Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Find the ending inventory and cost of good sold 2. Find the bad debt expense 3. The balance of accounts receivable that will be

1. Find the ending inventory and cost of good sold

2. Find the bad debt expense

3. The balance of accounts receivable that will be reported in the trial balance

4. The balance of allowance for doubtful accounts that will be reported in the trial balance

Please answer all the questions above.

Thank you

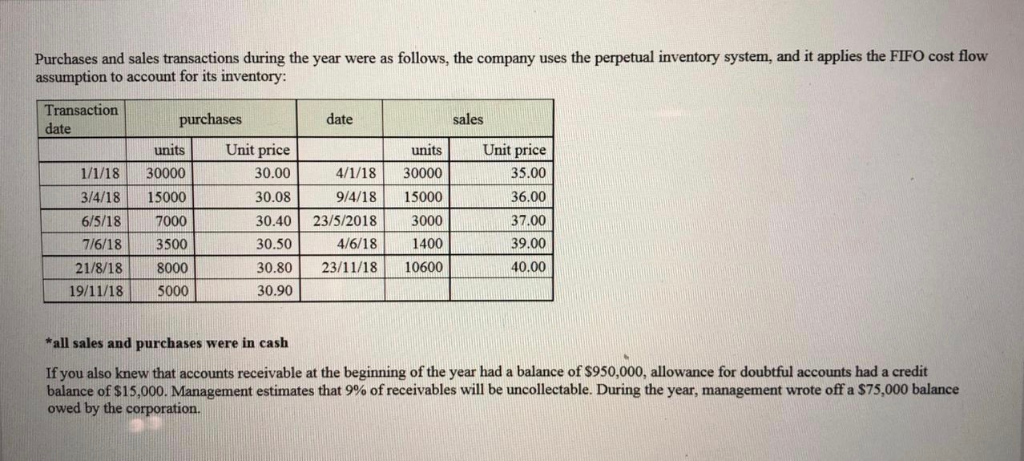

Purchases and sales transactions during the year were as follows, the company uses the perpetual inventory system, and it applies the FIFO cost flow assumption to account for its inventory Transaction date date sales unitsUnit price 35.00 36.00 37.00 39.00 40.00 Unit price units 1/1/18 30000 3/4/18 15000 6/5/18 7000 7/6/18 3500 30.00 30.08 30.40 23/5/2018 3000 30.50 30.80 23/11/18 10600 30.90 4/1/18 30000 9/4/18 15000 4/6/18 1400 21/8/18 8000 19/11/18 5000 "all sales and purchases were in cash If you also knew that accounts receivable at the beginning of the year had a balance of $950,000, allowance for doubtful accounts had a credit balance of $15,000. Management estimates that 9% of receivables will be uncollectable. During the year, management wrote off a $75,000 balance owed by the corporationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started