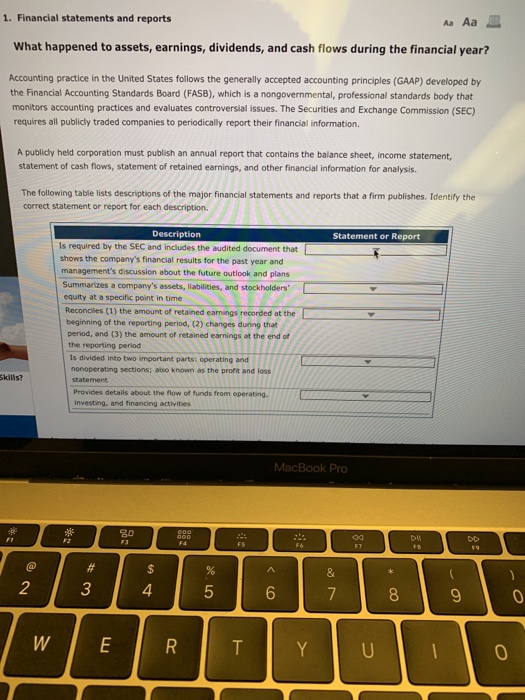

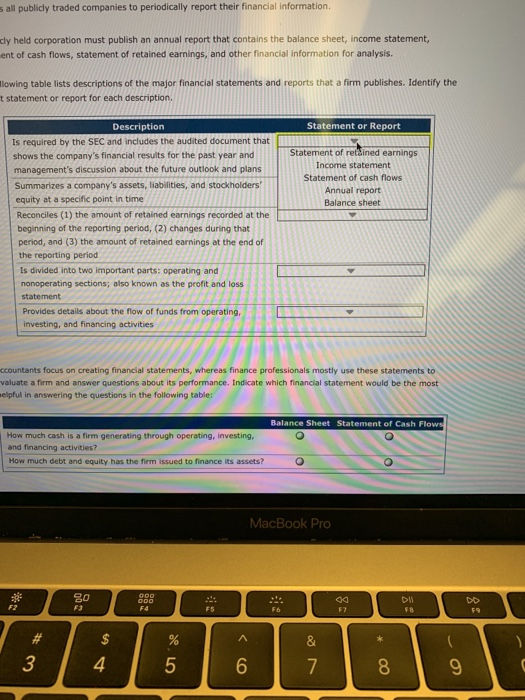

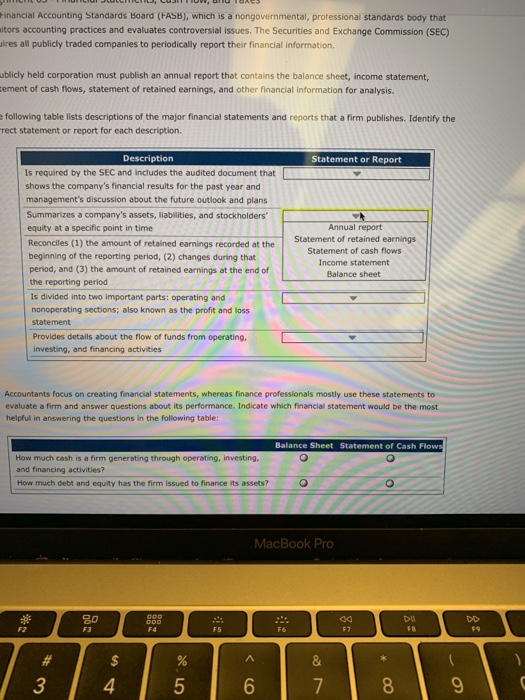

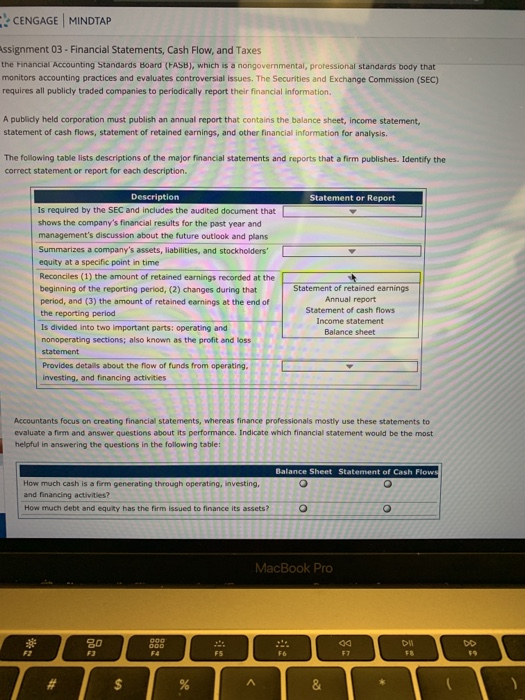

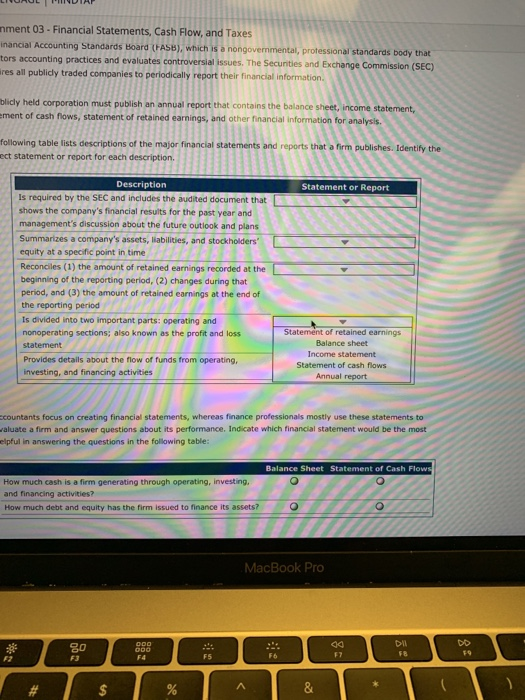

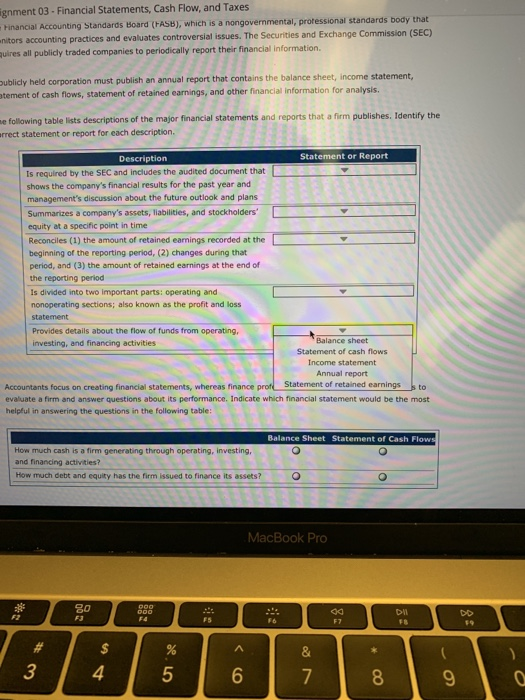

1. Financial statements and reports A Aa D What happened to assets, earnings, dividends, and cash flows during the financial year? Accounting practice in the United States follows the generally accepted accounting principles (GAAP) developed by the Financial Accounting Standards Board (FASB), which is a nongovernmental, professional standards body that monitors accounting practices and evaluates controversial issues. The Securities and Exchange Commission (SEC) requires all publicly traded companies to periodically report their financial information, A publicly held corporation must publish an annual report that contains the balance sheet, income statement, statement of cash flows, statement of retained earnings, and other financial information for analysis The following table lists descriptions of the major financial statements and reports that a firm publishes. Identify the correct statement or report for each description. Statement or Report Description is required by the SEC and includes the audited document that shows the company's financial results for the past year and management's discussion about the future outlook and plans Summarizes a company's assets, liabilities, and stockholders' equity at a specific point in time Reconciles (1) the amount of retained earnings recorded at the beginning of the reporting period, (2) changes during that period, and (3) the amount of retained earnings at the end of the reporting period is divided into two important parts operating and nonoperating sections, also known as the profit and loss statement Provides details about the flow of funds from operating investing, and financing activities skills? MacBook Pro s all publicly traded companies to periodically report their financial information. cly held corporation must publish an annual report that contains the balance sheet, income statement, ent of cash flows, statement of retained earnings, and other financial information for analysis. llowing table lists descriptions of the major financial statements and reports that a firm publishes. Identify the t statement or report for each description. Statement or Report Statement of retsined earnings Income statement Statement of cash flows Annual report Balance sheet Description Is required by the SEC and includes the audited document that