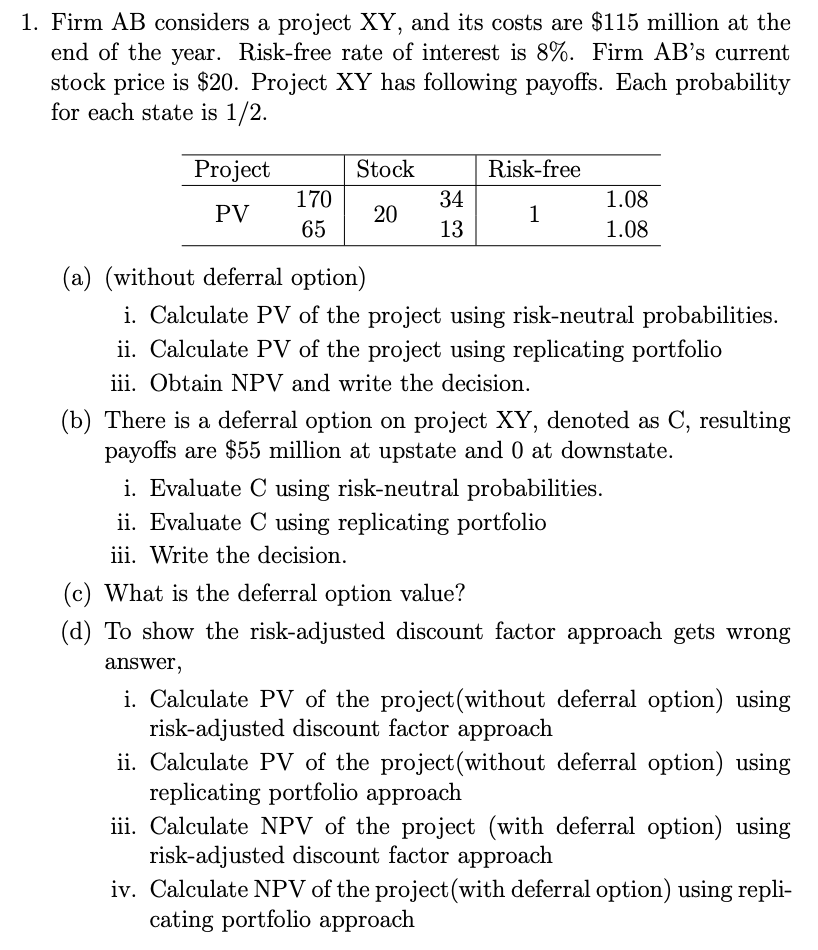

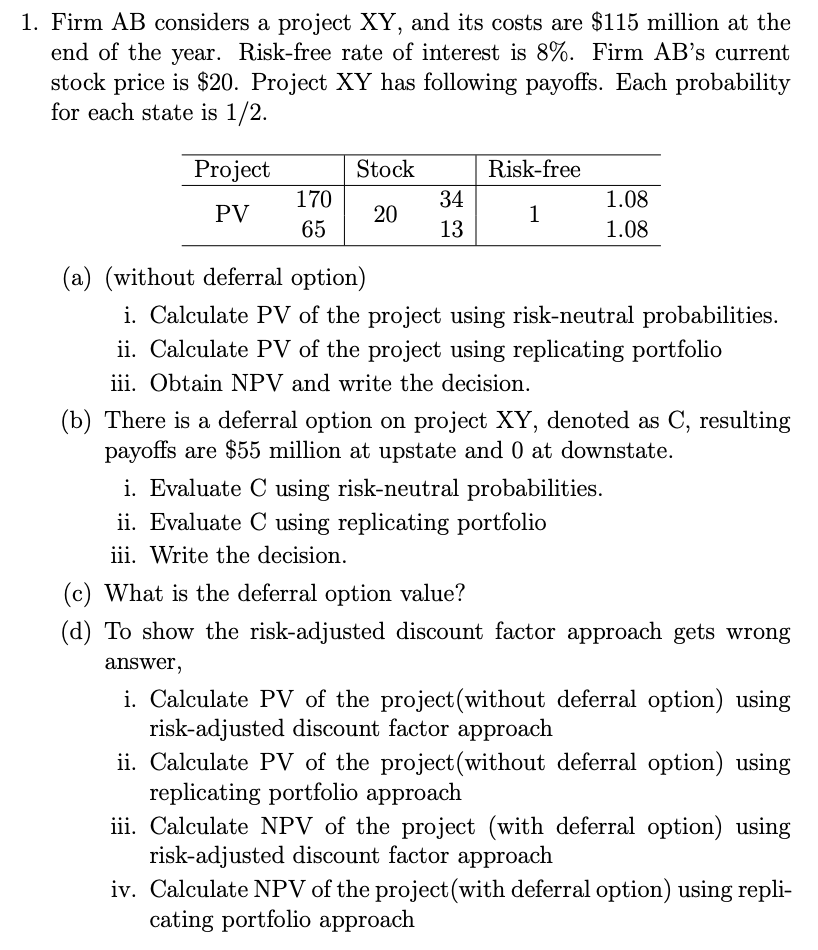

1. Firm AB considers a project XY, and its costs are $115 million at the end of the year. Risk-free rate of interest is 8%. Firm AB's current stock price is $20. Project XY has following payoffs. Each probability for each state is 1/2. Stock Risk-free Project 170 34 1.08 PV 20 1 1.08 65 13 (a) without deferral option) i. Calculate PV of the project using risk-neutral probabilities. ii. Calculate PV of the project using replicating portfolio iii. Obtain NPV and write the decision (b) There is a deferral option on project XY, denoted as C, resulting payoffs are $55 million at upstate and 0 at downstate. i. Evaluate C using risk-neutral probabilities ii. Evaluate C using replicating portfolio iii. Write the decision (c) What is the deferral option value? (d) To show the risk-adjusted discount factor approach gets wrong answer i. Calculate PV of the project(without deferral option) using risk-adjusted discount factor approach ii. Calculate PV of the project(without deferral option) using replicating portfolio approach ii. Calculate NPV of the project (with deferral option) using risk-adjusted discount factor approach iv. Calculate NPV of the project (with deferral option) using repli cating portfolio approach 1. Firm AB considers a project XY, and its costs are $115 million at the end of the year. Risk-free rate of interest is 8%. Firm AB's current stock price is $20. Project XY has following payoffs. Each probability for each state is 1/2. Stock Risk-free Project 170 34 1.08 PV 20 1 1.08 65 13 (a) without deferral option) i. Calculate PV of the project using risk-neutral probabilities. ii. Calculate PV of the project using replicating portfolio iii. Obtain NPV and write the decision (b) There is a deferral option on project XY, denoted as C, resulting payoffs are $55 million at upstate and 0 at downstate. i. Evaluate C using risk-neutral probabilities ii. Evaluate C using replicating portfolio iii. Write the decision (c) What is the deferral option value? (d) To show the risk-adjusted discount factor approach gets wrong answer i. Calculate PV of the project(without deferral option) using risk-adjusted discount factor approach ii. Calculate PV of the project(without deferral option) using replicating portfolio approach ii. Calculate NPV of the project (with deferral option) using risk-adjusted discount factor approach iv. Calculate NPV of the project (with deferral option) using repli cating portfolio approach