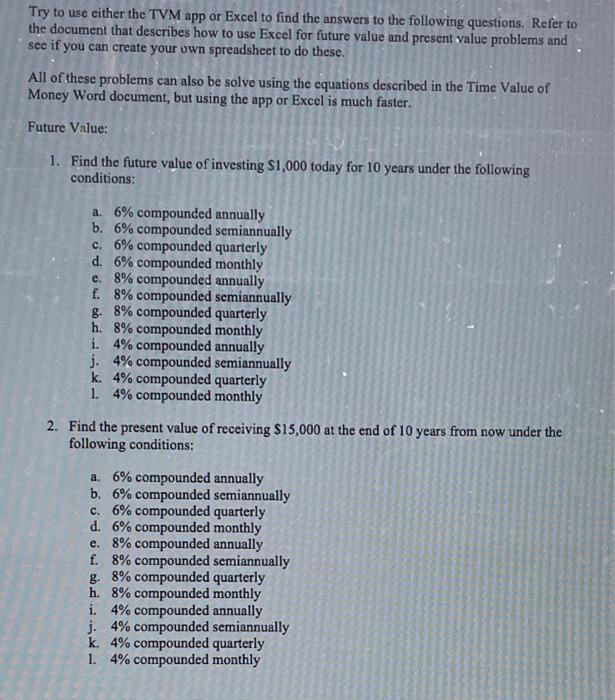

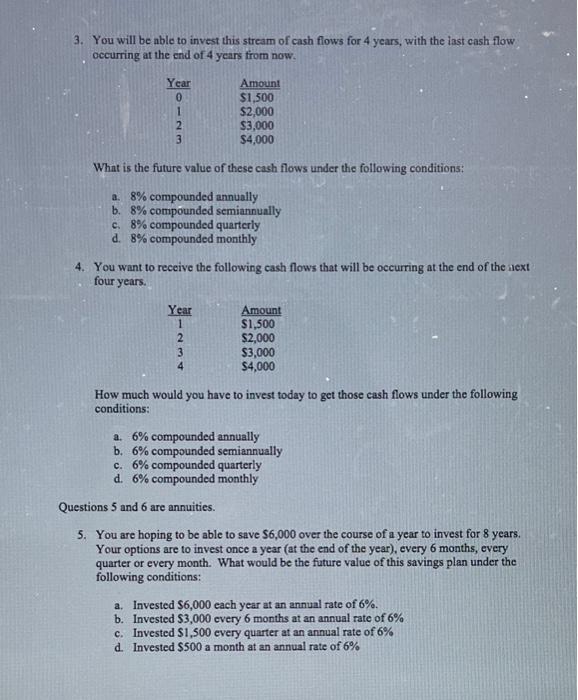

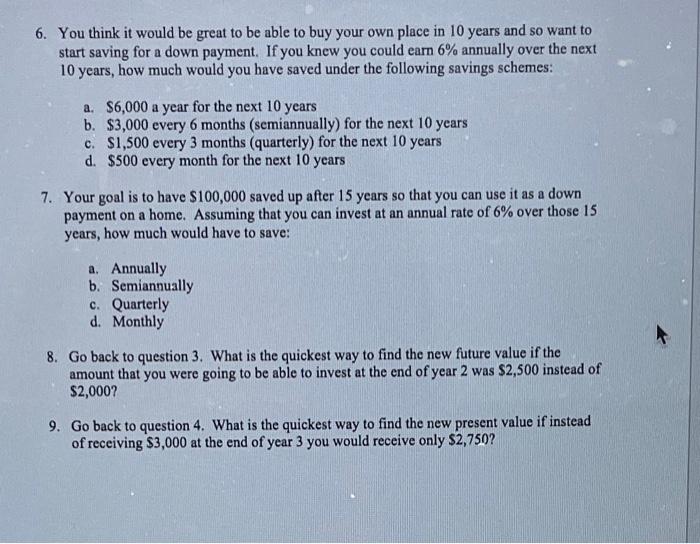

1. Find the future value of investing $1,000 today for 10 years under the following conditions: a. 6% compounded annually b. 6% compounded semiannually c. 6% compounded quarterly d. 6% compounded monthly e. 8% compounded annually f. 8% compounded semiannually g. 8% compounded quarterly h. 8% compounded monthly i. 4% compounded annually j. 4% compounded semiannually k. 4% compounded quarterly 1. 4% compounded monthly 2. Find the present value of receiving $15,000 at the end of 10 years from now under the following conditions: a. 6% compounded annually b. 6% compounded semiannually c. 6% compounded quarterly d. 6% compounded monthly e. 8% compounded annually f. 8% compounded semiannually g. 8% compounded quarterly h. 8% compounded monthly i. 4% compounded annually j. 4% compounded semiannually k. 4% compounded quarterly 1. 4% compounded monthly 3. You will be able to invest this stream of cash flows for 4 years, with the iast cash flow occurring at the end of 4 years from now. What is the future value of these cash flows under the following conditions: a. 8% compounded annually b. 8% compounded semiannually c. 8% compounded quarterly d. 8% compounded monthly 4. You want to receive the following cash flows that will be occurring at the end of the iext four years. How much would you have to invest today to get those cash flows under the following conditions: a. 6% compounded annually b. 6% compounded semiannually c. 6% compounded quarterly d. 6% compounded monthly Questions 5 and 6 are annuities. 5. You are hoping to be able to save $6,000 over the course of a year to invest for 8 years. Your options are to invest once a year (at the end of the year), every 6 months, every quarter or every month. What would be the future value of this savings plan under the following conditions: a. Invested $6,000 each year at an annual rate of 6%. b. Invested $3,000 every 6 months at an annual rate of 6% c. Invested S1,500 every quarter at an annual rate of 6% d. Invested $500 a month at an annual rate of 6% 6. You think it would be great to be able to buy your own place in 10 years and so want to start saving for a down payment. If you knew you could earn 6% annually over the next 10 years, how much would you have saved under the following savings schemes: a. $6,000 a year for the next 10 years b. $3,000 every 6 months (semiannually) for the next 10 years c. $1,500 every 3 months (quarterly) for the next 10 years d. $500 every month for the next 10 years 7. Your goal is to have $100,000 saved up after 15 years so that you can use it as a down payment on a home. Assuming that you can invest at an annual rate of 6% over those 15 years, how much would have to save: a. Annually b. Semiannually c. Quarterly d. Monthly 8. Go back to question 3. What is the quickest way to find the new future value if the amount that you were going to be able to invest at the end of year 2 was $2,500 instead of $2,000? 9. Go back to question 4. What is the quickest way to find the new present value if instead of receiving $3,000 at the end of year 3 you would receive only $2,750