Answered step by step

Verified Expert Solution

Question

1 Approved Answer

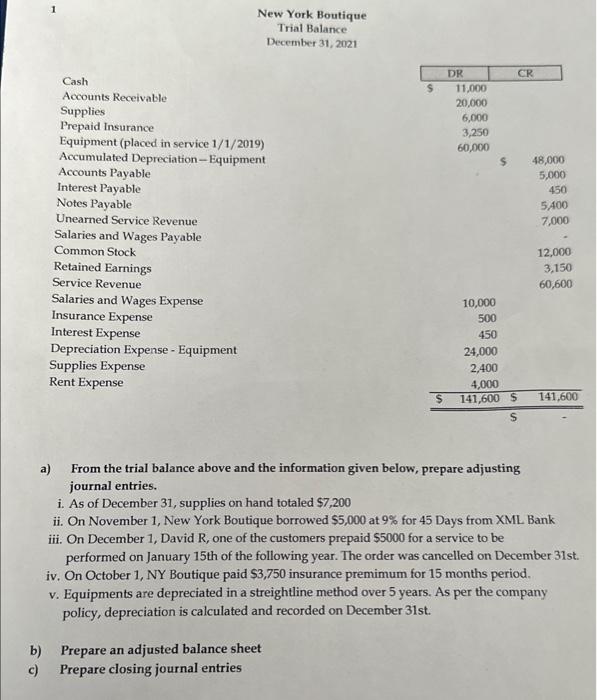

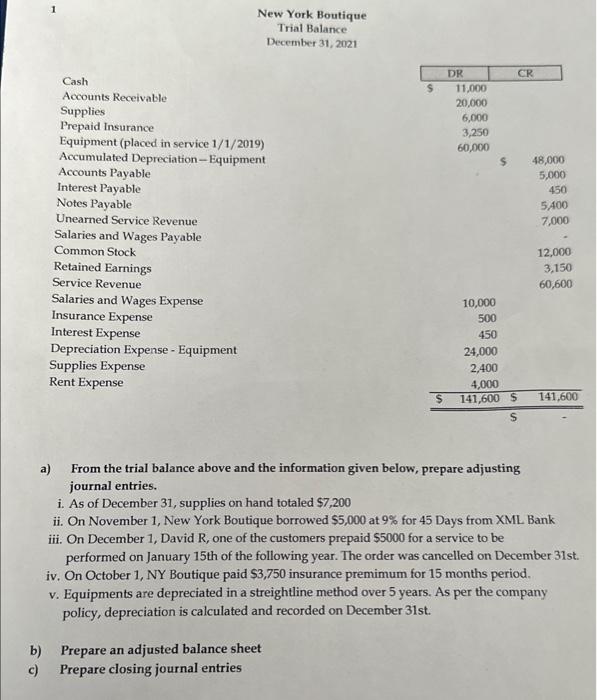

1) From the trial balance above and the information given below, Prepare adjusting journal entries. i. As of December 31, supplies on hand totaled $7,200

1) From the trial balance above and the information given below, Prepare adjusting journal entries.

i. As of December 31, supplies on hand totaled $7,200

ii. On November 1, New York Boutique borrowed $5,000 at 9% for 45 days from XML Bank

iii. On December 1, David R, one of the customers prepaid $5,000 for a service to be performed on January 15th of the following year. The Order was cancelled on December 31st.

iv. On October 1, NY Boutique paid $3,750 insurance premium for 15 months period.

v. Equipments are depreciated in a straightline method over 5 years. As per the company policy, depreciation is calculated and recorded on December 31st.

2) Prepare an adjusted balance sheet

3) Prepare closing journal entries

please do the adjusting entries, adjusted balance sheet and closing entries

a) From the trial balance above and the information given below, prepare adjusting journal entries. i. As of December 31 , supplies on hand totaled $7,200 ii. On November 1, New York Boutique borrowed $5,000 at 9% for 45 Days from XML Bank iii. On December 1, David R, one of the customers prepaid $5000 for a service to be performed on January 15 th of the following year. The order was cancelled on December 31 st. iv. On October 1, NY Boutique paid \$3,750 insurance premimum for 15 months period. v. Equipments are depreciated in a streightline method over 5 years. As per the company policy, depreciation is calculated and recorded on December 31 st. b) Prepare an adjusted balance sheet c) Prepare closing journal entries Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started