Answered step by step

Verified Expert Solution

Question

1 Approved Answer

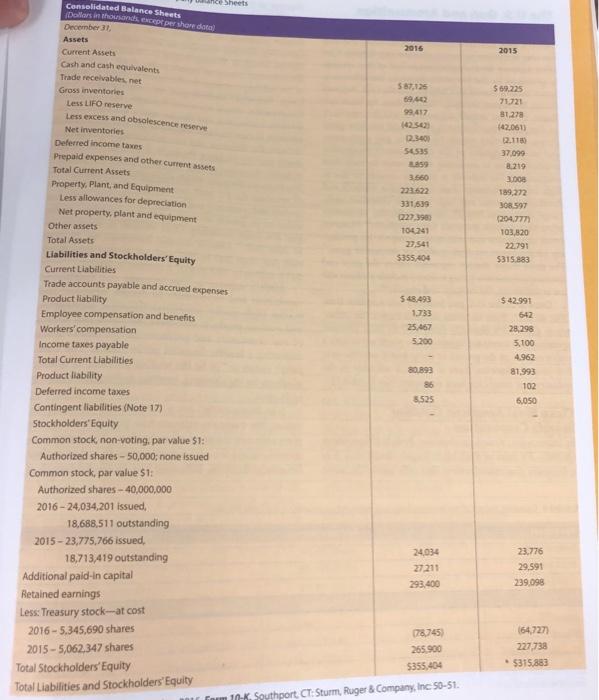

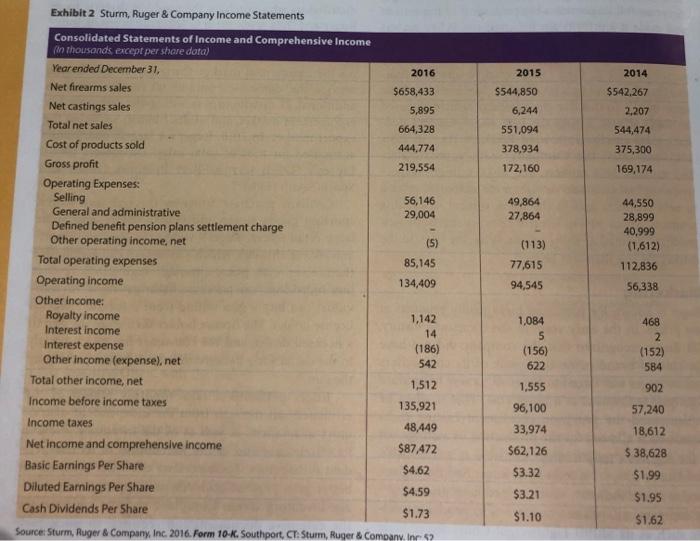

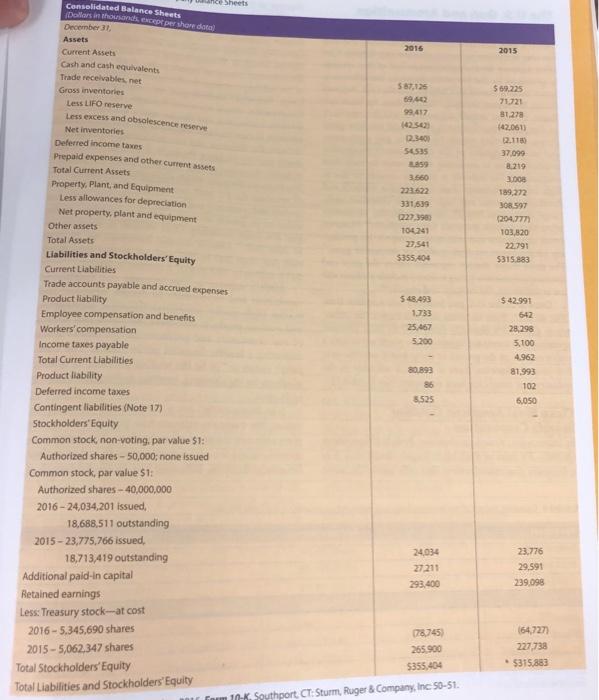

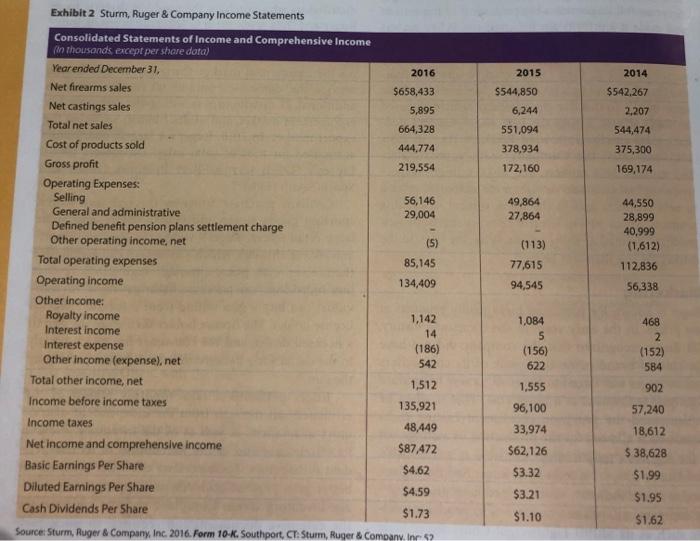

1. Find the dividend yield on common stock 2.Find the price-earnings ratio 3.Find the dividend payout ratio 4.Find the cash flow per share Sheets Consolidated

