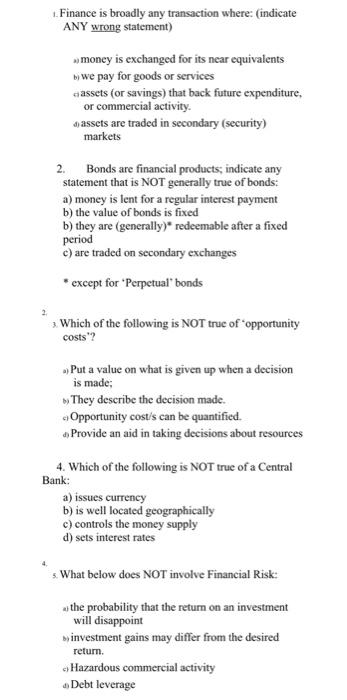

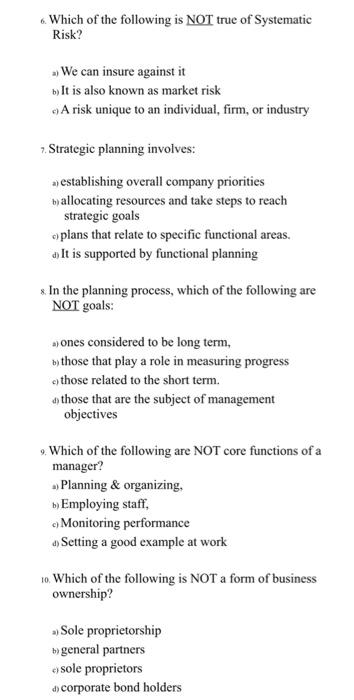

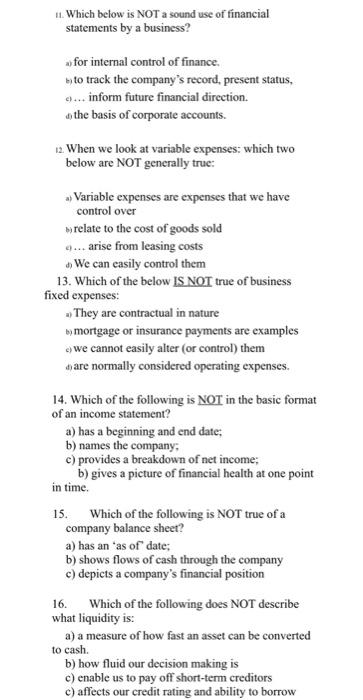

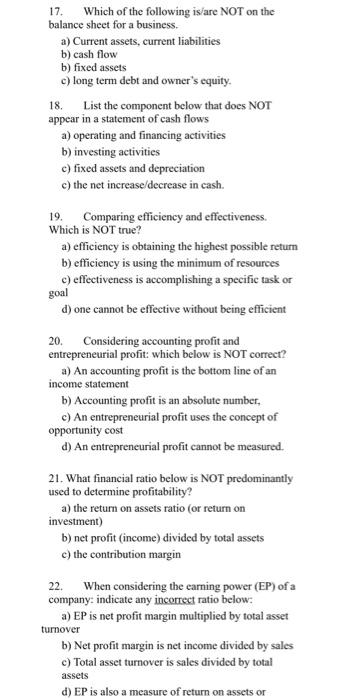

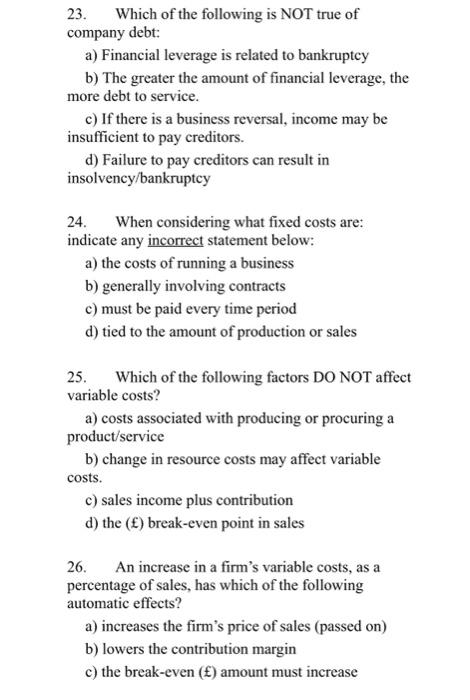

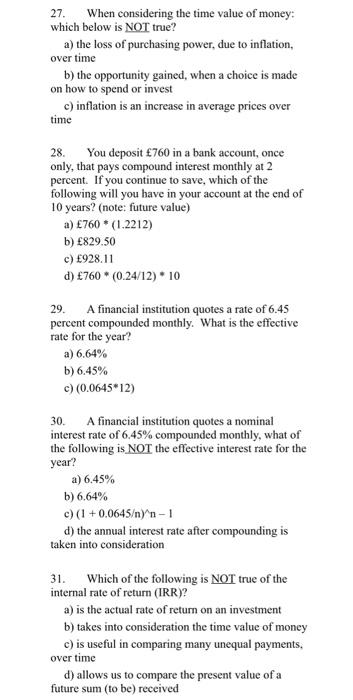

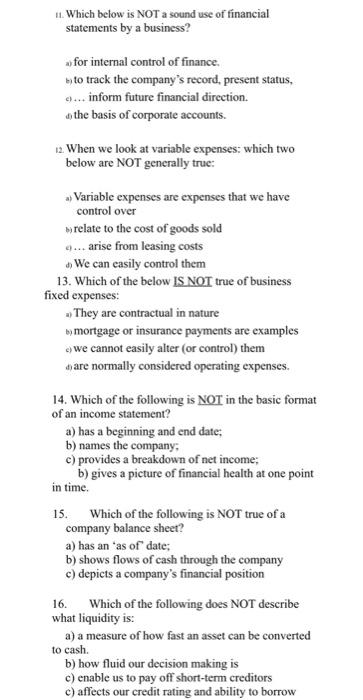

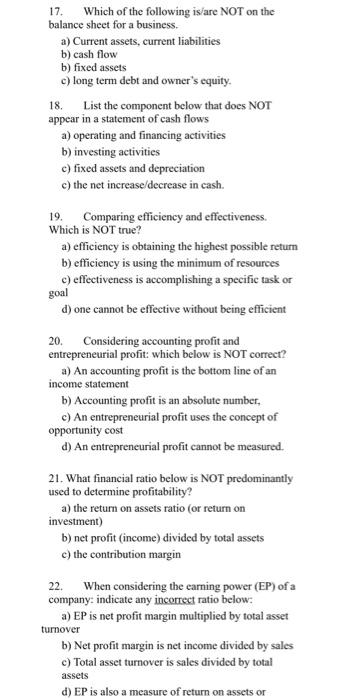

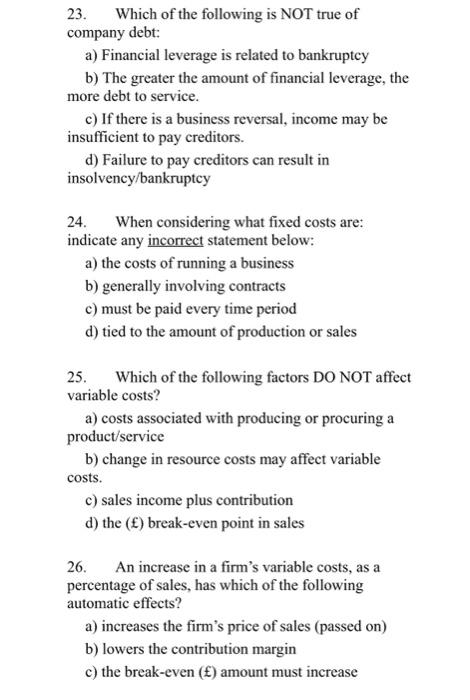

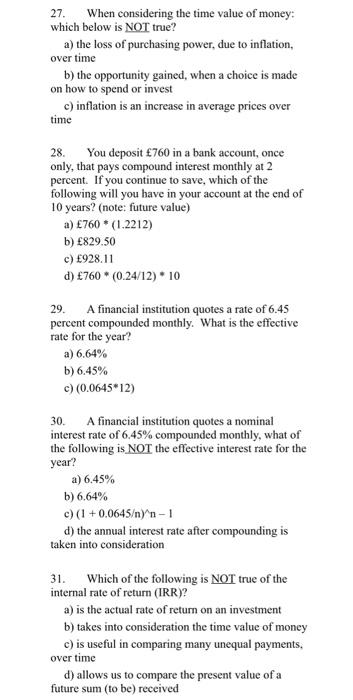

1. Finance is broadly any transaction where: (indicate ANY wrong statement) 3) money is exchanged for its near equivalents b) we pay for goods or services a assets (or savings) that back future expenditure, or commercial activity. a) assets are traded in secondary (security) markets 2. Bonds are financial products; indicate any statement that is NOT generally true of bonds: a) money is lent for a regular interest payment b) the value of bonds is fixed b) they are (generally) redeemable after a fixed period c) are traded on secondary exchanges * except for 'Perpetual' bonds 2. 3. Which of the following is NOT true of "opportunity costs +2 ? a) Put a value on what is given up when a decision is made; b) They describe the decision made. c) Opportunity cost/s can be quantified. Provide an aid in taking decisions about resources 4. Which of the following is NOT true of a Central Bank: a) issues currency b) is well located geographically c) controls the money supply d) sets interest rates 4. 5. What below does NOT involve Financial Risk: a) the probability that the return on an investment will disappoint b) investment gains may differ from the desired return. c) Hazardous commercial activity Debt leverage 6. Which of the following is NOT true of Systematic Risk? a) We can insure against it b) It is also known as market risk c) A risk unique to an individual, firm, or industry 7. Strategic planning involves: a) establishing overall company priorities b) allocating resources and take steps to reach strategic goals c) plans that relate to specific functional areas. d) It is supported by functional planning 8. In the planning process, which of the following are NOT goals: a) Ones considered to be long term, b) those that play a role in measuring progress c) those related to the short term. d) those that are the subject of management objectives 9. Which of the following are NOT core functions of a manager? ) Planning \& organizing, b) Employing staff, c) Monitoring performance d) Setting a good example at work 10. Which of the following is NOT a form of business ownership? a) Sole proprietorship b) general partners c) sole proprietors d) corporate bond holders 11. Which below is NOT a sound use of financial statements by a business? a) for internal control of finance. b to track the company's record, present status. c) ... inform future financial direction. w the basis of corporate accounts. 