Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Fantastic Jewellery is a respected jeweller in Canberra. For June 2022, Fantastic Jewellery sold $250 000 (excluding GST) worth of merchandise to customers

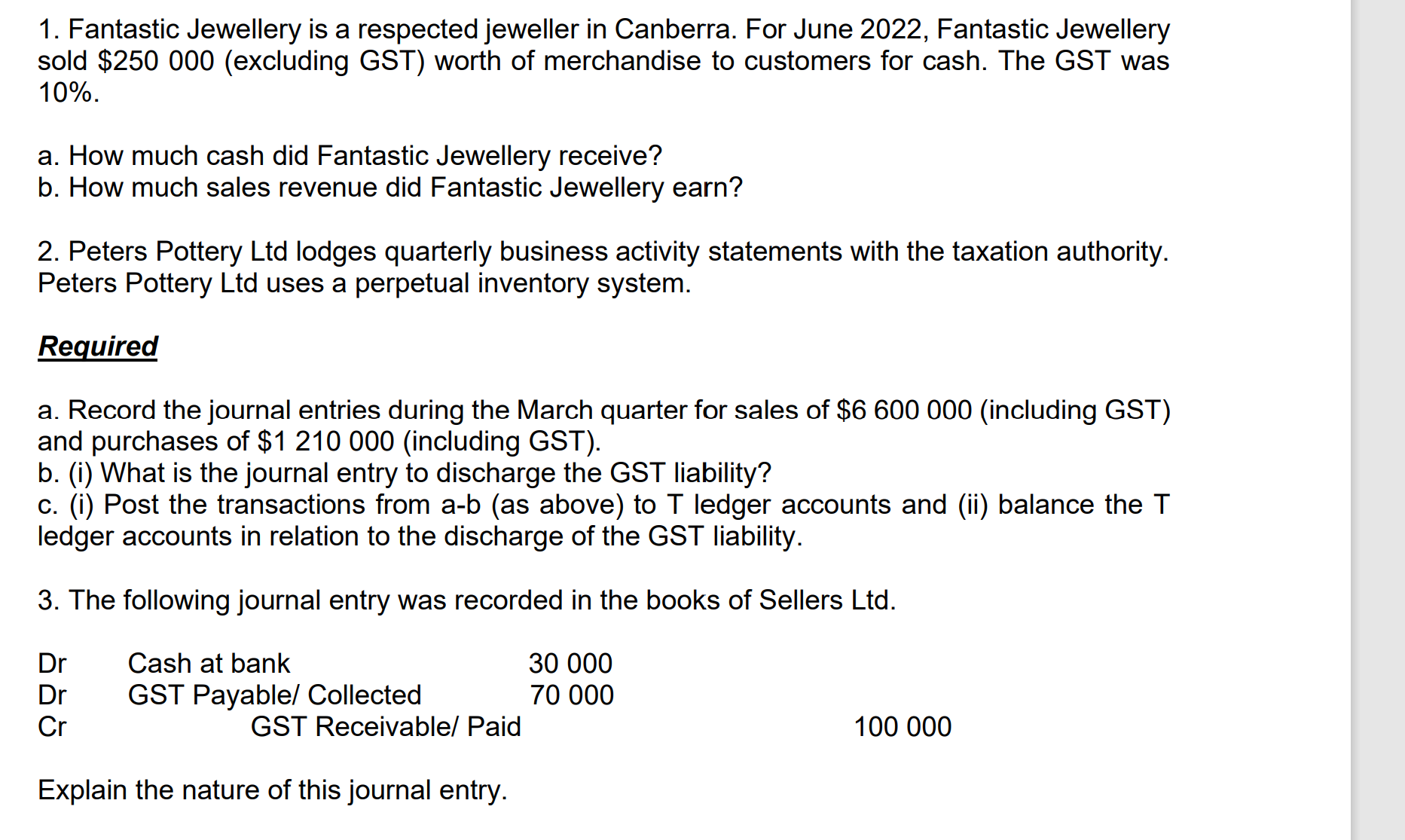

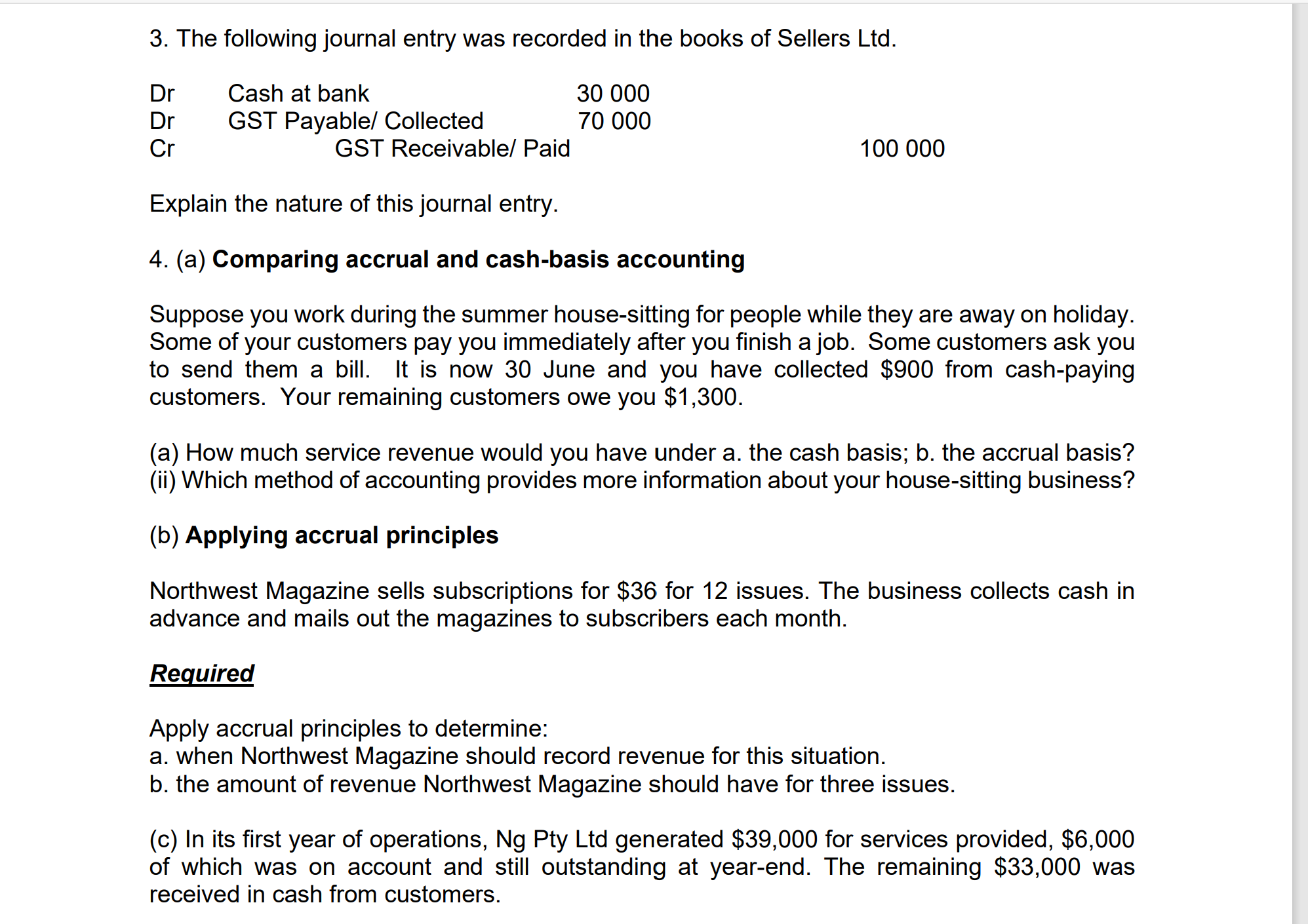

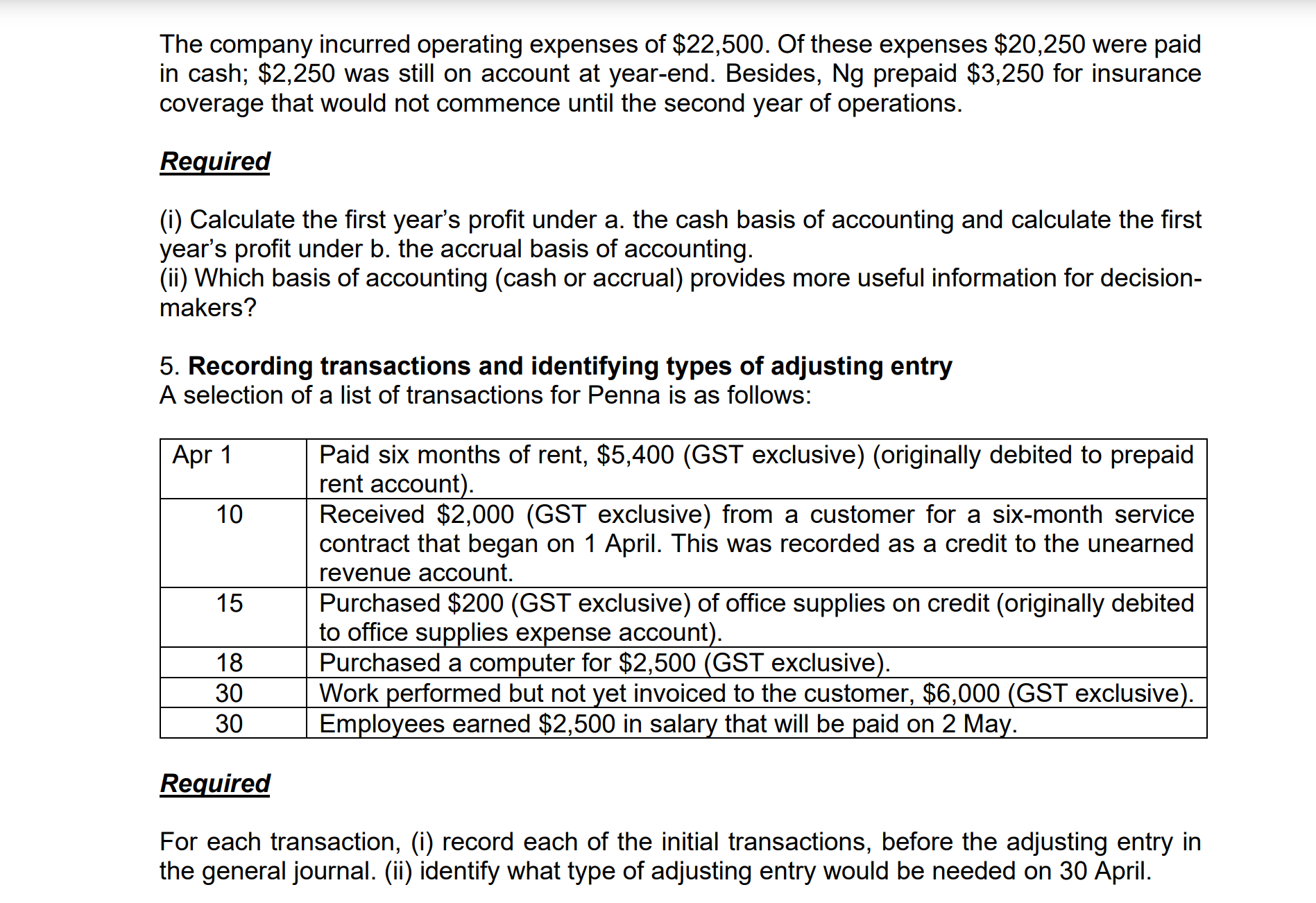

1. Fantastic Jewellery is a respected jeweller in Canberra. For June 2022, Fantastic Jewellery sold $250 000 (excluding GST) worth of merchandise to customers for cash. The GST was 10%. a. How much cash did Fantastic Jewellery receive? b. How much sales revenue did Fantastic Jewellery earn? 2. Peters Pottery Ltd lodges quarterly business activity statements with the taxation authority. Peters Pottery Ltd uses a perpetual inventory system. Required a. Record the journal entries during the March quarter for sales of $6 600 000 (including GST) and purchases of $1 210 000 (including GST). b. (i) What is the journal entry to discharge the GST liability? c. (i) Post the transactions from a-b (as above) to T ledger accounts and (ii) balance the T ledger accounts in relation to the discharge of the GST liability. 3. The following journal entry was recorded in the books of Sellers Ltd. Dr Cash at bank 30 000 Dr GST Payable/ Collected 70 000 Cr GST Receivable/ Paid Explain the nature of this journal entry. 