shows the company's financial results for the past year and management's discussion about the future outlook and plans Summarizes a company's assets, liabilities, and stockholders' equity at a specific point in time Reconciles (1) the amount of retained earnings recorded at the beginning of the reporting period, (2) changes during that period, and (3) the amount of retained earnings at the end of the reporting period Is divided into two important parts: operating and nonoperating sections, also known as the profit and loss statement Provides details about the flow of funds from operating, investing, and financing activities ccountants focus on creating financial statements, whereas finance professionals mostly use these statements to valuate a firm and answer questions about its performance Indicate which financial statement would be the most helpful in answering the questions in the following table: Balance Sheet Statement of Cash Flows How much cash is a firm generating through operating, investing, and financing activities? How much debt and equity has the firm issued to finance its assets? MacBook Pro F5 Financial Accounting Standards Board (FASB), which is a nongovernmental, professional standards body that itors accounting practices and evaluates controversial issues. The Securities and Exchange Commission (SEC) wires all publicly traded companies to periodically report their financial information ublicly held corporation must publish an annual report that contains the balance sheet, income statement, tement of cash flows, statement of retained earnings, and other financial information for analysis. following table lists descriptions of the major financial statements and reports that a firm publishes. Identify the rect statement or report for each description. Statement or Report Description Is required by the SEC and includes the audited document that shows the company's financial results for the past year and management's discussion about the future outlook and plans Summarizes a company's assets, liabilities, and stockholders' equity at a specific point in time Reconciles (1) the amount of retained earnings recorded at the beginning of the reporting period, (2) changes during that period, and (3) the amount of retained earnings at the end of the reporting period Is divided into two important parts: operating and nonoperating sections; also known as the profit and loss statement Provides details about the flow of funds from operating, investing, and financing activities Annual report Statement of retained earnings