Question

1. Find the average return and return variance of each asset and get formulas for asset 2. 2. Find the covariance of the two return

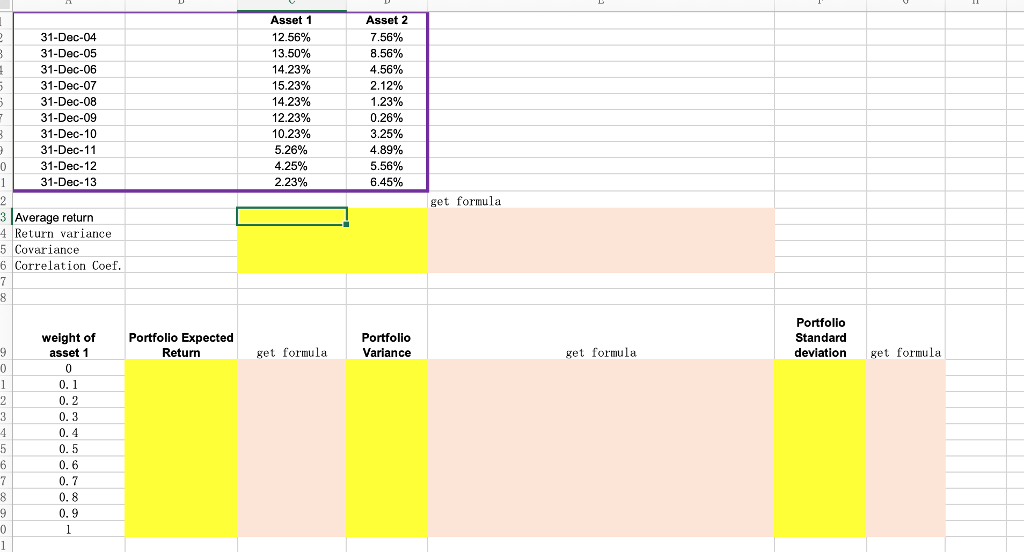

1. Find the average return and return variance of each asset and get formulas for asset 2.

2. Find the covariance of the two return series and get formula.

3. Find the correlation coefficient of the two return series and get formula.

4. Suppose we form portfolios with asset 1 and asset 2. Find the portfolio standard deviation and portfolio mean return given different weights and get formulas.

5. Make a smooth marked scatter plot of portfolio standard deviation vs portfolio mean return, with the portfolio mean return being the y-axis, portfolio standard deviation being the x-axis and title it as "Portfolio Risk vs Expected Return".

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started