Answered step by step

Verified Expert Solution

Question

1 Approved Answer

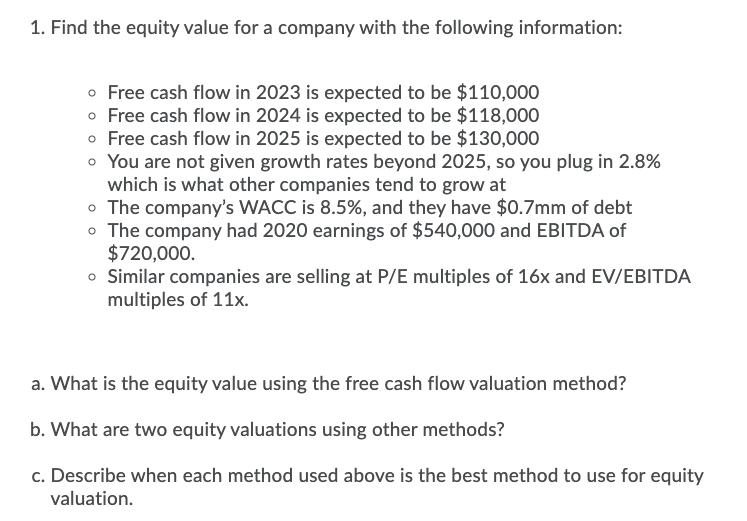

1. Find the equity value for a company with the following information: o Free cash flow in 2023 is expected to be $110,000 o

1. Find the equity value for a company with the following information: o Free cash flow in 2023 is expected to be $110,000 o Free cash flow in 2024 is expected to be $118,000 o Free cash flow in 2025 is expected to be $130,000 o You are not given growth rates beyond 2025, so you plug in 2.8% which is what other companies tend to grow at The company's WACC is 8.5%, and they have $0.7mm of debt o The company had 2020 earnings of $540,000 and EBITDA of $720,000. o Similar companies are selling at P/E multiples of 16x and EV/EBITDA multiples of 11x. a. What is the equity value using the free cash flow valuation method? b. What are two equity valuations using other methods? c. Describe when each method used above is the best method to use for equity valuation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Equity Valuation for the Company a Equity Value using Free Cash Flow FCF Valuation Terminal Value TV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started