Answered step by step

Verified Expert Solution

Question

1 Approved Answer

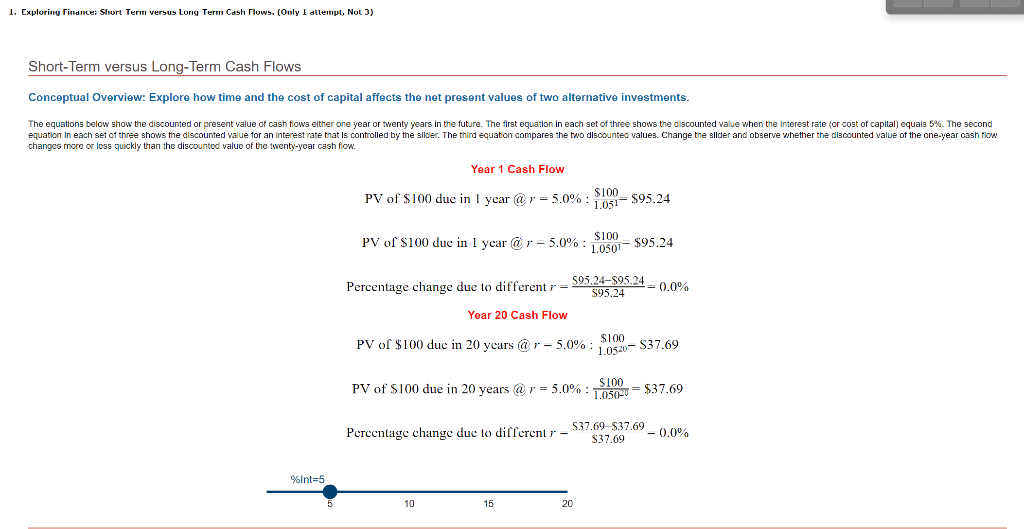

1. Expleriny Findnce; Short-Term versus Lorig Term Cash Fluws. (Only 1 attempl, Not 3) Short-Term versus Long-Term Cash Flows Conceptual Overview: Explore how time and

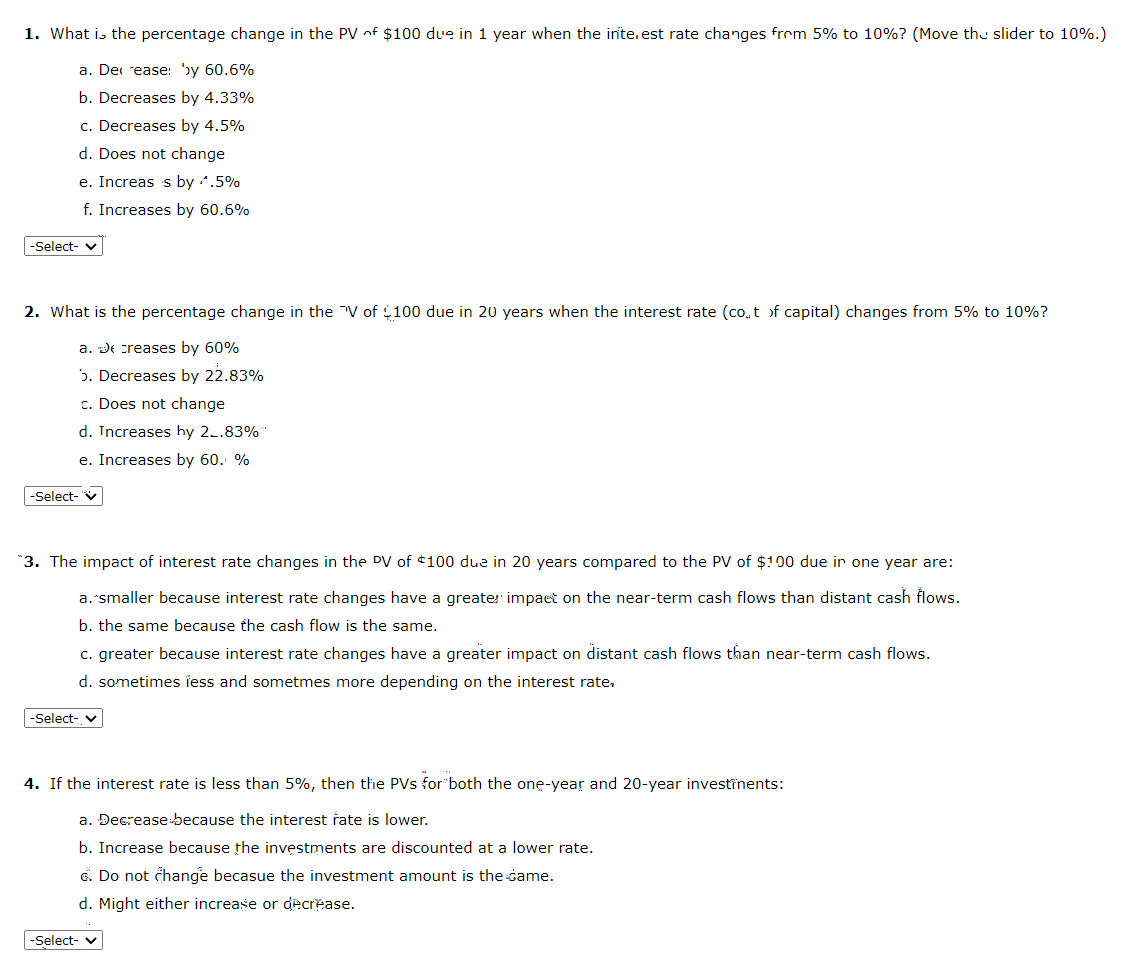

1. Expleriny Findnce; Short-Term versus Lorig Term Cash Fluws. (Only 1 attempl, Not 3) Short-Term versus Long-Term Cash Flows Conceptual Overview: Explore how time and the cost of capital affects the net present values of two alternative investments. changes more or less quickly than the discountod value of the twenty-year cash fow. Year 1 Cash Flow PV of $100 due in I year (a=5.0%:1.051$100=$95.24 PV of $100 due in 1 year (a) r=5.0%:1.0501$100=$95.24 Percentage change due to different r=$95.24$95.24$95.24=0.0% Year 20 Cash Flow PV of $100 duc in 20 years (a)r5.0%:1.0520$100$37.69 PV of $100 due in 20 years (r=5.0%:1.05020$100=$37.69 Pereentage change due to different r$37.69537.69$37.690.0% 3. The impact of interest rate changes in the PV of $100d. in 20 years compared to the PV of $100 due ir one year are: a.-smaller because interest rate changes have a greater impaet on the near-term cash flows than distant cash flows. b. the same because the cash flow is the same. c. greater because interest rate changes have a greater impact on distant cash flows than near-term cash flows. d. sometimes less and sometmes more depending on the interest rate. 4. If the interest rate is less than 5%, then the PVs for-both the one-year and 20-year invest thents: a. eerease because the interest rate is lower. b. Increase because the investments are discounted at a lower rate. Do not "hange becasue the investment amount is the d. Might either increase or

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started