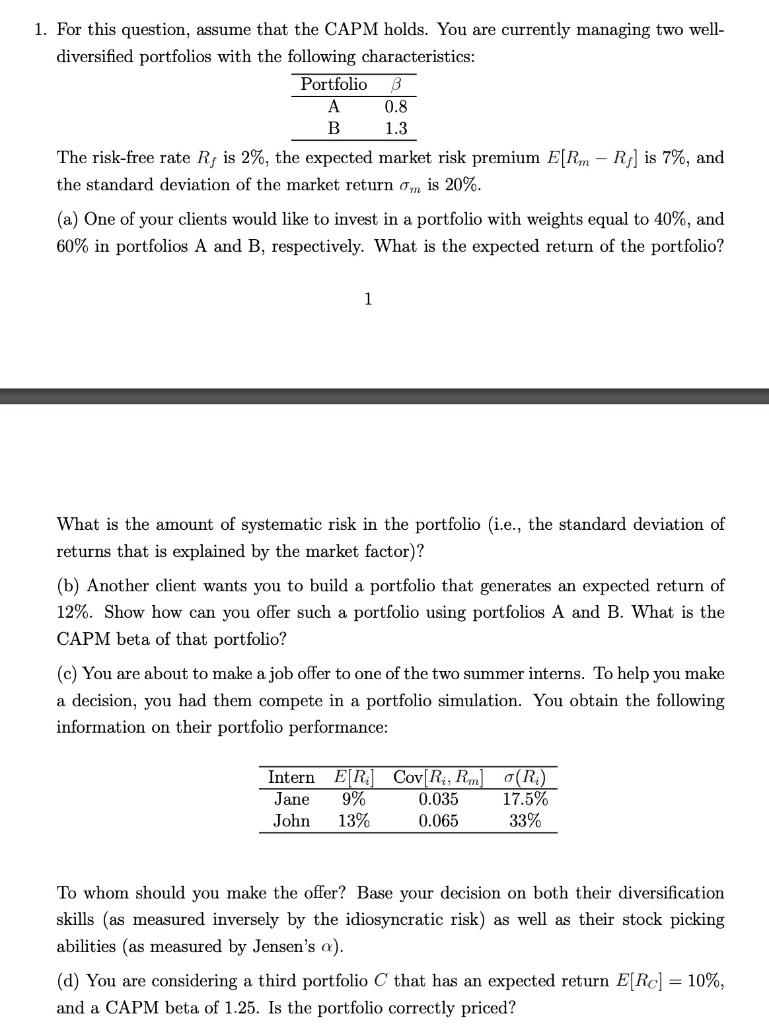

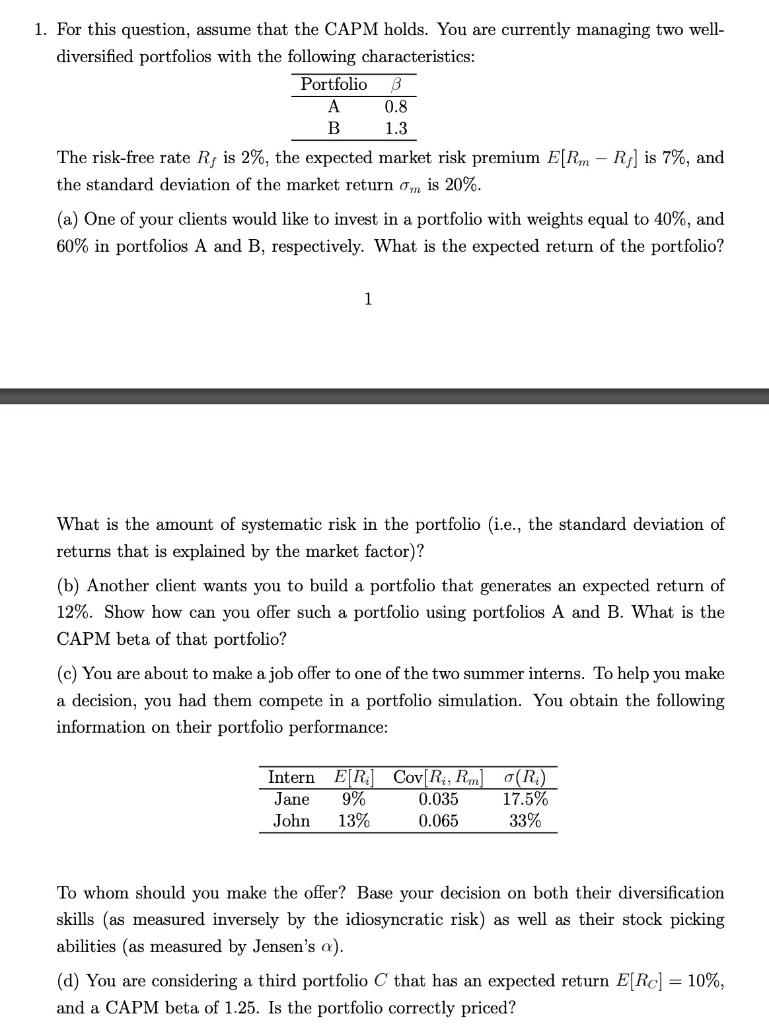

1. For this question, assume that the CAPM holds. You are currently managing two well- diversified portfolios with the following characteristics: Portfolio B A 0.8 1.3 The risk-free rate R, is 2%, the expected market risk premium E[Rm - Rj) is 7%, and the standard deviation of the market return Om is 20%. (a) One of your clients would like to invest in a portfolio with weights equal to 40%, and 60% in portfolios A and B, respectively. What is the expected return of the portfolio? 1 What is the amount of systematic risk in the portfolio i.e., the standard deviation of returns that is explained by the market factor)? (b) Another client wants you to build a portfolio that generates an expected return of 12%. Show how can you offer such a portfolio using portfolios A and B. What is the CAPM beta of that portfolio? (c) You are about to make a job offer to one of the two summer interns. To help you make a decision, you had them compete in a portfolio simulation. You obtain the following information on their portfolio performance: Intern E[R] Cov[Ri, Rm Jane 9% 0.035 John 13% 0.065 0(R) 17.5% 33% To whom should you make the offer? Base your decision on both their diversification skills (as measured inversely by the idiosyncratic risk) as well as their stock picking abilities (as measured by Jensen's a). (d) You are considering a third portfolio C that has an expected return E[Rc] = 10%, and a CAPM beta of 1.25. Is the portfolio correctly priced? 