Answered step by step

Verified Expert Solution

Question

1 Approved Answer

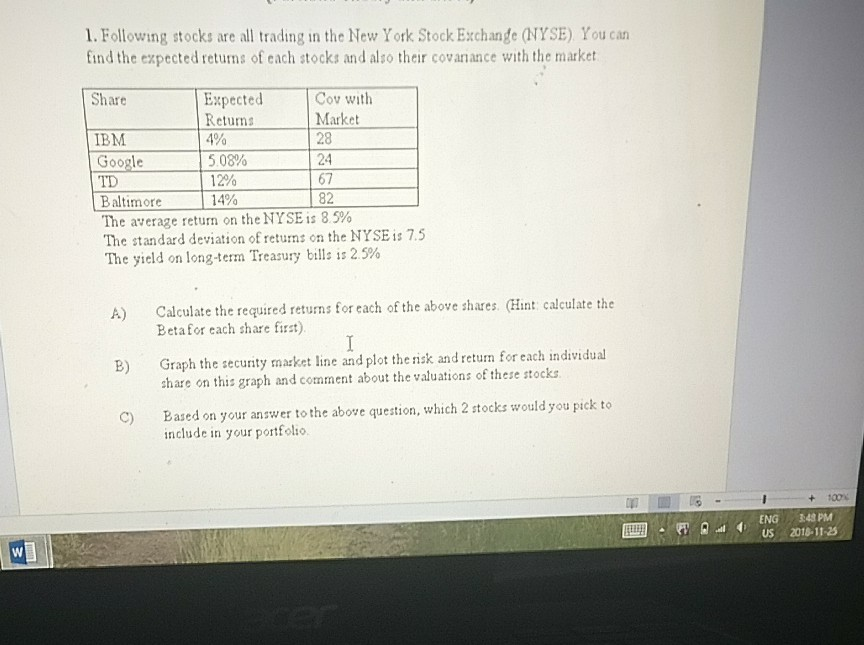

1. Following stocks are all trading in the New York Stock Exchange (NYSE) You can find the expected returns of each stocks and also their

1. Following stocks are all trading in the New York Stock Exchange (NYSE) You can find the expected returns of each stocks and also their covarance with the market Expected Returns Cov with Market Share 4% IBM Google TD Baltimore 28 24 67 82 5 08% 12% 14% The average return on the NYSE is 8 5% The standard deviation of retu on the NYSE is 7.5 The yield on long-tenn Treasury bills is 2.5% A) Calculate the required returns for each of the above shares. (Hint calculate the Betafor cach share first) B) Graph the security matket line and plot the rizk and return for each individual share on this graph and comment about the valuations of these stocks C) Based on your answer to the above question, which 2 stocks would you pick to include in your portfolio US 2018-11-23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started