Answered step by step

Verified Expert Solution

Question

1 Approved Answer

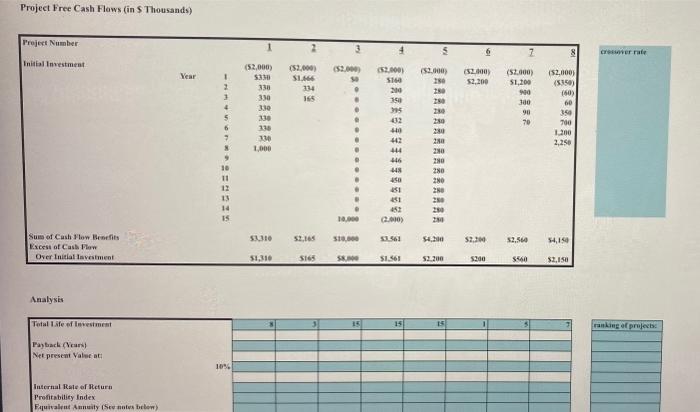

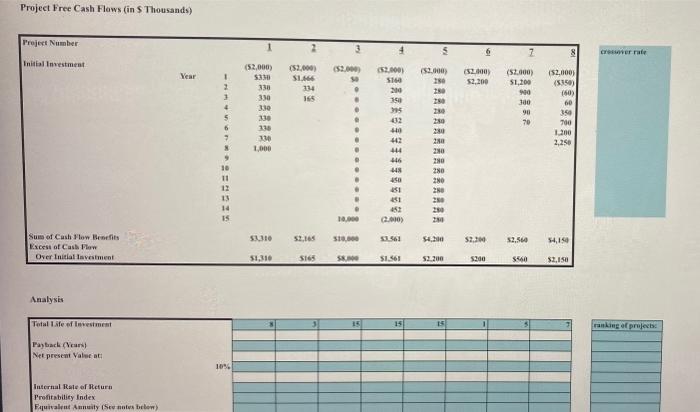

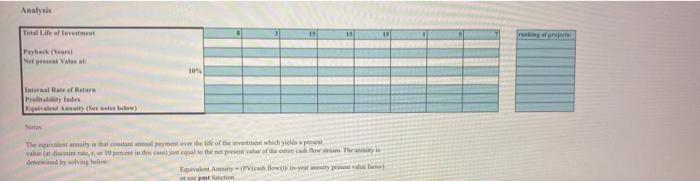

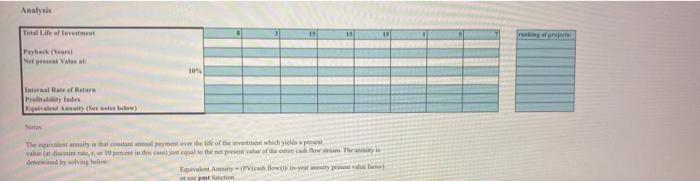

1. Find each project's payback period, NPV, IRR, profitability index and equivalent annuity. Tables of values and projects are attached. Please show all work and

1. Find each project's payback period, NPV, IRR, profitability index and equivalent annuity. Tables of values and projects are attached.

Please show all work and explain as much as possible, having trouble and need help D:

you just have to fill in this table

no spreadsheet was given, thats all the information that was given :(

Project Free Cash Flows (in S Thousands) Project Number 3 4 5 Cewer rate Initial Investment (52,000) 520 $2,000 Year 1 2 (52,000) 31.466 134 52.000) SI 200 200) 52,200 152.000 250 280 180 (52.000) $1,200 338 (52,000 (5550) (60) 60 900 . . . 300 4 35 402 90 150 330 330 330 130 130 5 250 20 700 6 40 1.200 2,250 444 280 20 20 280 280 20 9 10 11 12 13 448 . 151 14 IS 10.000 280 53.310 10.000 $2.00 52.560 54,10 Sum of Cash Flow Benefits Escess of Cash Flow Over Initial lavestment 51,310 5165 58. $1.561 52.200 5200 $2.150 Analysis Total Life of Investment 1 15 Paytrack (and Net present Value at: 105 Internal Rate of Return Profitability Index Fquivalent Amnity (Sent below) Analysis Tu Line of Net Vital 184 internal Rate of They started the white de invatam Thebe odbywing Amany resine Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started