100 000 3. The following journal entry was recorded in the books of Sellers Ltd. Dr Cash at bank Dr GST Payable/ Collected 30 000 70 000 Cr GST Receivable/ Paid 100 000 Explain the nature of this journal entry. 4. (a) Comparing accrual and cash-basis accounting Suppose you work during the summer house-sitting for people while they are away on holiday. Some of your customers pay you immediately after you finish a job. Some customers ask you to send them a bill. It is now 30 June and you have collected $900 from cash-paying customers. Your remaining customers owe you $1,300. (a) How much service revenue would you have under a. the cash basis; b. the accrual basis? (ii) Which method of accounting provides more information about your house-sitting business? (b) Applying accrual principles Northwest Magazine sells subscriptions for $36 for 12 issues. The business collects cash in advance and mails out the magazines to subscribers each month. Required Apply accrual principles to determine: a. when Northwest Magazine should record revenue for this situation. b. the amount of revenue Northwest Magazine should have for three issues. (c) In its first year of operations, Ng Pty Ltd generated $39,000 for services provided, $6,000 of which was on account and still outstanding at year-end. The remaining $33,000 was received in cash from customers. The company incurred operating expenses of $22,500. Of these expenses $20,250 were paid in cash; $2,250 was still on account at year-end. Besides, Ng prepaid $3,250 for insurance coverage that would not commence until the second year of operations. Required (i) Calculate the first year's profit under a. the cash basis of accounting and calculate the first year's profit under b. the accrual basis of accounting. (ii) Which basis of accounting (cash or accrual) provides more useful information for decision- makers? 5. Recording transactions and identifying types of adjusting entry A selection of a list of transactions for Penna is as follows: Apr 1 10 15 18 30 30 Paid six months of rent, $5,400 (GST exclusive) (originally debited to prepaid rent account). Received $2,000 (GST exclusive) from a customer for a six-month service contract that began on 1 April. This was recorded as a credit to the unearned revenue account. Purchased $200 (GST exclusive) of office supplies on credit (originally debited to office supplies expense account). Purchased a computer for $2,500 (GST exclusive). Work performed but not yet invoiced to the customer, $6,000 (GST exclusive). Employees earned $2,500 in salary that will be paid on 2 May. Required For each transaction, (i) record each of the initial transactions, before the adjusting entry in the general journal. (ii) identify what type of adjusting entry would be needed on 30 April.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started