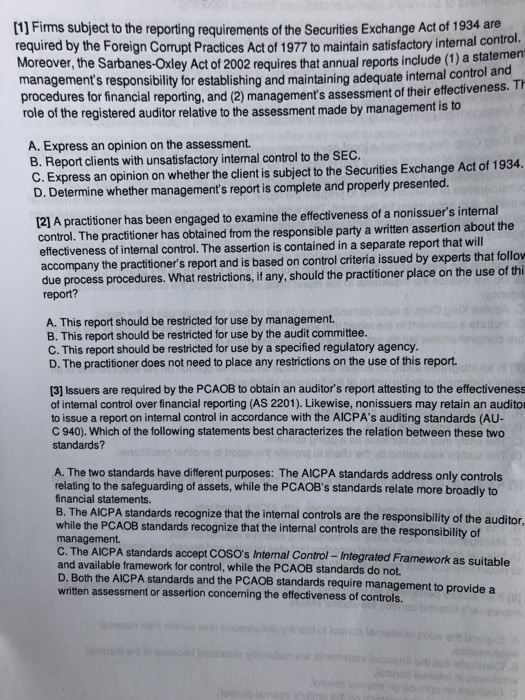

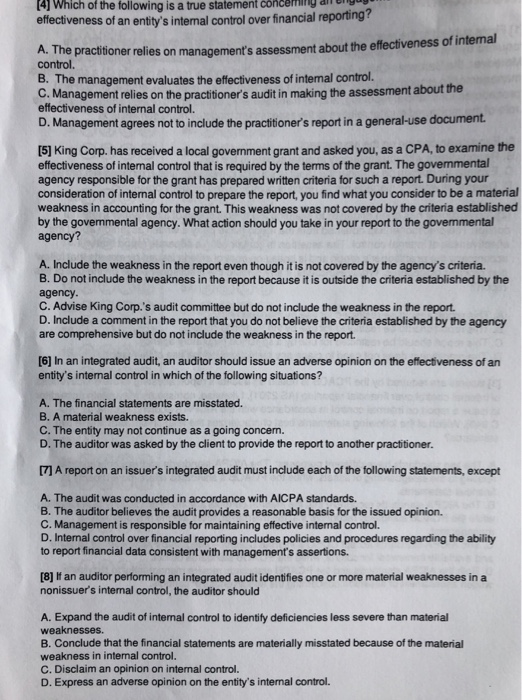

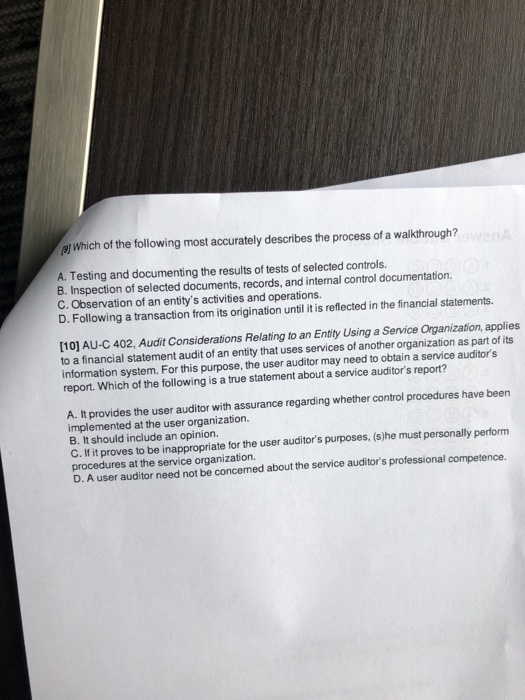

[1] Firms subject to the reporting requirements of the Securities Exchange Act of 1934 ar required by the Foreign Comupt Practices Act of 1977 to maintain satisfactory internal control. Moreover, the Sarbanes-Oxley Act of 2002 requires that annual reports include (1) a statemen management's responsibility for establishing and maintaining adequate intemal con procedures role of the registered auditor relative to the assessment made by management is to for financial reporting, and (2) management's assessment of their effectiveness. T A. Express an opinion on the assessment. B. Report clients with unsatisfactory internal control to the SEC. C. Express an opinion on whether the client is subject to the Securities Exchange Act of 1934. D. Determine whether management's report is complete and properly presented. 12] A practitioner has been engaged to examine the effectiveness of a nonissuer's internal control. The practitioner has obtained from the responsible party a written assertion about the effectiveness of internal control. The assertion is contained in a separate report th accompany the practitioner's report and is based on control criteria issued by experts that follo due process procedures. What restrictions, if any, should the practitioner place on the use of thi report? A. This report should be restricted for use by management. B. This report should be restricted for use by the audit committee C. This report should be restricted for use by a specified regulatory agency. D. The practitioner does not need to place any restrictions on the use of this report [3] Issuers are required by the PCAOB to obtain an auditor's report attesting to the effectiveness of internal control over financial reporting (AS 2201). Likewise, nonissuers may retain an audito to issue a report on internal control in accordance with the AICPA's auditing standards (AU- C 940). Which of the following statements best characterizes the relation between these two standards? A. The two standards have different purposes: The AICPA standards address only controls relating to the safeguarding of assets, while the PCAOB's standards relate more broadly to financial statements. B. The AICPA standards recognize that the internal controls are the responsibility of the auditor while the PCAOB standards recognize that the internal controls are the responsibility of management C. The AICPA standards accept COSO's Internal Control -Integrated Framework as and available framework for control, while the PCAOB standards do not. D. Both the AICPA standards and the PCAOB standards require management to provide a written assessment or assertion conceming the effectiveness of controls. 4] Which of the following is a true statement conceming a es efectiveness of an entity's intermal control over financial reporting? practtoner relies on management's assessment about the effectiveness of internal control. B. The management evaluates the effectiveness of intemal control. C. Management relies on the practitioners audit in making the assessment about the effectiveness of internal control. D. Management agrees not to include the practitioner's report in a general-use document [5] King Corp. has received a local government grant and asked you, as a CPA, to examine the effectiveness