Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. For the audit of Helium Ltd, the audit team has decided to use non-statistical sampling in the test of controls and the substantive tests

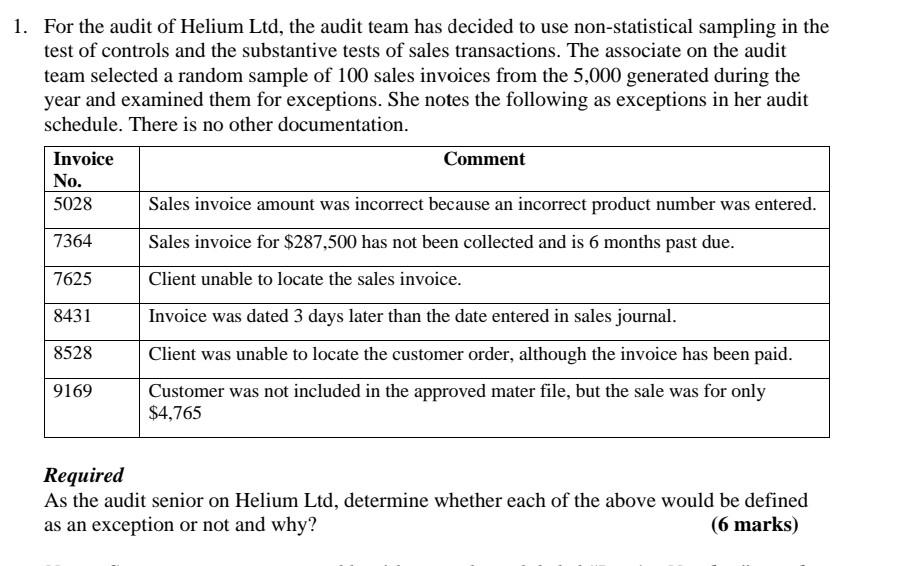

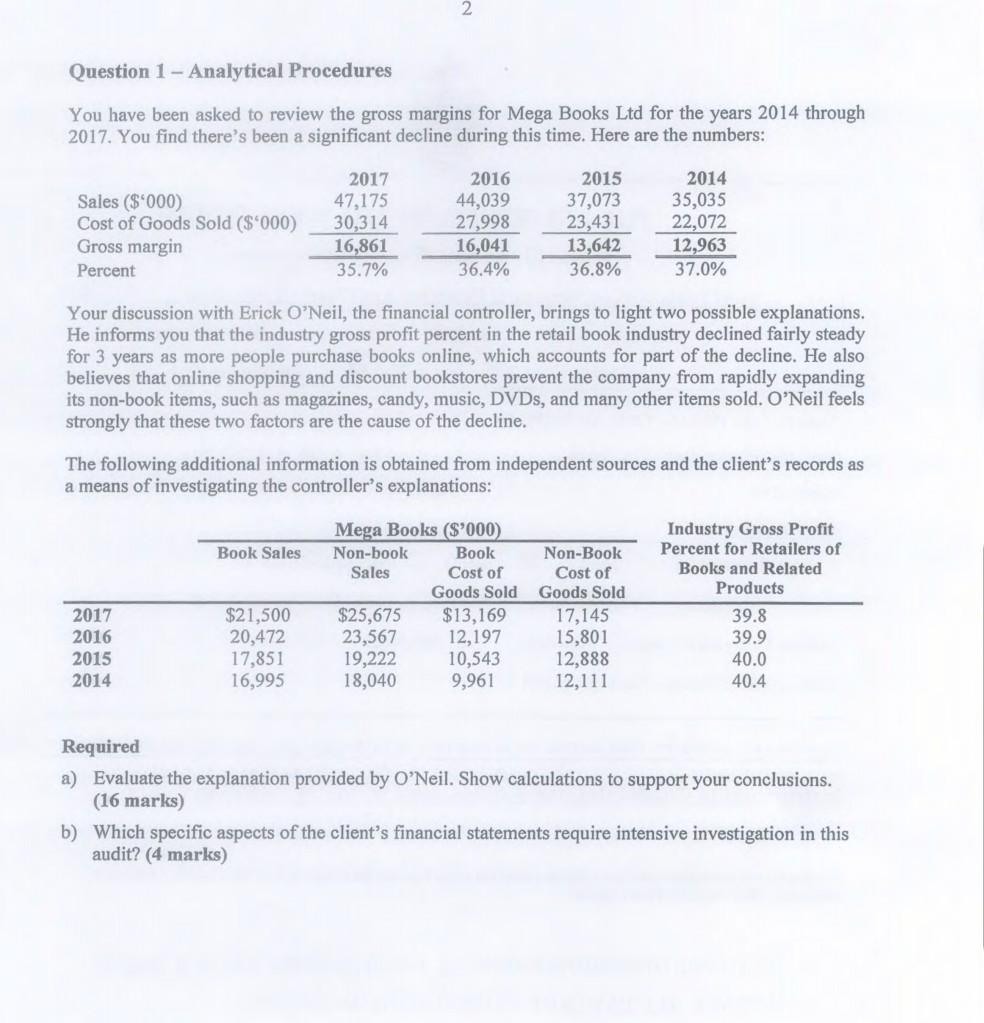

1. For the audit of Helium Ltd, the audit team has decided to use non-statistical sampling in the test of controls and the substantive tests of sales transactions. The associate on the audit team selected a random sample of 100 sales invoices from the 5,000 generated during the year and examined them for exceptions. She notes the following as exceptions in her audit schedule. There is no other documentation. Invoice Comment No. 5028 Sales invoice amount was incorrect because an incorrect product number was entered. 7364 Sales invoice for $287,500 has not been collected and is 6 months past due. 7625 Client unable to locate the sales invoice. 8431 Invoice was dated 3 days later than the date entered in sales journal. 8528 Client was unable to locate the customer order, although the invoice has been paid. 9169 Customer was not included in the approved mater file, but the sale was for only $4,765 Required As the audit senior on Helium Ltd, determine whether each of the above would be defined as an exception or not and why? (6 marks) Question 1 - Analytical Procedures You have been asked to review the gross margins for Mega Books Ltd for the years 2014 through 2017. You find there's been a significant decline during this time. Here are the numbers: Sales ($ 000) Cost of Goods Sold ($'000) Gross margin Percent 2017 47,175 30,314 16,861 35.7% 2016 44,039 27,998 16,041 36.4% 2015 37,073 23,431 13,642 36.8% 2014 35,035 22,072 12,963 37.0% Your discussion with Erick O'Neil, the financial controller, brings to light two possible explanations. He informs you that the industry gross profit percent in the retail book industry declined fairly steady for 3 years as more people purchase books online, which accounts for part of the decline. He also believes that online shopping and discount bookstores prevent the company from rapidly expanding its non-book items, such as magazines, candy, music, DVDs, and many other items sold. O'Neil feels strongly that these two factors are the cause of the decline. The following additional information is obtained from independent sources and the client's records as a means of investigating the controller's explanations: Book Sales 2017 2016 2015 2014 Mega Books ($'000) Non-book Book Sales Cost of Goods Sold $25,675 $13,169 23,567 12,197 19,222 10,543 18,040 9,961 Industry Gross Profit Percent for Retailers of Books and Related Products 39.8 39.9 40.0 40.4 $21,500 20,472 17,851 16,995 Non-Book Cost of Goods Sold 17,145 15,801 12,888 12,111 Required a) Evaluate the explanation provided by O'Neil. Show calculations to support your conclusions. (16 marks) b) Which specific aspects of the client's financial statements require intensive investigation in this audit? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started