Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Fancy Toys Inc. can procure additional 650 pounds of resins at a cost of $3 per pound. Should it be purchased? Explain in 1

1. Fancy Toys Inc. can procure additional 650 pounds of resins at a cost of $3 per pound. Should it be purchased? Explain in 1 sentence.

2. Suppose that Fancy Toys Inc. has an additional $100 to invest. It can allocate it to either renting out a machine at the cost of $1 per hour, or towards purchasing plastic resins at $1 per pound (or both). What should it do? Explain in 1 sentence.

3. How would the number of cars and trucks change if the profit margin on the cars increased by $1?

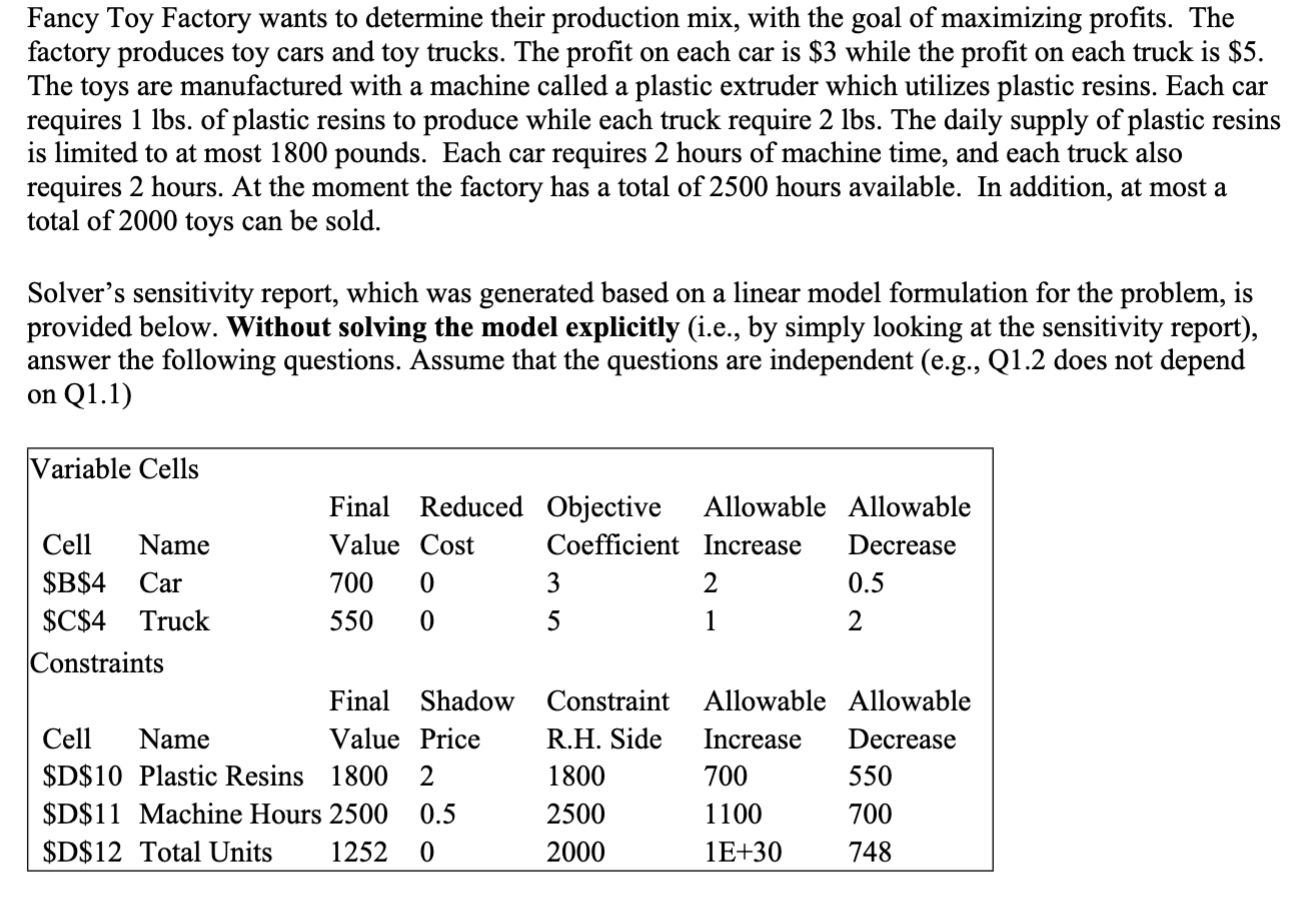

Fancy Toy Factory wants to determine their production mix, with the goal of maximizing profits. The factory produces toy cars and toy trucks. The profit on each car is $3 while the profit on each truck is $5. The toys are manufactured with a machine called a plastic extruder which utilizes plastic resins. Each car requires 1lbs. of plastic resins to produce while each truck require 2lbs. The daily supply of plastic resins is limited to at most 1800 pounds. Each car requires 2 hours of machine time, and each truck also requires 2 hours. At the moment the factory has a total of 2500 hours available. In addition, at most a total of 2000 toys can be sold. Solver's sensitivity report, which was generated based on a linear model formulation for the problem, is provided below. Without solving the model explicitly (i.e., by simply looking at the sensitivity report), answer the following questions. Assume that the questions are independent (e.g., Q1.2 does not depend on Q1.1)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started