1. For this question, assume that the CAPM holds. You are currently managing two well- diversified portfolios with the following characteristics: Portfolio B A 0.8 1.3 The risk-free rate R, is 2%, the expected market risk premium E[Rm - Rj) is 7%, and the standard deviation of the market return Om is 20%. (a) One of your clients would like to invest in a portfolio with weights equal to 40%, and 60% in portfolios A and B, respectively. What is the expected return of the portfolio? 1 What is the amount of systematic risk in the portfolio i.e., the standard deviation of returns that is explained by the market factor)? (b) Another client wants you to build a portfolio that generates an expected return of 12%. Show how can you offer such a portfolio using portfolios A and B. What is the CAPM beta of that portfolio? (c) You are about to make a job offer to one of the two summer interns. To help you make a decision, you had them compete in a portfolio simulation. You obtain the following information on their portfolio performance: Intern E[R] Cov[Ri, Rm Jane 9% 0.035 John 13% 0.065 0(R) 17.5% 33% To whom should you make the offer? Base your decision on both their diversification skills (as measured inversely by the idiosyncratic risk) as well as their stock picking abilities (as measured by Jensen's a). (d) You are considering a third portfolio C that has an expected return E[Rc] = 10%, and a CAPM beta of 1.25. Is the portfolio correctly priced