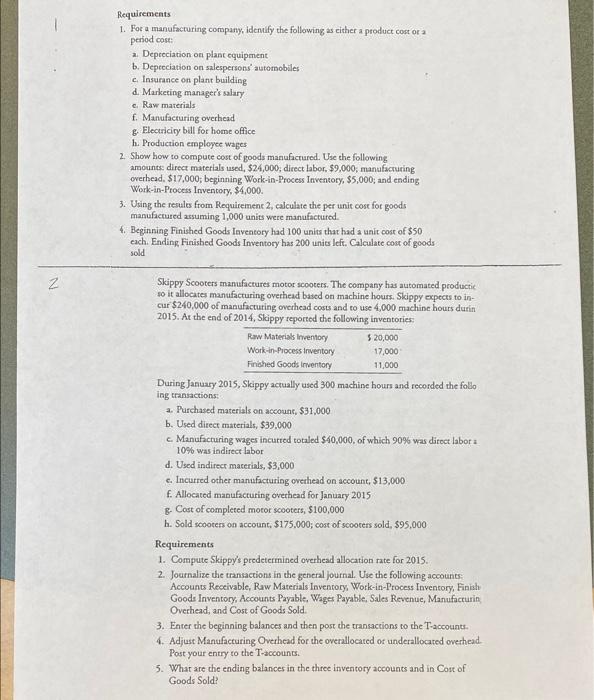

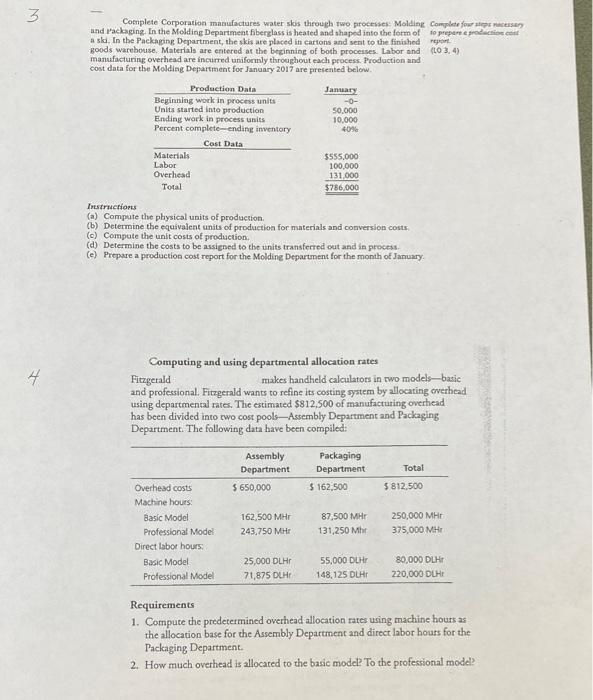

1. Foc a manufacturing company, idenuify the following as either a product cost or a period cost: a. Depreciation on planc equipment b. Depteciation on salespersons' automobiles c. Insurance on plant building d. Marketing manager's salary c. Raw materials f. Manufacturing overhead g. Electricity bill for home office h. Production employee wages 2. Show how to compute cost of goods manuficrured. Use the following amounts direct materials used, $24,000; direct labor, $9,000; manufacruring overhead, \$17,000; beginning Work-in-Process Inventory, \$5,000; and ending Work-in-Process Inventory, $4,000. 3. Using the resules from Requiremene 2 , calculate the per unit cost for goods manufictured arsuming 1,000 units were manuffctured. 4. Beginning Finished Goods Iaventory had 100 units that had a uait cost of $50. each. Ending. Finished Goods Inventory has 200 units Ieff. Calculate cost of goods sold Skippy Scooters manufactures motor scooters. The company has automated productic so it allocates manufacturing overhead based on machine hours. Skippy expects to incar $240,000 of manufactuting overhead coss and to use 4,000 machine hours durin 2015. At the end of 2014, Skippy reported the following inventories: During January 2015, Skippy actually used 300 machine hours and recorded the follo ing transactions: a. Purchased materials on account, $31,000 b. Used direct materials, $39,000 c. Manufacruring wager incurred totaled $40,000, of which 90% was ditoct labor a 10% was indirect labor d. Used indirecr macerials, $3,000 c. Incurred other manufacturing overhead on account, 513,000 f. Allocated manufacturing overhead for January 2015 g. Cost of completed moror scooters, $100,000 h. Sold scooters on account, $175,000; cost of scoorers sold, $95,000 Requirements 1. Compute Skippy's predetermined overhead allocation rate for 2015. 2. Journalize the transactions in the general journal. Use the following account: Accounts Receivable, Raw Materials Inventory, Work-in-Process Inventory, Finiah Goods Inventory, Accounts Payable, Wages Payable, Sales Revenue, Manufacturin Overhead, and Cost of Goods Sold. 3. Enter the beginning balances and then post the transaceions to the T-accounts. 4. Adjust Manufacturing Overhead for the overallocated of underallocated overhead. Post your entry to the T-accouncs. 5. What are the ending balances in the three inventory accounts and in Cost of Goods Sold? Complete Corporation manufactures water slos through two parocesses: Moldiag Compler fow atpr necesen and rackaging. In the Molding Departmeat fiberglass is heated and ahaped into the form of to preperte prodectios eat a ski. In the Packaging Department, the skis are placed in cartons and sent to the finiahed repongoods warehouse. Materials are entered at the beginning of both proceises tabor and (403,4) manufacturing overhead are incurred uniformly throughout each process. Production and cost data for the Molding Department for Janaary 2017 are preiented below. Instructions (a) Compute the physical units of production. (b) Determine the equivalent units of production for materials and conversion costs. (c) Compute the unit costs of production. (d) Determine the costs to be assiened to the units transferred out and in proceis. (e) Prepare a production cost report for the Molding Deparment for the month of January. Computing and using departmental allocation rates Firzgerald makes handheld calculators in rwo models-basic and professional. Fitzgerald wants to refine its costing syntem by allocating overhead using departmental rates. The estimated $812,500 of manufacturing overtvead has been divided into cwo cost pools-Assembly Department and Packaging Department. The following data have been compiled: Requirements 1. Compure the predetermined overhead allocation rates using machine hours as the allocation base for the Assembly Department and direct labor hours for the Packaging Department. 2. How much overhead is allocared to the basic model? To the professional mode