Question

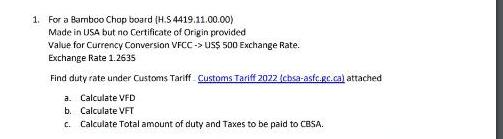

1. For a Bamboo Chop board (H.S 4419.11.00.00) Made in USA but no Certificate of Origin provided Value for Currency Conversion VFCC-> US$ 500

1. For a Bamboo Chop board (H.S 4419.11.00.00) Made in USA but no Certificate of Origin provided Value for Currency Conversion VFCC-> US$ 500 Exchange Rate. Exchange Rate 1.2635 Find duty rate under Customs Tariff Customs Tariff 2022 (cbsa-asfc.gc.ca) attached a. Calculate VFD b. Calculate VFT c. Calculate Total amount of duty and Taxes to be paid to CBSA.

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a VFD US 500 x 12635 C ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App