1. Find the dividend yield on common stock

Sheets Consolidated Balance Sheets Dollars in towns, ce per shoredana 2015 2015 587,125 9.42 99.417 12.3402 5635 3.560 223622 331,619 227.3983 104241 27,541 $355,404 $69.225 71721 31.278 142,061 2.118 37,099 8.219 3.00 189.272 308.597 (204.777 103,820 22.791 $315.883 548,493 1.733 25.467 5.200 December 31 Assets Current Assets Cash and cash equivalents Trade receivables.net Gross inventories Less LIFO reserve Less excess and obsolescente reserve Net inventories Deferred income taxes Prepaid expenses and other current assets Total Current Assets Property, Plant, and Equipment Less slowances for depreciation Net property, plant and equipment Other assets Total Assets Liabilities and Stockholders'Equity Current Liabilities Trade accounts payable and accrued expenses Product liability Employee compensation and benefits Workers' compensation Income taxes payable Total Current Liabilities Product liability Deferred income taxes Contingent liabilities (Note 17) Stockholders'Equity Common stock, non-voting. par value $1: Authorized shares - 50,000: none issued Common stock, par value $1: Authorized shares - 40,000,000 2016-24,034,201 issued 18,688,511 outstanding 2015 - 23,775,766 issued 18,713,419 outstanding Additional paid-in capital Retained earnings Less: Treasury stock---at cost 2016-5.345,690 shares 2015 - 5,062.347 shares Total Stockholders'Equity $42.991 542 28,298 5.100 4.962 81.993 102 80.893 86 3525 6,050 24.034 27.211 293.400 23.776 29,591 239,098 164,7271 227,738 - 5315883 178.745 265 900 $355.404 106 Southport.CT:Sturm, Ruger & Company, Inc 50-51. Total Liabilities and Stockholders' Equity 2015 $544,850 6,244 551,094 378,934 172,160 2014 $542.267 2,207 544,474 375,300 169,174 49,864 27,864 Exhibit 2 Sturm, Ruger & Company Income Statements Consolidated Statements of Income and Comprehensive Income (in thousands except per share data) Year ended December 31, 2016 Net firearms sales $658,433 Net castings sales 5,895 Total net sales 664,328 Cost of products sold 444,774 Gross profit 219,554 Operating Expenses: Selling 56,146 General and administrative 29,004 Defined benefit pension plans settlement charge Other operating income, net (5) Total operating expenses 85,145 Operating income 134,409 Other Income: Royalty income 1,142 Interest income 14 Interest expense (186) Other income (expense), net 542 Total other income, net 1,512 Income before income taxes 135,921 Income taxes 48,449 Net income and comprehensive income $87,472 Basic Earnings Per Share $4.62 Diluted Earnings Per Share $4.59 Cash Dividends Per Share $1.73 Source: Sturm, Ruger & Company, Inc. 2016. Form 10-K. Southport, Cr Sturm, Ruger & Company. Inr: 52 (113) 77,615 94,545 44,550 28,899 40,999 (1,612) 112.836 56,338 1,084 5 (156) 622 468 2 (152) 584 1,555 902 57,240 96,100 33,974 $62,126 18,612 $ 38,628 $1.99 $1.95 $3.32 $3.21 $1.10 $1.62 Sheets Consolidated Balance Sheets Dollars in towns, ce