12. When we look at variable expenses: which two below are NOT generally true: a) Variable expenses are expenses that we have control over brelate to the cost of goods sold a.... arise from leasing costs . We can casily control them 13. Which of the below IS NOT true of business fixed expenses: a) They are contractual in nature b) mortgage or insurance payments are examples c) we cannot easily alter (or control) them are normally considered operating expenses. 14. Which of the following is NOT in the basic format of an income statement? a) has a beginning and end date: b) names the company; c) provides a breakdown of net income: b) gives a picture of financial health at one point in time. 15. Which of the following is NOT true of a company balance sheet? a) has an "as of dater b) shows flows of cash through the company c) depicts a company's financial position 16. Which of the following does NOT describe what liquidity is: a) a measure of how fast an asset can be converted to cash. b) how fluid our decision making is c) enable us to pay off short-term creditors c) affects our credit rating and ability to borrow 17. Which of the following is/are NOT on the balance sheet for a business. a) Current assets, current liabilities b) cash flow b) fixed assets c) long term debt and owner's equity. 18. List the component below that does NOT appear in a statement of cash flows a) operating and financing activities b) investing activities c) fixed assets and depreciation c) the net increase/decrease in cash. 19. Comparing efficiency and effectiveness. Which is NOT true? a) efficiency is obtaining the highest possible return b) efficiency is using the minimum of resources c) effectiveness is accomplishing a specific task or goal d) one cannot be effective without being efficient 20. Considering accounting profit and entrepreneurial profit: which below is NOT correct? a) An accounting profit is the bottom line of an income statement b) Accounting profit is an absolute number, c) An entrepreneurial profit uses the concept of opportunity cost d) An entrepreneurial profit cannot be measured. 