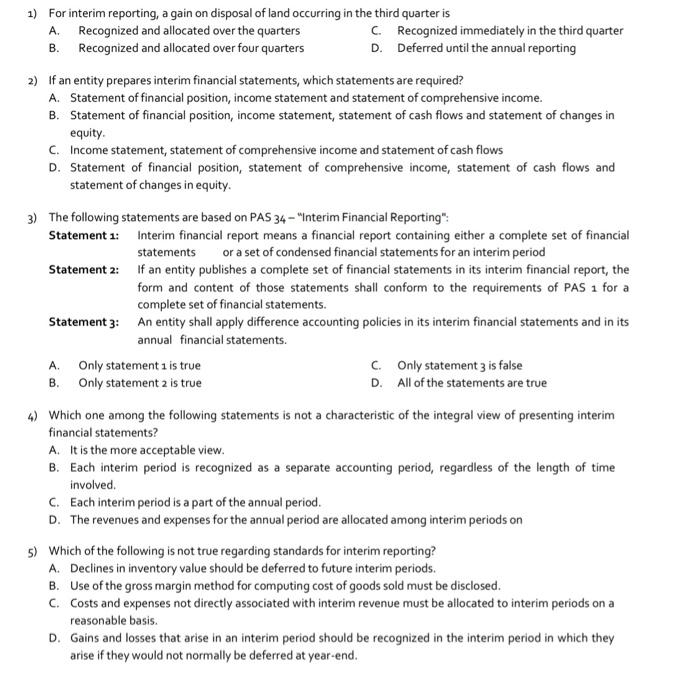

1) For interim reporting, a gain on disposal of land occurring in the third quarter is A. Recognized and allocated over the quarters C Recognized immediately in the third quarter B. Recognized and allocated over four quarters D. Deferred until the annual reporting 2) If an entity prepares interim financial statements, which statements are required? A. Statement of financial position, income statement and statement of comprehensive income. B. Statement of financial position, income statement, statement of cash flows and statement of changes in equity C. Income statement, statement of comprehensive income and statement of cash flows D. Statement of financial position, statement of comprehensive income, statement of cash flows and statement of changes in equity. 3) The following statements are based on PAS 34 - "Interim Financial Reporting" Statement 1: Interim financial report means a financial report containing either a complete set of financial statements or a set of condensed financial statements for an interim period Statement 2: If an entity publishes a complete set of financial statements in its interim financial report, the form and content of those statements shall conform to the requirements of PAS 1 for a complete set of financial statements. Statement 3: An entity shall apply difference accounting policies in its interim financial statements and in its annual financial statements. Only statement 1 is true C. Only statement 3 is false B. Only statement 2 is true D. All of the statements are true 4) Which one among the following statements is not a characteristic of the integral view of presenting interim financial statements? A. It is the more acceptable view B. Each interim period is recognized as a separate accounting period, regardless of the length of time involved C. Each interim period is a part of the annual period. D. The revenues and expenses for the annual period are allocated among interim periods on 5) Which of the following is not true regarding standards for interim reporting? A. Declines in inventory value should be deferred to future interim periods. B. Use of the gross margin method for computing cost of goods sold must be disclosed. C. Costs and expenses not directly associated with interim revenue must be allocated to interim periods on a reasonable basis. D. Gains and losses that arise in an interim period should be recognized in the interim period in which they arise if they would not normally be deferred at year-end. A