per shoredana 2015 2015 587,125 9.42 99.417 12.3402 5635 3.560 223622 331,619 227.3983 104241 27,541 $355,404 $69.225 71721 31.278 142,061 2.118 37,099 8.219 3.00 189.272 308.597 (204.777 103,820 22.791 $315.883 548,493 1.733 25.467 5.200 December 31 Assets Current Assets Cash and cash equivalents Trade receivables.net Gross inventories Less LIFO reserve Less excess and obsolescente reserve Net inventories Deferred income taxes Prepaid expenses and other current assets Total Current Assets Property, Plant, and Equipment Less slowances for depreciation Net property, plant and equipment Other assets Total Assets Liabilities and Stockholders'Equity Current Liabilities Trade accounts payable and accrued expenses Product liability Employee compensation and benefits Workers' compensation Income taxes payable Total Current Liabilities Product liability Deferred income taxes Contingent liabilities (Note 17) Stockholders'Equity Common stock, non-voting. par value $1: Authorized shares - 50,000: none issued Common stock, par value $1: Authorized shares - 40,000,000 2016-24,034,201 issued 18,688,511 outstanding 2015 - 23,775,766 issued 18,713,419 outstanding Additional paid-in capital Retained earnings Less: Treasury stock---at cost 2016-5.345,690 shares 2015 - 5,062.347 shares Total Stockholders'Equity $42.991 542 28,298 5.100 4.962 81.993 102 80.893 86 3525 6,050 24.034 27.211 293.400 23.776 29,591 239,098 164,7271 227,738 - 5315883 178.745 265 900 $355.404 106 Southport.CT:Sturm, Ruger & Company, Inc 50-51. Total Liabilities and Stockholders' Equity 2015 $544,850 6,244 551,094 378,934 172,160 2014 $542.267 2,207 544,474 375,300 169,174 49,864 27,864 Exhibit 2 Sturm, Ruger & Company Income Statements Consolidated Statements of Income and Comprehensive Income (in thousands except per share data) Year ended December 31, 2016 Net firearms sales $658,433 Net castings sales 5,895 Total net sales 664,328 Cost of products sold 444,774 Gross profit 219,554 Operating Expenses: Selling 56,146 General and administrative 29,004 Defined benefit pension plans settlement charge Other operating income, net (5) Total operating expenses 85,145 Operating income 134,409 Other Income: Royalty income 1,142 Interest income 14 Interest expense (186) Other income (expense), net 542 Total other income, net 1,512 Income before income taxes 135,921 Income taxes 48,449 Net income and comprehensive income $87,472 Basic Earnings Per Share $4.62 Diluted Earnings Per Share $4.59 Cash Dividends Per Share $1.73 Source: Sturm, Ruger & Company, Inc. 2016. Form 10-K. Southport, Cr Sturm, Ruger & Company. Inr: 52 (113) 77,615 94,545 44,550 28,899 40,999 (1,612) 112.836 56,338 1,084 5 (156) 622 468 2 (152) 584 1,555 902 57,240 96,100 33,974 $62,126 18,612 $ 38,628 $1.99 $1.95 $3.32 $3.21 $1.10 $1.62 2.Find the price-earnings ratio

3.Find the dividend payout ratio

4.Find the cash flow per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started