Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Finding the future value of a cash flow or series of cash flows is called points) 2. Please describe the difference between an annuity

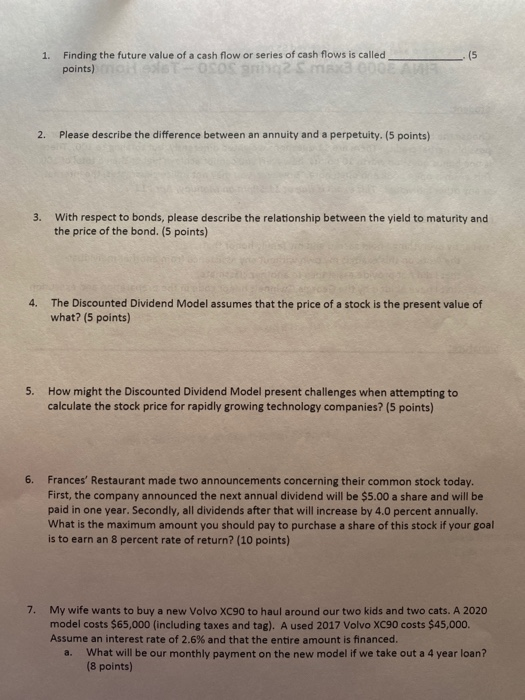

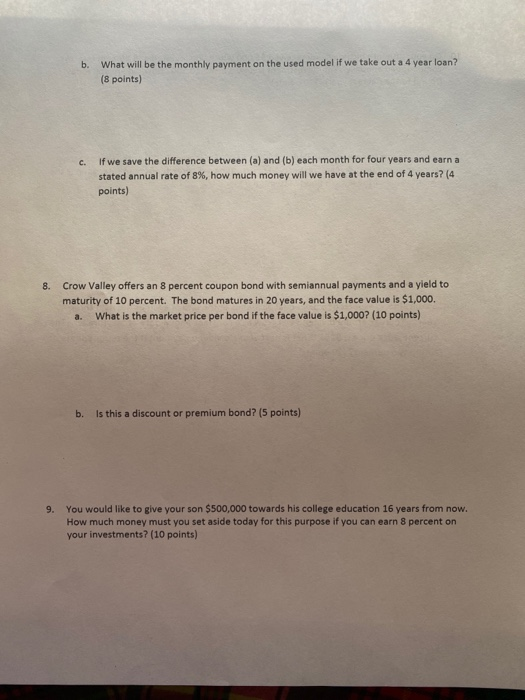

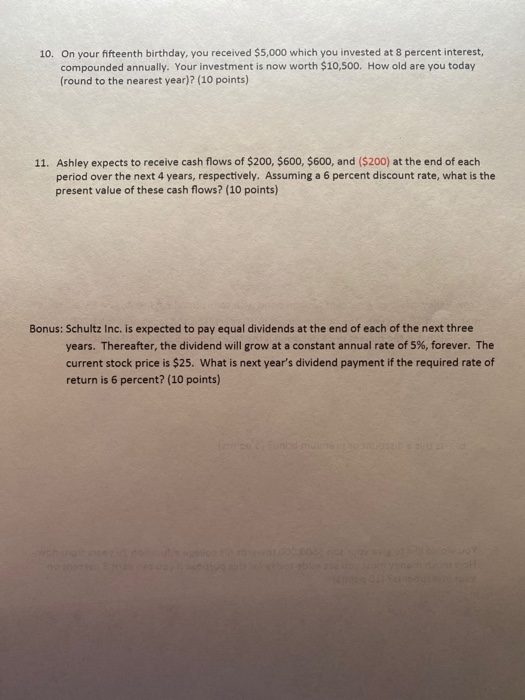

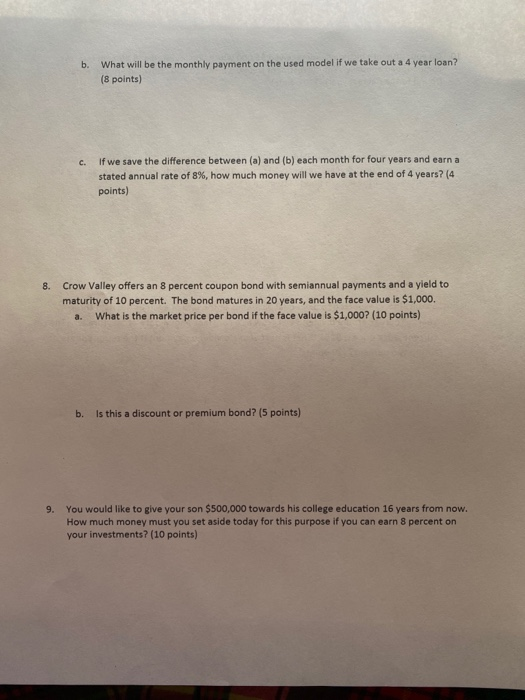

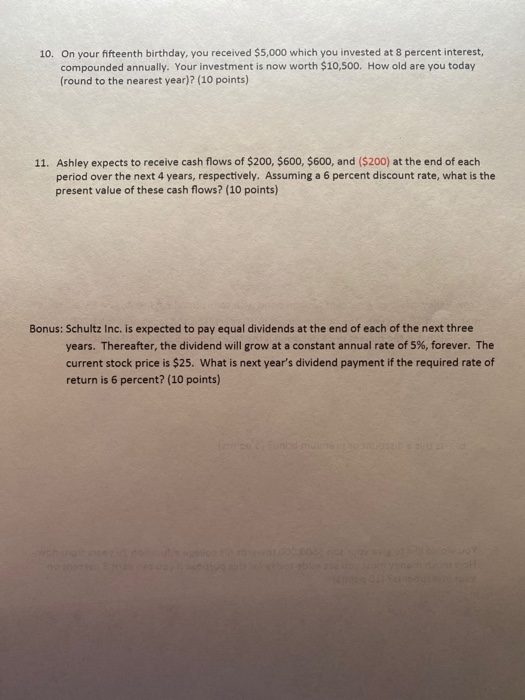

1. Finding the future value of a cash flow or series of cash flows is called points) 2. Please describe the difference between an annuity and a perpetuity. (5 points) 3. With respect to bonds, please describe the relationship between the yield to maturity and the price of the bond. (5 points) 4. The Discounted Dividend Model assumes that the price of a stock is the present value of what? (5 points) 5. How might the Discounted Dividend Model present challenges when attempting to calculate the stock price for rapidly growing technology companies? (5 points) 6. Frances' Restaurant made two announcements concerning their common stock today. First, the company announced the next annual dividend will be $5.00 a share and will be paid in one year. Secondly, all dividends after that will increase by 4.0 percent annually, What is the maximum amount you should pay to purchase a share of this stock if your goal is to earn an 8 percent rate of return? (10 points) My wife wants to buy a new Volvo XC90 to haul around our two kids and two cats. A 2020 model costs $65,000 (including taxes and tag). A used 2017 Volvo XC90 costs $45,000. Assume an interest rate of 2.6% and that the entire amount is financed. a. What will be our monthly payment on the new model if we take out a 4 year loan? (8 points) b. What will be the monthly payment on the used model if we take out a 4 year loan? (8 points) c. If we save the difference between (a) and (b) each month for four years and earn a stated annual rate of 8%, how much money will we have at the end of 4 years? (4 points) 8. Crow Valley offers an 8 percent coupon bond with semiannual payments and a yield to maturity of 10 percent. The bond matures in 20 years, and the face value is $1,000. a. What is the market price per bond if the face value is $1,000? (10 points) b. Is this a discount or premium bond? (5 points) 9. You would like to give your son $500,000 towards his college education 16 years from now. How much money must you set aside today for this purpose if you can earn 8 percent on your investments? (10 points) 10. On your fifteenth birthday, you received $5,000 which you invested at 8 percent interest, compounded annually. Your investment is now worth $10,500. How old are you today (round to the nearest year)? (10 points) 11. Ashley expects to receive cash flows of $200, $600, $600, and ($200) at the end of each period over the next 4 years, respectively. Assuming a 6 percent discount rate, what is the present value of these cash flows? (10 points) Bonus: Schultz Inc. is expected to pay equal dividends at the end of each of the next three years. Thereafter, the dividend will grow at a constant annual rate of 5%, forever. The current stock price is $25. What is next year's dividend payment if the required rate of return is 6 percent? (10 points)

