Answered step by step

Verified Expert Solution

Question

1 Approved Answer

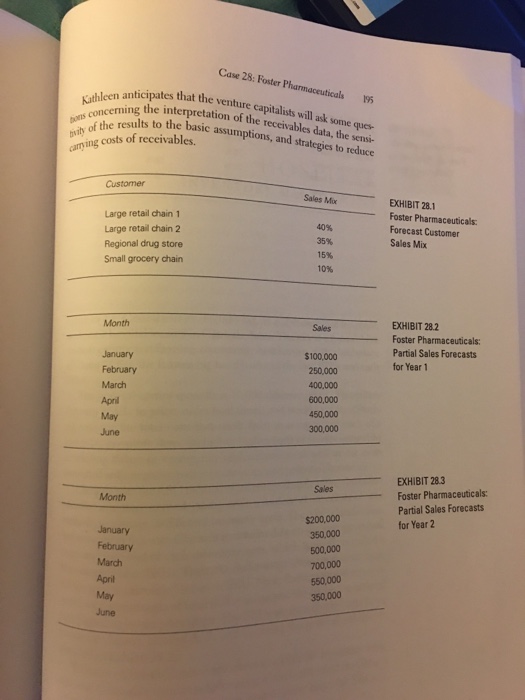

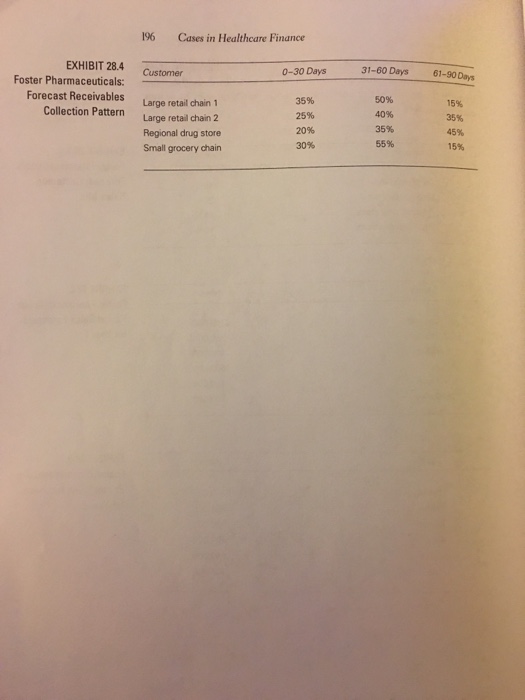

1. For all of question 1, ignore the forecasted receivables collection pattern in Exhibit 28.4 and the model. Assume that 30% of all customers will

1. For all of question 1, ignore the forecasted receivables collection pattern in Exhibit 28.4 and the model. Assume that 30% of all customers will pay on the 10thday after sale, 50% will pau on the 30th day, and 20% will pay on the 60th day. Assume a 360-day year.

a. What is the projected average collection period (ACP) and average daily sales (in dollars)?

b. What is the firms projected average receivables level?

c. Assuming a 20% contribution margin and short-term loans costing 8%, what would the figures on both sides of the firms balance sheet be at the end of the year if notes payable are used to finance the investment in receivables. (Show a balance sheet with only receivables on the asset side and notes payable and retained earning assuming that profits from sales are recorded as additions to retained earnings)

d. Given the 8% percent cost of financing receivables with bank notes, what is the projected annual cost of carrying the receivables?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started