Statement of cash flows Income statement Balance sheet Accountants focus on creating financial statements, whereas finance professionals mostly use these statements to evaluate a firm and answer questions about its performance. Indicate which financial statement would be the most helpful in answering the questions in the following table: Balance Sheet Statement of Cash Flows How much cash is a firm generating through operating, investing, and financing activities? How much debt and equity has the firm issued to finance its assets? MacBook Pro w 7 8 LIURUL INDIA nment 03 - Financial Statements, Cash Flow, and Taxes inancial Accounting Standards Board (FASB), which is a nongovernmental, professional standards body that tors accounting practices and evaluates controversial issues. The Securities and Exchange Commission (SEC) ires all publicly traded companies to periodically report their financial information blicly held corporation must publish an annual report that contains the balance sheet, income statement, ament of cash flows, statement of retained earnings, and other financial Information for scana following table lists descriptions of the major financial statem, ents and reports that a firm ect statement or report for each description Statement or Report Description Is required by the SEC and includes the audited document that shows the company's financial results for the past year and management's discussion about the future outlook and plans Summarizes a company's assets, liabilities, and stockholders' equity at a specific point in time Reconciles (1) the amount of retained earnings recorded at the beginning of the reporting period, (2) changes during that period, and (3) the amount of retained earnings at the end of the reporting period is divided into two important parts: operating and nonoperating sections; also known as the profit and loss statement Provides details about the flow of funds from operating, investing, and financing activities Statement of retained earnings Balance sheet Income statement Statement of cash flows Annual report countants focus on creating financial statements, whereas finance professionals mostly use these statements to waluate a firm and answer questions about its performance Indicate which financial statement would be the most elpful in answering the questions in the following table: Balance Sheet Statement of Cash Flows How much cash is a firm generating through operating, investing and financing activities? How much debt and equity has the firm issued to finance its assets? MacBook Pro