of internal control that is required by the terms of the grant. The govemmental agency responsible for the grant has prepared written criteria for such a report. During your consideration of internal control to prepare the report, you find what you consider to be a material weakness in accounting for the grant. This weakness was not covered by the criteria established by the govemmental agency. What action should you take in your report to the govemmental agency? A. Include the weakness in the report even though it is not covered by the agency's criteria. B. Do not include the weakness in the report because it is outside the criteria established by the agency C. Advise King Corp.'s audit committee but do not include the weakness in the report D. Include a comment in the report that you do not believe the criteria established by the agency are comprehensive but do not include the weakness in the report [6] In an integrated audit, an auditor should issue an adverse opinion on the effectiveness of an entity's internal control in which of the following situations? A. The financial statements are misstated B. A material weakness exists C. The entity may not continue as a going concern D. The auditor was asked by the client to provide the report to another practitioner. 7] A report on an issuer's integrated audit must include each of the following statements, except A. The audit was conducted in accordance with AICPA standards. B. The auditor believes the audit provides a reasonable basis for the issued opinion. C. Management is responsible for maintaining effective internal control. D. Internal control over financial reporting includes policies and procedures regarding the ability to report financial data consistent with management's assertions. (8] If an auditor performing an integrated audit identifies one or more material weaknesses in a nonissuer's internal control, the auditor should A. Expand the audit of intemal control to identify deficiencies less severe than material weaknesses. B. Conclude that the financial statements are materially misstated because of the material weakness in intemal control. C. Disclaim an opinion on internal control. D. Express an adverse opinion on the entity's internal control. which of the following most accurately describes the process of a walkthrough? A. Testing and documenting the results of tests of selected controls. B. Inspection of selected documents, records, and internal control documentation C. Observation of an entity's activities and operations. D. Following a transaction from its origination until it is reflected in the financial statements [10] AU-C 402, Audit Considerations Relating to an Entity Using a Service Organization, applies to a financial statement audit of an entity that uses services of another organization as part of its information system. For this purpose, the user auditor may need to obtain a service auditor's report. Which of the following is a true statement about a service auditor's report? A. It provides the user auditor with assurance regarding whether control procedures have been implemented at the user organization B. It should include an opinion. C. If it proves to be inappropriate for the user auditor's purposes, (s)he must personally perform procedures at the service organization. D. A user auditor need not be concemed about the service auditor's professional competence