21. What financial ratio below is NOT predominantly used to determine profitability? a) the return on assets ratio (or return on investment) b) net profit (income) divided by total assets c) the contribution margin 22. When considering the earning power (EP) of a company: indicate any incorrect ratio below: a) EP is net profit margin multiplied by total asset turnover b) Net profit margin is net income divided by sales c) Total asset turnover is sales divided by total assets d) EP is also a measure of return on assets or 23. Which of the following is NOT true of company debt: a) Financial leverage is related to bankruptcy b) The greater the amount of financial leverage, the more debt to service. c) If there is a business reversal, income may be insufficient to pay creditors. d) Failure to pay creditors can result in insolvency/bankruptcy 24. When considering what fixed costs are: indicate any incorrect statement below: a) the costs of running a business b) generally involving contracts c) must be paid every time period d) tied to the amount of production or sales 25. Which of the following factors DO NOT affect variable costs? a) costs associated with producing or procuring a product/service b) change in resource costs may affect variable costs. c) sales income plus contribution d) the ( f ) break-even point in sales 26. An increase in a firm's variable costs, as a percentage of sales, has which of the following automatic effects? a) increases the firm's price of sales (passed on) b) lowers the contribution margin c) the break-even (f) amount must increase 27. When considering the time value of money: which below is NOT true? a) the loss of purchasing power, due to inflation, over time b) the opportunity gained, when a choice is made on how to spend or invest c) inflation is an increase in average prices over time 28. You deposit 760 in a bank account, once only, that pays compound interest monthly at 2 percent. If you continue to save, which of the following will you have in your account at the end of 10 years? (note: future value) a) 760(1.2212) b) 829.50 c) 928.11 d) 760(0.24/12)10 29. A financial institution quotes a rate of 6.45 percent compounded monthly. What is the effective rate for the year? a) 6.64% b) 6.45% c) (0.064512) 30. A financial institution quotes a nominal interest rate of 6.45% compounded monthly, what of the following is NOT the effective interest rate for the year? a) 6.45% b) 6.64% c) (1+0.0645)1 d) the annual interest rate after compounding is taken into consideration 31. Which of the following is NOT true of the internal rate of return (IRR)? a) is the actual rate of return on an investment b) takes into consideration the time value of money c) is useful in comparing many unequal payments, over time d) allows us to compare the present value of a future sum (to be) received