Question

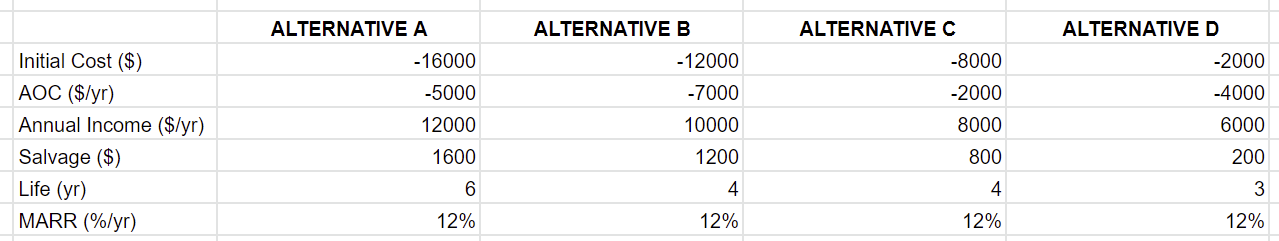

1. For an INDEPENDENT present worth analysis, what is the Present Worth of Alternative A? 2. For a MUTUALLY EXCLUSIVE present worth analysis using the

1. For an INDEPENDENT present worth analysis, what is the Present Worth of Alternative A?

1. For an INDEPENDENT present worth analysis, what is the Present Worth of Alternative A?

2. For a MUTUALLY EXCLUSIVE present worth analysis using the LCM method, which of the following values should be substituted for "n" in the following term

3. For a MUTUALLY EXCLUSIVE present worth analysis using the a study period of 5 years, what would the net cash flow ($) be for Alternative D in year 5?

4.For an INDEPENDENT present worth analysis, what is the Present Worth of Alternative B?

5.For an INDEPENDENT present worth analysis, which alternative(s) should be selected?

ALTERNATIVE A ALTERNATIVE D ALTERNATIVE C -8000 - 16000 -5000 12000 ALTERNATIVE B - 12000 -7000 10000 1200 -2000 -4000 Initial Cost ($) AOC ($/yr) Annual Income ($/yr) Salvage ($) Life (yr) MARR (%/yr) -2000 8000 6000 200 1600 800 6 4 4 3 12% 12% 12% 12% ALTERNATIVE A ALTERNATIVE D ALTERNATIVE C -8000 - 16000 -5000 12000 ALTERNATIVE B - 12000 -7000 10000 1200 -2000 -4000 Initial Cost ($) AOC ($/yr) Annual Income ($/yr) Salvage ($) Life (yr) MARR (%/yr) -2000 8000 6000 200 1600 800 6 4 4 3 12% 12% 12% 12%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started