Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Explain WeWork's business model. - How does their model differ from some software as a service (SaaS) companies? - How does their model differ

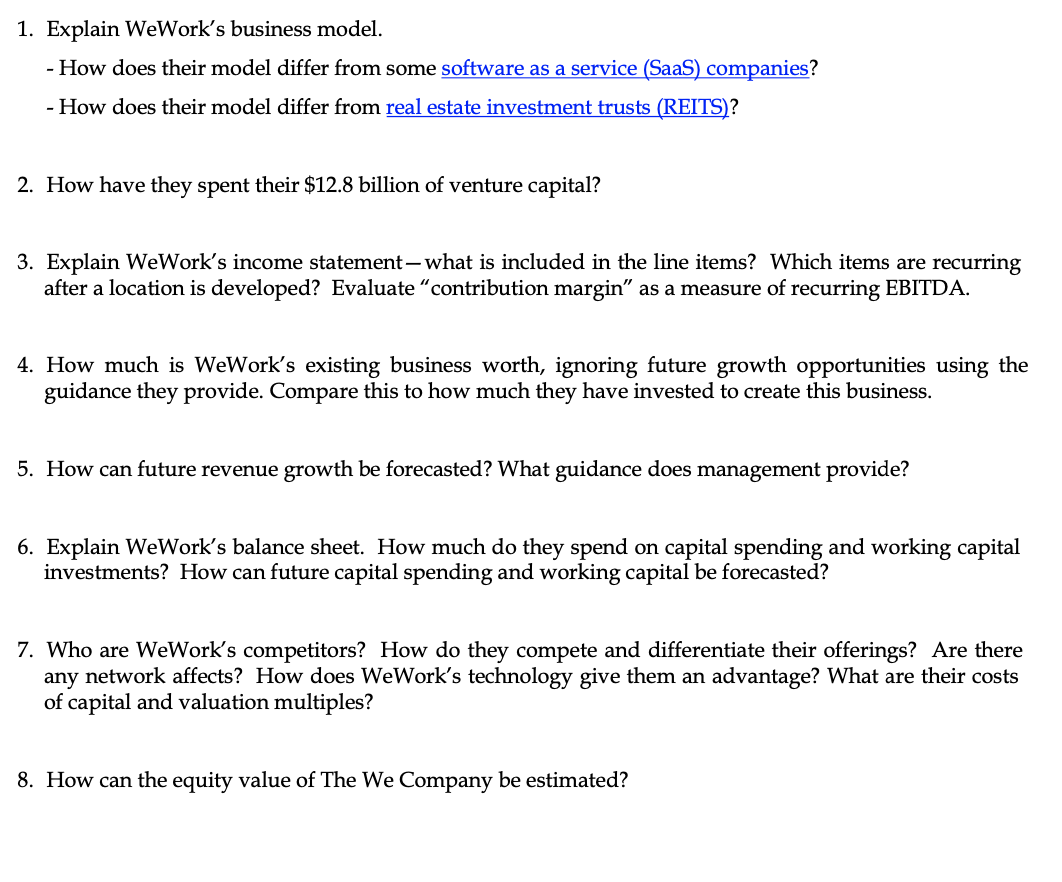

1. Explain WeWork's business model. - How does their model differ from some software as a service (SaaS) companies? - How does their model differ from real estate investment trusts (REITS)? 2. How have they spent their $12.8 billion of venture capital? 3. Explain WeWork's income statement-what is included in the line items? Which items are recurring after a location is developed? Evaluate "contribution margin" as a measure of recurring EBITDA. 4. How much is WeWork's existing business worth, ignoring future growth opportunities using the guidance they provide. Compare this to how much they have invested to create this business. 5. How can future revenue growth be forecasted? What guidance does management provide? 6. Explain WeWork's balance sheet. How much do they spend on capital spending and working capital investments? How can future capital spending and working capital be forecasted? 7. Who are WeWork's competitors? How do they compete and differentiate their offerings? Are there any network affects? How does WeWork's technology give them an advantage? What are their costs of capital and valuation multiples? 8. How can the equity value of The We Company be estimated

1. Explain WeWork's business model. - How does their model differ from some software as a service (SaaS) companies? - How does their model differ from real estate investment trusts (REITS)? 2. How have they spent their $12.8 billion of venture capital? 3. Explain WeWork's income statement-what is included in the line items? Which items are recurring after a location is developed? Evaluate "contribution margin" as a measure of recurring EBITDA. 4. How much is WeWork's existing business worth, ignoring future growth opportunities using the guidance they provide. Compare this to how much they have invested to create this business. 5. How can future revenue growth be forecasted? What guidance does management provide? 6. Explain WeWork's balance sheet. How much do they spend on capital spending and working capital investments? How can future capital spending and working capital be forecasted? 7. Who are WeWork's competitors? How do they compete and differentiate their offerings? Are there any network affects? How does WeWork's technology give them an advantage? What are their costs of capital and valuation multiples? 8. How can the equity value of The We Company be estimated Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started