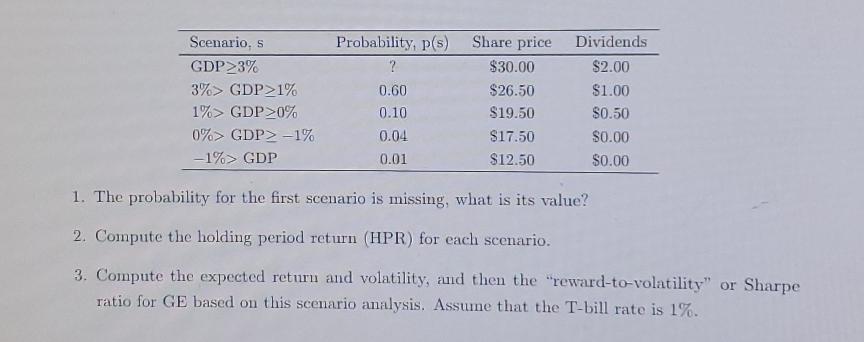

GE is currently traded at $25 per share. The following is a scenario analysis for its future share price in one year. Scenario, s

GE is currently traded at $25 per share. The following is a scenario analysis for its future share price in one year. Scenario, s Probability, p(s) Share price Dividends GDP3% ? $30.00 $2.00 3%> GDP1% 0.60 $26.50 $1.00 1%> GDP0% 0.10 $19.50 $0.50 0% GDP-1% 0.04 $17.50 $0.00 -1%> GDP 0.01 $12.50 $0.00 1. The probability for the first scenario is missing, what is its value? 2. Compute the holding period return (HPR) for each scenario. 3. Compute the expected return and volatility, and then the "reward-to-volatility" or Sharpe ratio for GE based on this scenario analysis. Assume that the T-bill rate is 1%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

GE Share Price Scenario Analysis 1 Missing Probability The sum of all scenario probabilities must eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started