1. Finding the future value of a cash flow or series of cash flows is called points) 2. Please describe the difference between an annuity and a perpetuity. (5 points) 3. With respect to bonds, please describe the relationship between the yield to maturity and the price of the bond. (5 points) 4. The Discounted Dividend Model assumes that the price of a stock is the present value of what? (5 points) 5. How might the Discounted Dividend Model present challenges when attempting to calculate the stock price for rapidly growing technology companies? (5 points) 6. Frances' Restaurant made two announcements concerning their common stock today. First, the company announced the next annual dividend will be $5.00 a share and will be paid in one year. Secondly, all dividends after that will increase by 4.0 percent annually, What is the maximum amount you should pay to purchase a share of this stock if your goal is to earn an 8 percent rate of return? (10 points) My wife wants to buy a new Volvo XC90 to haul around our two kids and two cats. A 2020 model costs $65,000 (including taxes and tag). A used 2017 Volvo XC90 costs $45,000. Assume an interest rate of 2.6% and that the entire amount is financed. a. What will be our monthly payment on the new model if we take out a 4 year loan? (8 points) b. What will be the monthly payment on the used model if we take out a 4 year loan? (8 points) c. If we save the difference between (a) and (b) each month for four years and earn a stated annual rate of 8%, how much money will we have at the end of 4 years? (4 points) 8. Crow Valley offers an 8 percent coupon bond with semiannual payments and a yield to maturity of 10 percent. The bond matures in 20 years, and the face value is $1,000. a. What is the market price per bond if the face value is $1,000? (10 points) b. Is this a discount or premium bond? (5 points) 9. You would like to give your son $500,000 towards his college education 16 years from now. How much money must you set aside today for this purpose if you can earn 8 percent on your investments? (10 points) 10. On your fifteenth birthday, you received $5,000 which you invested at 8 percent interest, compounded annually. Your investment is now worth $10,500. How old are you today (round to the nearest year)? (10 points) 11. Ashley expects to receive cash flows of $200, $600, $600, and ($200) at the end of each period over the next 4 years, respectively. Assuming a 6 percent discount rate, what is the present value of these cash flows? (10 points) Bonus: Schultz Inc. is expected to pay equal dividends at the end of each of the next three years. Thereafter, the dividend will grow at a constant annual rate of 5%, forever. The current stock price is $25. What is next year's dividend payment if the required rate of return is 6 percent? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started