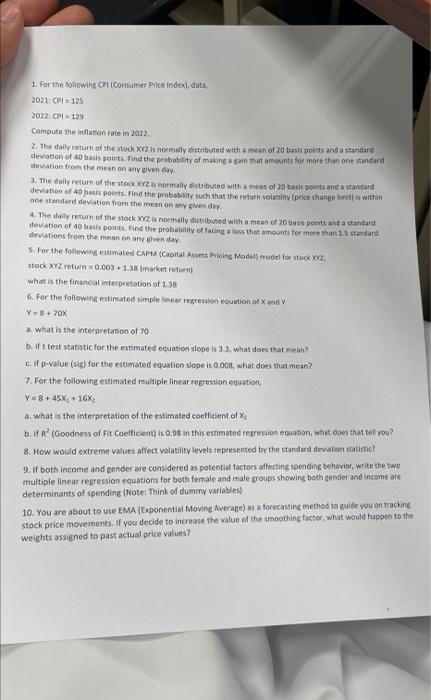

1. For the following Consumer Price Index.date. 2021: CP125 20221 CPL 129 Compute the inflation rate in 2022. 2. The daily return of the stock XYZ is normally distributed with a mean of 20 basis points and a standard deviation of 40 balls points. Find the probability of making again that amounts for more than one standard deviation from the mean on any given day. 3. The daily return of the stock XYZ is normally distributed with a man of 20 basis points and a standard deviation of 40 basis points. Find the probability such that the return volatility (price change it is within one standard deviation from the mean on any even duy. 4. The daily return of the stock XYZ is normally distributed with a mean of 20 basis points and a standard deviation of 40 basis points. Find the probability of facing a loss that amounts for more than 15 standard deviations from the mean on an even day 5. For the following estimated CAPM (Capital Assets Pricing Model model for stock 2 stock XY2 return 0.003. 1.35 market return what is the financial interpretation of 138 6. For the following estimated simple linear regression equation of Xandy Y = 8 + 70% a. what is the interpretation of 70 b. ifto I test statistic for the estimated equation slopes 3.a, what does that mem? cil p-value() for the estimated equation slope is 0.008, what does that mean? 7. For the following estimated multiple linear regression ecuation, Y 8+45X + 16% a. what is the interpretation of the estimated coefficient of X b. R (Goodness of Fit Coefficient) is 0.98 in this estimated regression equation, what does that tell you? 8. How would extreme values affect volatility levels represented by the standard deviation statistic 9. If both income and gender are considered as potential factors affecting spending behavior, write the two multiple linear regression equations for both female and male groups showing both gender and income are determinants of spending (Note: Think of dummy variables 10. You are about to use EMA (Exponential Moving Averace) as a forecasting method to guide you on tracking stock price movements. If you decide to increase the value of the smoothing factor, what would happen to the weights assigned to past actual price values