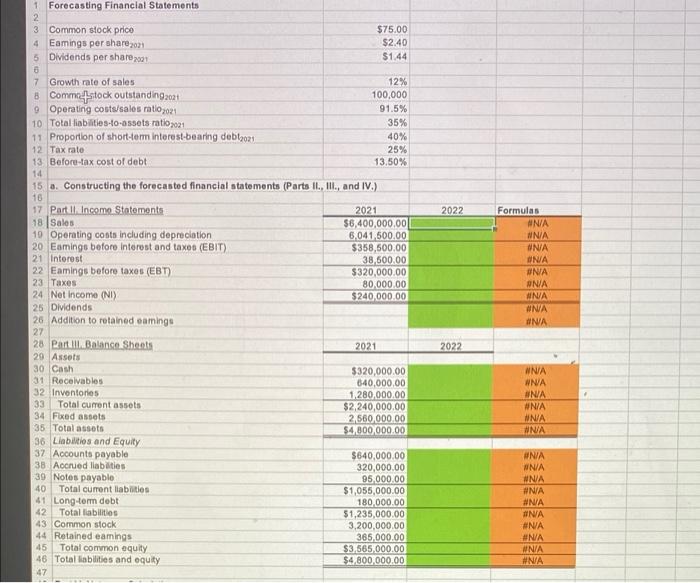

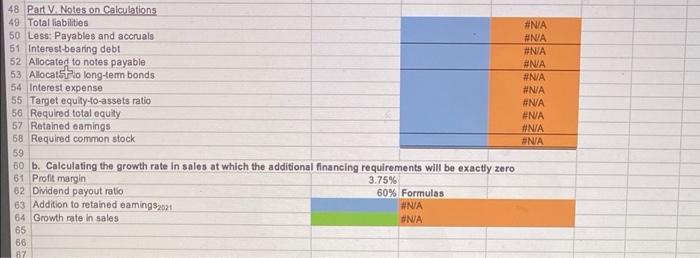

1 Forecasting Financial Statements 2 3 Common stock price $75.00 4 Eamings per share 2021 $2.40 5 Dividends per share 2021 $1.44 6 7 Growth rate of sales 12% 8 Commstock outstanding2021) 100,000 91.5% 9 Operating costs/sales ratio2021 10 Total liabilities-to-assets ratio 021 35% 40% 11 Proportion of short-term interest-bearing debl2021 12 Tax rate 25% 13 Before-tax cost of debt. 13.50% 14 15 a. Constructing the forecasted financial statements (Parts II., III., and IV.). 16 17 Part II. Income Statements 2021 18 Sales $6,400,000.00 19 Operating costs including depreciation 6,041,500.00 20 Eamings before interest and taxes (EBIT) $358,500.00 21 Interest 38,500.00 22 Eamings before taxes (EBT) $320,000.00 23 Taxes 80,000.00 24 Net Income (NI) $240,000.00 25 Dividends 26 Addition to retained eamings 27 28 Part Ill. Balance Sheets 2021 29 Assets 30 Cash $320,000.00 31 Receivables 640,000,00 32 Inventories 1.280.000.00 33 Total current assets i $2,240,000.00 34 Fixed assets 2,560,000.00 35 Total assets $4,800,000.00 36 Liabilities and Equity 37 Accounts payable $640,000.00 38 Accrued liabities 320,000.00 39 Notes payable 95,000.00 40 Total current liabilities $1,055,000.00 41 Long-term debt 180,000.00 42 Total liabilities $1,235,000.00 43 Common stock 3,200,000.00 44 Retained eamings 365,000.00 45 Total common equity $3,565,000.00 46 Total liabilities and equity $4,800,000.00 47 2022 2022 Formulas #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A 48 Part V. Notes on Calculations 49 Total liabilities #N/A #N/A 50 Less: Payables and accruals 51 Interest-bearing debt #N/A 52 Allocated to notes payable #N/A #N/A 53 Allocato long-term bonds 54 Interest expense #N/A 55 Target equity-to-assets ratio #N/A 56 Required total equity #N/A 57 Retained eamings #N/A 58 Required common stock #N/A 59 60 b. Calculating the growth rate in sales at which the additional financing requirements will be exactly zero 61 Profit margin 3.75% 62 Dividend payout ratio 60% Formulas 63 Addition to retained eamings2021 #N/A 64 Growth rate in sales #N/A 65 66 67 1 Forecasting Financial Statements 2 3 Common stock price $75.00 4 Eamings per share 2021 $2.40 5 Dividends per share 2021 $1.44 6 7 Growth rate of sales 12% 8 Commstock outstanding2021) 100,000 91.5% 9 Operating costs/sales ratio2021 10 Total liabilities-to-assets ratio 021 35% 40% 11 Proportion of short-term interest-bearing debl2021 12 Tax rate 25% 13 Before-tax cost of debt. 13.50% 14 15 a. Constructing the forecasted financial statements (Parts II., III., and IV.). 16 17 Part II. Income Statements 2021 18 Sales $6,400,000.00 19 Operating costs including depreciation 6,041,500.00 20 Eamings before interest and taxes (EBIT) $358,500.00 21 Interest 38,500.00 22 Eamings before taxes (EBT) $320,000.00 23 Taxes 80,000.00 24 Net Income (NI) $240,000.00 25 Dividends 26 Addition to retained eamings 27 28 Part Ill. Balance Sheets 2021 29 Assets 30 Cash $320,000.00 31 Receivables 640,000,00 32 Inventories 1.280.000.00 33 Total current assets i $2,240,000.00 34 Fixed assets 2,560,000.00 35 Total assets $4,800,000.00 36 Liabilities and Equity 37 Accounts payable $640,000.00 38 Accrued liabities 320,000.00 39 Notes payable 95,000.00 40 Total current liabilities $1,055,000.00 41 Long-term debt 180,000.00 42 Total liabilities $1,235,000.00 43 Common stock 3,200,000.00 44 Retained eamings 365,000.00 45 Total common equity $3,565,000.00 46 Total liabilities and equity $4,800,000.00 47 2022 2022 Formulas #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A 48 Part V. Notes on Calculations 49 Total liabilities #N/A #N/A 50 Less: Payables and accruals 51 Interest-bearing debt #N/A 52 Allocated to notes payable #N/A #N/A 53 Allocato long-term bonds 54 Interest expense #N/A 55 Target equity-to-assets ratio #N/A 56 Required total equity #N/A 57 Retained eamings #N/A 58 Required common stock #N/A 59 60 b. Calculating the growth rate in sales at which the additional financing requirements will be exactly zero 61 Profit margin 3.75% 62 Dividend payout ratio 60% Formulas 63 Addition to retained eamings2021 #N/A 64 Growth rate in sales #N/A 65 66 67