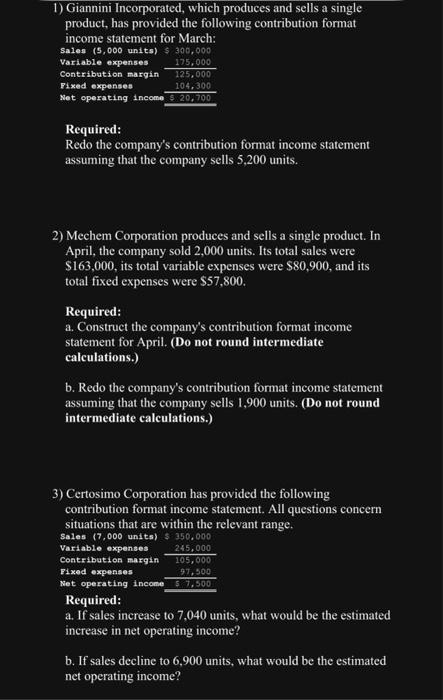

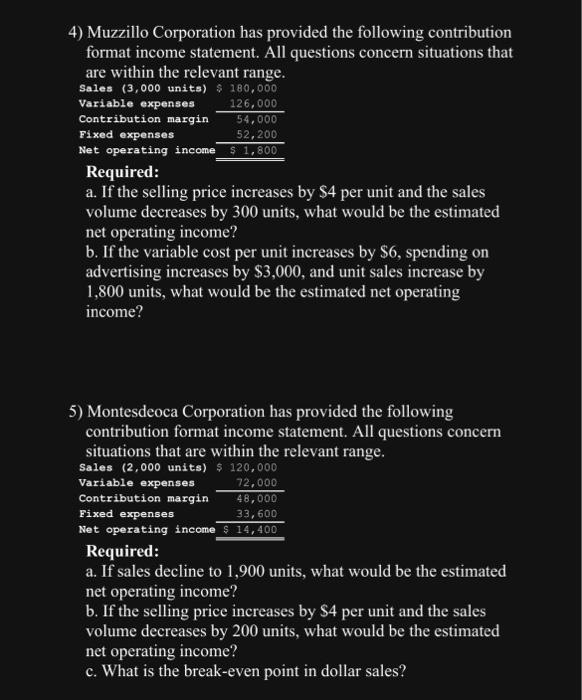

1) Giannini Incorporated, which produces and sells a single product, has provided the following contribution format income statement for March: sales (5,000 units) $300,000 Variable expenses 125,000175,000 Fixed expenses 50,700104,300 Required: Redo the company's contribution format income statement assuming that the company sells 5,200 units. 2) Mechem Corporation produces and sells a single product. In April, the company sold 2,000 units. Its total sales were $163,000, its total variable expenses were $80,900, and its total fixed expenses were $57,800. Required: a. Construct the company's contribution format income statement for April. (Do not round intermediate calculations.) b. Redo the company's contribution format income statement assuming that the company sells 1,900 units. (Do not round intermediate calculations.) 3) Certosimo Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range. sales (7,000 units) $150,000 Variable expenses 105,000245,000 Fixed expenses 57,50097,500 Required: a. If sales increase to 7,040 units, what would be the estimated increase in net operating income? b. If sales decline to 6,900 units, what would be the estimated net operating income? 4) Muzzillo Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range. sales (3,000 units $180,000 Variable expenses 54,000126,000 Required: a. If the selling price increases by $4 per unit and the sales volume decreases by 300 units, what would be the estimated net operating income? b. If the variable cost per unit increases by $6, spending on advertising increases by $3,000, and unit sales increase by 1,800 units, what would be the estimated net operating income? 5) Montesdeoca Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range. Sales (2,000 units) $120,000 VariableexpensesContributionmargin72,00048,000 Fixed expenses Netoperatingincome$14,40033,600 Required: a. If sales decline to 1,900 units, what would be the estimated net operating income? b. If the selling price increases by $4 per unit and the sales volume decreases by 200 units, what would be the estimated net operating income? c. What is the break-even point in dollar sales