Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Find the FV: a) You plan to lend $11,000, for two years at an interest rate of 8% a year. How much do you

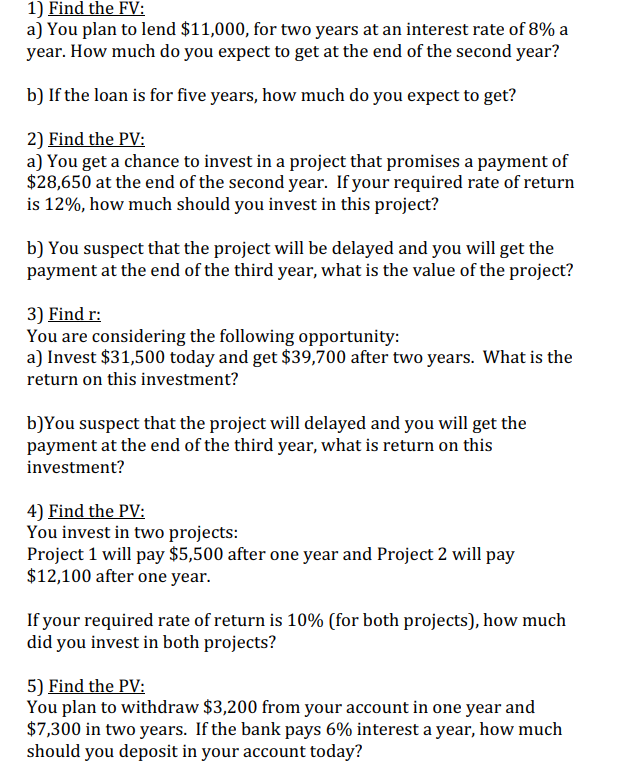

1) Find the FV: a) You plan to lend $11,000, for two years at an interest rate of 8% a year. How much do you expect to get at the end of the second year? b) If the loan is for five years, how much do you expect to get? 2) Find the PV: a) You get a chance to invest in a project that promises a payment of $28,650 at the end of the second year. If your required rate of return is 12%, how much should you invest in this project? b) You suspect that the project will be delayed and you will get the payment at the end of the third year, what is the value of the project? 3) Find r : You are considering the following opportunity: a) Invest $31,500 today and get $39,700 after two years. What is the return on this investment? b)You suspect that the project will delayed and you will get the payment at the end of the third year, what is return on this investment? 4) Find the PV: You invest in two projects: Project 1 will pay $5,500 after one year and Project 2 will pay $12,100 after one year. If your required rate of return is 10% (for both projects), how much did you invest in both projects? 5) Find the PV: You plan to withdraw $3,200 from your account in one year and $7,300 in two years. If the bank pays 6% interest a year, how much should you deposit in your account today

1) Find the FV: a) You plan to lend $11,000, for two years at an interest rate of 8% a year. How much do you expect to get at the end of the second year? b) If the loan is for five years, how much do you expect to get? 2) Find the PV: a) You get a chance to invest in a project that promises a payment of $28,650 at the end of the second year. If your required rate of return is 12%, how much should you invest in this project? b) You suspect that the project will be delayed and you will get the payment at the end of the third year, what is the value of the project? 3) Find r : You are considering the following opportunity: a) Invest $31,500 today and get $39,700 after two years. What is the return on this investment? b)You suspect that the project will delayed and you will get the payment at the end of the third year, what is return on this investment? 4) Find the PV: You invest in two projects: Project 1 will pay $5,500 after one year and Project 2 will pay $12,100 after one year. If your required rate of return is 10% (for both projects), how much did you invest in both projects? 5) Find the PV: You plan to withdraw $3,200 from your account in one year and $7,300 in two years. If the bank pays 6% interest a year, how much should you deposit in your account today Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started