Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Explain why this securitization for accounting treatment as sale. 2. Compute the amounts of total assets retained after this secuiritization (round 2 decimal places)

1. Explain why this securitization for accounting treatment as sale.

2. Compute the amounts of total assets retained after this secuiritization (round 2 decimal places)

total assets (in million $)

retained earnings (in million $)

3. Compute the amounts of total assets and retained esrnings if this securitization sid not qualify for accounting treatment as a sale (round 2 decimal places)

total assets (in million $)

retained earnings (in million $)

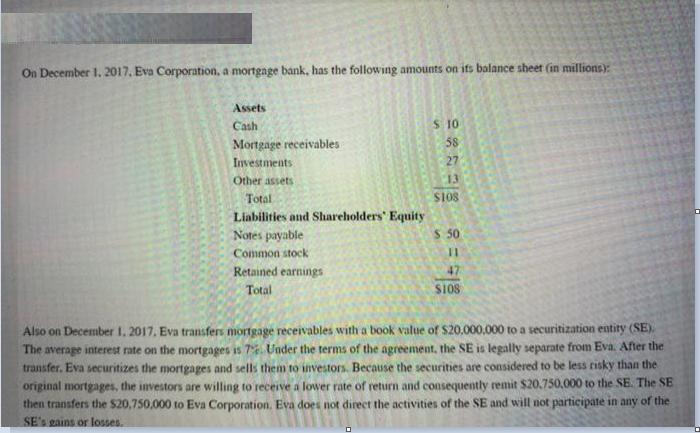

On December 1. 2017, Eva Corporation, a mortgage bank, has the following amounts on its balance sheet (in millions) Assets Cash S 10 Mortgage receivables 58 Investments 27 Other assets 13 Total $108 Liabilities and Shareholders' Equity Notes payable S 50 Common stock Retained earnings 47 Total SIOS Also on December 1. 2017. Eva transfers mortgage receivables with a book value of $20.000.000 to a securitization entity (SE). The average interest rate on the mortgages is 7. Uader the terms of the agreement, the SE is legally separate from Eva. After the transfer. Eva securitizes the mortgages and sells them to investors. Because the securities are considered to be less risky than the original mortgages, the investors are willing to receive a lower rate of return and consequently remit $20.750.000 to the SE. The SE then transfers the $20,750,000 to Eva Corporation. Eva does not direet the activities of the SE and will not participate in any of the SE's gains or losses.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Explain why this securitization for accounting treatment as sale 2 Compu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started